June 2023 Vol. 78 No. 6

Features

Despite challenges, HDD market continues impressive growth

25th Annual Directional Drilling Survey

By Robert Carpenter | Editor-in-Chief

(UI) — In the horizontal directional drilling (HDD) land of milk and honey, there are still plenty of bees flying around.

The 25th Annual Underground Infrastructure HDD Survey provides insight into the complex, yet generally lucrative, world of directional boring. Indeed, HDD is a technology that continues to expand to even further heights. It has clearly demonstrated how the introduction and development of this disruptive technology forever changed the face of utility and pipeline construction.

The exclusive Underground Infrastructure industry research effort was conducted during March and April 2023. It polled U.S. contractors and utilities that actively own and operate HDD units to enable a statistical portrayal of the market.

For small to medium drillers working in the fiber market and, increasingly, the electric power markets, opportunities abound. Abundantly funded by private industry, fiber networks and to-the-premises programs have been proliferating for several years, long before COVID struck.

The popularity of fiber has swelled over the past decades as the significance of ample broadband width necessary to enable not only large businesses, but individuals and small businesses, as well, has reached boom levels. Broadband has become essential for all parts of the country to provide the bones for effective regional and national business models.

But most of that work has been limited to cities of a certain size, fitting a particular financial profile that offsets risk for fiber providers and offers immediate payback on network capital investments. Similar to the early days of electricity and even landline telephones, rural areas typically just don’t meet the financial profile for the providers.

As the fiber wave has encompassed modern society, rural areas have found themselves in the situation of having to build their own network, if financially able, or wait until the major fiber providers might deem market conditions and profit opportunities attractive enough to circle back to small community installation.

Famously, the two-year old Infrastructure Bill arrived with billions for underground construction funding, including broadband ($65 billion), and electric and power infrastructure ($73 billion). Much of that money was tied to work in rural or underserved suburban areas.

All of a sudden, small towns and rural areas have become ground zero for building fiber networks – largely by HDD. And with the spending to “harden” power infrastructure and minimize network disruptions during storms, the historic trepidation about perceived costs in placing electric infrastructure underground are evaporating, as well.

Unlike the sewer and water markets where infrastructure dollars, operating in the public market, have to go through various phases, including extensive engineering and planning before being released, fiber and new electric projects immediately roared to life in late 2021. In 2023, HDD contractors working in those markets are sometimes almost overwhelmed with projects.

Hiccups

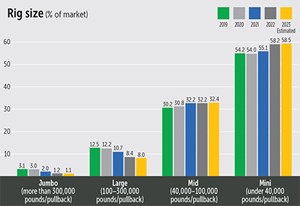

But like any boom-time market, there can be, and usually are, disruptions to the rosy market picture. The obvious challenge for HDD remains a somewhat depressed large rig market.

President Biden’s war on the oil and gas business has dramatically reduced the number of large-diameter oil/gas pipeline projects throughout the country. In fact, it seems that larger energy companies are bowing to political pressure and major headwinds in bringing a major interstate pipeline proposal to completion.

Projects are being moved to the backburner while energy companies, instead, experiment in other energy ventures. Of course, that could all change overnight with the next presidential election.

The good news is that there is enough work spread over many different markets for large rig operations to allow that segment to keep its head above water. In fact, some of the large rig contractors reported this forced diversification would be good for their future.

“Would I rather do pipeline work? Sure. But we’re actually gaining a foothold in water, electric transmission and other markets we would not have pursued in the past,” said this established contractor. “Even if gas pipeline work comes back as strong as ever, we’re always going to keep part of our focus on these other businesses going forward – it just pays to be diversified.”

Another challenge faced by all contractors, regardless of rig size, is finding and retaining the workforce, especially in this era of growth for small rigs in the fiber and power markets.

“There’s tremendous pressure on us to increase our production,” bemoaned one contractor. “But just buying new rigs isn’t good enough; we’ve got to be able to put crews on those rigs that are also productive. Those people are just almost impossible to find right now.”

“We are continuing to work with tech schools, public schools, job fairs – anybody we can think of – to groom new workers,” explained this respondent. “We have a work-as-you-learn program that mentors and trains new employees. And we pay very competitively while they are being trained.”

Yet another contractor lamented that “untrained help is bad for business, and hard on equipment.”

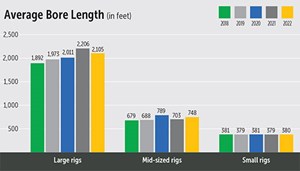

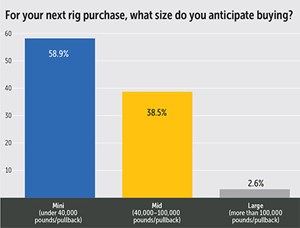

Supply chain issues also continue to choke the HDD market. While showing improvement, availability of certain sizes of rigs remains tight. Based upon the overall size, growth and demand for the fiber market, due to fiber and increasingly electric distribution, one would think small rig sales would be booming. And indeed, they are. However, slowed by first COVID followed by worker shortages and finally the severe supply chain issues, the small rig market has struggled mightily since 2020. The issue is meeting contractor demand for not only expanding crews but simply replacement equipment.

Rig sales

Rigs continue to be sold months in advance of expected delivery. While both major and small HDD rig manufacturers have succeeded in shortening the purchase/delivery gap, there still remains a substantial time lag. “But it’s getting better,” stressed one manufacturer.

One manufacturer has added a night shift, while yet another has brought in a weekend shift. All these are efforts to keep up with the manufacturing process, as supplies are slowly arriving in a more expeditious manner and rig orders remain stacked up. Dealers continue to scramble to find local answers to obtain minor parts and complete almost-finished rigs.

The extremely heavy use and long hours of work for small rigs has shortened their effective life. And it’s not just the rigs themselves. All kinds of steel replacement parts, tools, drill pipes, etc. have been in short supply. Further, soaring prices have driven items like drill pipe to record levels.

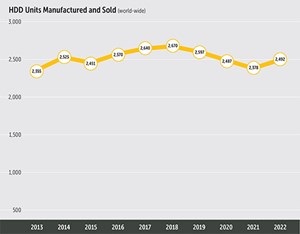

The 2022 rig sales climbed back up to 2,492, reflecting enhanced availability of smaller rigs and offseting the continued depressed sales of large rigs.

Another hiccup in the market is what one respondent called “rogue drillers.” The contractor explained that “sometimes just inexperienced contractors can be a burden to an otherwise booming market.” A common complaint is that too many of the new entrants into HDD are “leaving money on the table.”

But the most frequent complaint about many of the new breed of HDD contractors is that they have poor safety and damage prevention practices. Not only does that put lives at risk, several contractors stressed, but ultimately it raises costs for all.

“We don’t mind competition – that’s what America is all about,” emphasized a contractor. “But we don’t want to create dead spots around the country where cities or utilities have banned HDD because someone who didn’t know what they were doing walked away or really messed up a job.”

HDDA

One promising solution in dealing with many of these issues has been the recent formation of the Horizontal Directional Drilling Association (HDDA). A group of contractors and suppliers first gathered in 2022 to discuss the concept and ultimately launched the HDDA.

They recently held the first formal meeting and even conducted a mud workshop for crews in the Dallas area. Plans are to continue the training workshops with different topics and rotating locations.

HDDA has strong momentum with an established infrastructure and finances in place to grow the association. Committees are already beginning to tackle many of the most common issues facing HDD today.

Qualities and markets

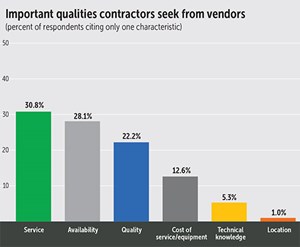

The survey historically asks contractors about the most important characteristics they seek from their manufacturer and supplier partners. Typically, service and quality are by far the strongest responses, followed by availability (support, equipment and supplies).

As a sign of the times, there was a shake-up this year. While service remained the strongest desirable characteristic of vendors, it was at a much lower level than in the past – 30.7 percent compared to 34.1 percent just a year ago. In fact, availability surged into second place, at 28.1 percent, assumably reflective of lingering long waits for rigs and sometimes accompanying tools and supplies. Quality fell to third place at 22.2 percent.

Another significant change came with the cost of service/equipment, which jumped to 12.6 percent, up from 7.0 percent in 2022. That was not unexpected as inflation (including high steel prices), combined with tight supplies, continued to drive up equipment prices.

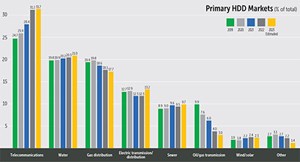

Even with the slowdowns in HDD rigs and equipment, telecommunications (essentially fiber) remains the largest market segment by a substantial margin, climbing to a 31.7 percent estimated market share for 2023.

Water HDD climbed to 21 percent, up from 20.3 in 2022. Interestingly, water drilling experienced an even larger growth rate for big rig work. The value of HDD for installing water mains continues to gain traction. With the additional investment of federal infrastructure dollars in the water market through at least 2026, it’s expected to continue its climb in both small- and large-diameter installations.

Gas distribution fell to a 17.7 percent market share. Not surprisingly, sewer work (primarily force mains) at 9.7 percent market share, has far surpassed energy transmission pipeline work (3.0 percent).

Mud disposal of drilling fluid remains a major issue for many contractors and was again referenced frequently in the survey comments.

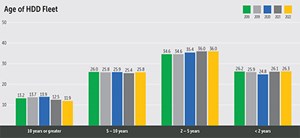

With the expansion of the fiber market over the past few years, it’s no surprise that the average age of a contractor’s HDD rig fleet decreased in 2022. Of course, to some degree the slower rate of getting new rigs to customers also impacted the age of rigs, as contractors had to keep older equipment operating longer.

Rigs 10 years and older comprise about 11.9 percent of active units while rigs that are two-to-five-years old comprise the largest market segment at 36.0 percent, and 26.3 percent of small rigs are under two years old.

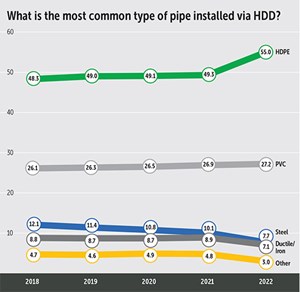

In 2022 and continuing into 2023, plastic pipe made big jumps as the material of choice for HDD. With the high steel and cast iron prices, plus a depressed pipeline construction market, it’s no surprise that plastic pipe jumped in popularity.

The most common pipe installed via HDD remains HDPE, which increased its market share from 49.3 to 55 percent. PVC, particularly the growth of fusible PVC, helped push its market share to 27.2 percent. Steel fell to 7.7 percent of the market and ductile/iron dropped to 7.1 percent.

Original equipment manufacturers (OEMs) in the HDD tooling and drill pipe sectors play a vital role with many contractors. About 43.9 percent of downhole tooling is purchased from OEMs and 49.1 percent of drill pipe.

Ready for the future

HDD contractors as a whole portray the image of hard-working, hard-nosed individuals powering through obstacles to successfully deliver products to the market. To a certain degree, that is an accurate picture, especially for those who have been working within the industry for decades.

However, there is much more to today’s HDD contractors. They have learned the business nuisances and know how to turn a profit even in the toughest of situations. They also know how to say “no” to unrealistic expectations. They can engineer, survey and plan jobs with the best in any market. They have advanced to be true, dedicated artisans of their craft.

The face of HDD construction also continues to gain bright young contractors who will build the market further as technology expands to every fabric of utility and pipeline construction.

When asked about future prospects for the continued growth of HDD, most respondents – even large-rig contractors – remained overwhelmingly bullish on HDD’s future, despite the challenges of today.

“It’s been a great run for me and my family,” said a long-time contractor. “Now, my children are taking over, and HDD shows no sign of slowing down. I’m hoping we’ll have our grandchildren working in the business, too!”

Said a big-rig respondent, “It’s been tough with the downturn of big rig drilling for pipelines. But we’re surviving, keeping everybody employed and, in fact, are finding different business opportunities that we’ll probably continue to pursue even when pipelines come back.”

“Pure and simple, HDD is here to stay,” explained this contractor. “We’re definitely in it for the long haul.”

Comments