June 2009 Vol. 64 No. 6

Features

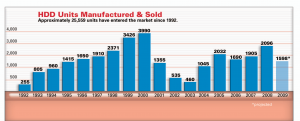

2009 A Bumpy Road But Bright Future Awaits HDD

That the United States (and world) economies are mired in a deep recession is old news. For the horizontal directional drilling industry, this recession is much broader than in 2001 when the telecommunications market imploded.

Then, an out-of-control telecom construction industry had whipped the small HDD rig market into a frenzied state – far beyond realistic expectations. The mid-sized rig market had still not fully developed its niche and the large rig market was struggling as the pipeline construction industry was experiencing one of its “valley” stages. A deep depression followed for the young industry that saw a market contraction by as much as 40 percent.

Just eight years later, one would expect the current recession to be much worse for HDD. And certainly for some HDD contractors, conditions have deteriorated in 2009. “It’s tough – only the smart and strong will survive” observed a mid-Atlantic contractor. A Southwest contractor lamented that “we don’t have much hope for 2010 so we’ll probably stay the course for now . . . I’m hoping for a comeback in 2011 but it all depends on the overall economy.”

However, for the HDD industry as a whole, there seems to be reason for optimism. The market is showing a remarkable elasticity and an upbeat – though tempered by realism – attitude towards the current economic state of affairs.

A matter of perspective

Three perspectives best describe the attitude of respondents to Underground Construction’s exclusive 11th Annual U.S. Horizontal Directional Drilling Survey: optimism, diversification and acceptance.

An Ohio contractor said he believes the market “is building back up. We work hard at giving directional drilling a good name so more people and cities want this technology used on their jobs.” Another Midwest contractor said their company expects a “slight decline from 2008 revenues yet steady for 2009.”

Conducted in April and early May, the survey queried contractors and utilities who own and actively operate HDD rigs and equipment. Survey participants were asked about industry trends, concerns and market status. Certainly the economy was foremost on many of the respondent’s minds and several regions around the country are struggling mightily. Yet, most believe things will get better – in fact already have for some – and many areas are holding their own. “I see the market remaining flat through 2009 with an expected 10 percent increase in 2010 due to stimulus money,” said one Illinois contractor.

To its benefit, the HDD market continued to mature as the economy regained its footing after the telecom meltdown. The industry has experienced an “extreme make-over” that is paying dividends in this slow construction market. The development of the mid-sized market has brought a competitive edge and diversity for many contractors formerly engaged in just small rig applications.

Another survival tactic for the small rig HDD market has been an innate ability to diversify its applicability and develop profitable niches. For example, several HDD contractors have found steady work in the geothermal industry. In an article chronicled in this issue of Underground Construction, a Nebraska contractor used HDD to install radiant heating pipes through frozen ground that reached into the middle of a cold storage facility. The list of unique – and profitable – applications for HDD seems limited only by imagination. While HDD has not reached the status of the backhoe within the utility construction industry – a common, versatile tool on virtually every construction site – it is well on that path.

“Our company does not rely on one market to keep our drills running. We are always looking for different application. Although the economy is slow we maintain our clientel by providing a competitive and quality job,” said this respondent from California. Another contractor in the Midwest sees emerging opportunities as “more engineering firms are designing jobs with the option to directional bore instead of open trench.”

A Southwest contractor pointed out the good news/bad news of underground utility construction during this recession: “There is more HDD, but fewer overall contracts.”

Price cutting

One of the less-than-desirable by-products of the previous telecom recession was that as desperate contractors struggled to stay in business, they engaged in fierce price cutting to the point of charging below their actual costs. As markets have slowed in 2009, that misguided survival ploy is beginning to emerge again in some areas around the country. A Mid-Atlantic respondent pointed out, “Though there is slight growth in our HDD projects, the pricing structure continues to be driven down.”

Another contractor from the same region emphasized that “due to economic pressure, 2009 is going to be a tough year – everyone is lowering their prices just to get the work.” A Southeastern contractor suggested that “there is absolutely no way these companies can do the work for the prices they’re quoting. We’ll see some companies go broke.” A Southwest contractor pointed out that “people who began late and borrowed heavy are distressed to the degree that they are drilling at greatly reduced prices. This not only distresses the industry overall, but uses up their equipment without allowing for replacement.”

The industry continues to evolve and develop. Though the frequent quantum technology leaps in the basic rig structure has tapered off, refinements and enhancements continue to make rig operation for all sizes more efficient and productive, and the learning curves much shorter. Technology jumps are now coming from tooling and electronics. For example, several new mid to large rig tracking and positioning systems have been introduced over the past five years. For smaller rigs, Digital Control released its new F2 tracking system based upon a three-dimensional field view last January. In April, Ditch Witch announced its new laser system for achieving line and grade drilling which they are hoping willfacilitate HDD growth into the sewer market. These types of technological advancement serve to further develop and diversify HDD markets. “As suburbs grow and congestion continues, trenchless methods (HDD) answer too many questions not to thrive,” concluded a Virginia contractor.

That 2008 was an eventful year for HDD is an understatement, particularly for the large drill market which was being driven by the energy sector. Less than a year ago, the price of oil was rushing towards $150 a barrel and natural gas was hitting $13 per Btu. Large rig companies were bidding projects two years away. There was no end to the people and companies trying to enter this perceived lucrative market. Some entered the market with carefully crafted business plans; too many jumped in without a net.

Inevitably, for the energy industry in particular, what goes up must come down and by the end of last summer, oil and gas commodities were in a downward price spiral. Oil fell to as low as $33 per barrel by December and gas dipped below $3.50. But this energy market scenario is more complex with many different factors coming into play. Most experts expect that energy prices will rebound to a higher level and that is already beginning to happen. At press time, oil prices were hovering around $60 per barrel and natural gas had cleared $4 per Btu. A benchmark oil price of at least $70 – $80 per barrel and the corresponding gas price is considered realistic and sustainable by the world’s economy – and inevitable. At those prices, pipeline projects will go forward at an aggressive pace for several years and large directional drilling projects will reap the benefits of a healthy market.

Other market impacts

Water woes continue to plague the country and HDD has the potential to play a significant role as the water infrastructure is replaced and expanded. Notably, many small to medium rig operators have adapted effectively to public works operations and frequently either contract or subcontract installation of water lines. With most water mains pressurized, line and grade tolerances are more flexible.

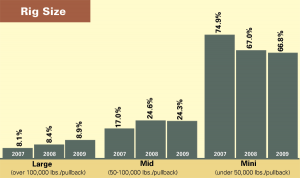

But small drill side still dominates the HDD contractor – and rig – population. Telecom, electric and gas distribution remain a great match with HDD technology. The under 40,000 pounds of pullback rigs constitute 66.8 percent of the overall market followed by mid-sized rigs (40,000 to 100,000 pounds/pullback) at 24.3, and large rigs (over 100,000 pounds/pullback) make up 8.9 percent.

Contractors predict they will be able to utilize HDD on about 45.1 percent of their overall construction operations in 2009 and by 2014 will climb to over 50 percent.

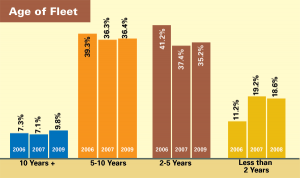

As the small rig market started slowing in late 2007 and continued to contract through 2008 and into 2009 due to the recession, contractors are obviously hanging on to their rigs longer. Subsequently, the age of the overall HDD fleet is increasing. About 9.8 percent of active rigs are now more than 10-years-old; 36.4 percent are five to 10-years-old; 35.2 percent are two to 5 years of age; and 18.6 percent are less than two-years-old.

While telecom work has been spotty depending upon what area of the country you are working in, it has been steady. Verizon is still intent on their quest to spend $2 billion per year growing their fiber network. AT&T has been concentrating less on build-out of new fiber and more on utilizing the network they’ve already got in place with fiber trunk lines. They continue to push their hybrid U-Verse system.

Others are following suit to some degree or another. Cable giants, which at one point seemed to have the upper hand, are now increasingly finding themselves in a competitive situation – something they are not used to. Cable is being forced to improve and grow their networks to keep up. Especially with the advent of VoiP, the traditional definitions between telephone companies and cable companies no longer apply. The lines of structure separating cable and telephone are blurred and separated only be government rules and classifications. But the key to the fiber-to-the-premises market continues to hinge on finances. To truly chase the big dollars of businesses, telecom companies need also to create a consumer base. However, creating and funding the fiber-to-the-premises market is still the Holy Grail of the telecom market.

Underground electric installations still face an uphill battle with the “it’s way too expensive” argument. The flawed and now largely irrelevant Electric Power Research Institute study which placed the infamous cost estimate of a underground electric installation at $1 million per mile, is far too often pulled out of the vault whenever a utility company comes under fire for not going underground. This too is changing as new studies – including one by a state corporation commission – reflect true modern cost factors.

Stats

With the recent boom in oil and natural gas pipeline drilling, the number of contractors doing over $20 million in HDD volume increased from 6 percent in 2007 to 6.4 percent in 2008. Perhaps demonstrating the increased frequency of small HDD rig use and broad applications, the number of contractors doing less than $500,000 in work increased from 27 percent to 37.6; contract values of $500,000 to $1 million was 23.8 percent; $1 million to $5 million was 26.6 percent and $5 million to $10 million was 5.5 percent.

Not surprisingly, 44.1 percent of the respondents expect their contract volume to decrease in 2009, 40.2 percent anticipate doing roughly the same amount of volume in 2009 as they did in 2008; and 15.7 percent actually expect an increase in their HDD volume of work.

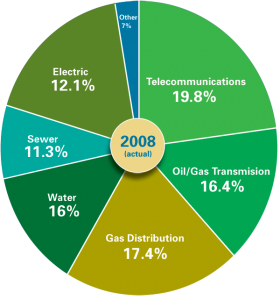

As HDD continues to gain further acceptance and diversify, the number of contractors concentrating their business primarily on drilling continues to grow, now at 10.7 percent of the overall market. HDD has truly found a role in virtually every utility market. Of those contractors utilizing HDD frequently on their projects, 20.4 percent were involved in the water market, 18.9 percent in sewer, 14.7 percent in the electrical industry, 14.4 percent in telecom, 13.9 percent in gas distribution and 6.7 percent in energy pipeline construction – a very balanced utilization of directional drilling by diverse contractors.

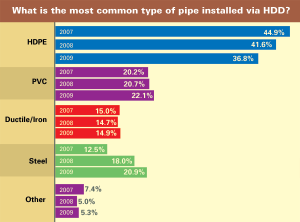

While HDPE pipe remains the most common type of product installed via HDD utilized on roughly 36.8 percent of projects, advances in pipe design have made PVC and ductile iron pipe installation practical and cost competitive. In 2008, PVC pipe was used on 24.1 percent of installations and ductile iron 12.9 percent. Steel pipe installation jumped to claim a 20.9 percent share, not surprising due to the increase in oil and gas pipeline installations. In keeping with its continued diversification, projects experimenting with other types of pipe materials occurred on 5.3 percent of the work.

With maturity and stability of the primary HDD equipment, the used rig market has developed into a viable – and needed – industry segment. More than 46 percent of respondents say they have purchased used rigs and almost 50 percent indicated they would strongly consider buying a used rig for their next purchase.

Bumps in the road

Challenges abound for the HDD market, for both small and large rig markets. As discussed earlier, pricing continues to plague the market. A Midwest contractor summed up the problem: “With a growing number of contractors owning HDD equipment, it is important not to undercut each other, but to keep per foot prices high enough to cover maintenance, upkeep and eventually machine replacement while still producing a yearly profit.”

Education also is another challenge cited by many survey respondents. It is important to “Convince owners that HDD costs are justified over open cut methods . . .” stressed this Northeast contractor. “Educating the public is critical,” added a Midwest contractor. Other challenges frequently cited by respondents include spoil removal and environmental issues, liability insurance, finding and retaining competent personnel, improved utility locating and overcoming the poor quality work from previous projects.

Overall, positive attitudes and expanding opportunities are how most contractors view the HDD industry. “For a lot of years, I fought getting involved with HDD but finally we couldn’t avoid it,” said this Pacific Northwest contractor. “But it was a move I haven’t regretted. It has opened up a lot of work in areas that I would not have expected.” A California respondent related that “we just purchased our first machine and have already lined up jobs to cut down paving restoration costs and keep our landscape in tact. If the machine continues to prove useful, I may consider buying a second machine in the near future.”

A Southwest contractor offered some sage advice to the HDD market: “If you are going to participate in the industry, be a good steward and make sure you can do the work, that you practice good safety and damage prevention practices, and you leave everyone with the best impression of HDD possible – otherwise, you shouldn’t be drilling.”

For most involved in the HDD market, this Texas contractor optimistically summed up the industry outlook: “It’s the future! Everything is involved with directional boring.”

Comments