October 2024 Vol. 79 No. 10

Features

Utility & communications construction: Investment trends and sector growth update

By Daniel Shumate, Managing Director, FMI Capital Advisors Inc.

(UI) — Across the underground utility infrastructure segment, companies are performing quite well in the power, gas distribution and water and wastewater construction segments. Strong investment by investor-owned utilities, the federal government, states and municipalities have led to quality project opportunities that brought significant growth to the contractors serving those markets.

The additional theme that is beginning to emerge in the underground construction segment is one of decentralization of investment. This began with the population shift from city centers to suburban areas during 2020 and has continued to shape the infrastructure segments. Providing a decentralized population means that power, water, gas and high-speed internet has come from not only the large providers, but also entrepreneurial groups that are ensuring that communities have strong communication networks and distributed renewable generation.

In addition to the changing grid due to population, privately financed power generation and transmission is also an emerging theme as the power demand from data centers fueling the AI boom exceeds current grid capacity. The companies are simply not getting their needs met by the incumbent investor-owned utility. The owners of these data centers have no shortage of cash and are making their own investments in their generation needs. This includes making massive private investments in clean energy generation, substations, transmission and distribution to address their power needs.

Additionally venture capital has increased their investment in grid infrastructure to meet the growing demand for power. Venture funds are pouring billions into the technology and projects that increase power generating capacity, grid reliability and efficiency. The growth of this segment is one of the many reasons for Quanta’s acquisition of Cupertino – a direct diversification from the outside electrical services into the commercial and data center power applications that are growing to address the increasing need.

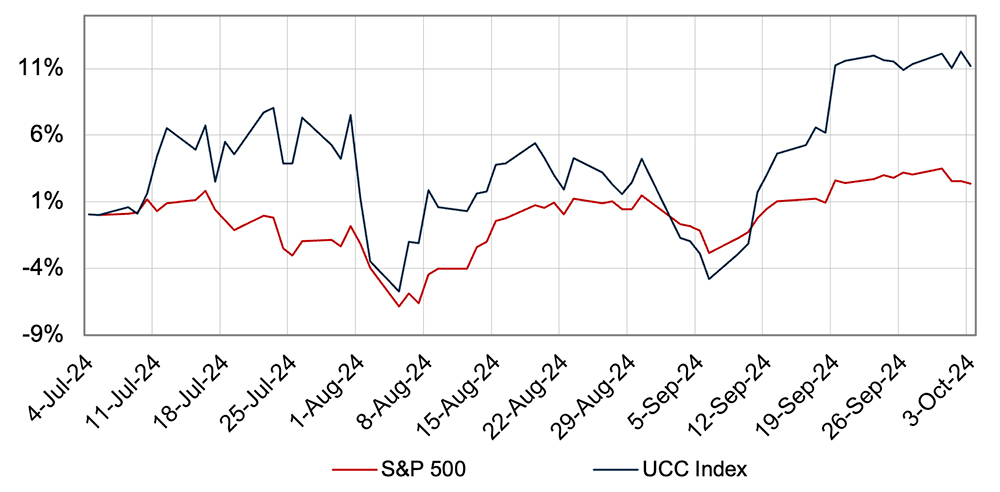

The Utility & Communications Construction Index presented below presents the stock performance of the sector’s publicly traded stocks for the past three months (Figure 1), year-to-date (Figure 2), and for the past three years (Figure 3). The old adage of “sell in May and go away” appeared to play out in the public markets this year as prices were stable until interest decreases from the Federal Reserve entered the picture. The UCC Index returned to exceeding the return of the S&P 500 with price growth in the quarter of 11.2 percent compared to 2.3 percent, respectively. Projected increases in the availability of funds for maintenance and repair combined with an uptick in expected power requirements creates an interesting and growing opportunity for the UCCI companies.

Figure 2: Three Month UCC Index

Source: FMI Research, S&P Capital IQ; as of October 3, 2024

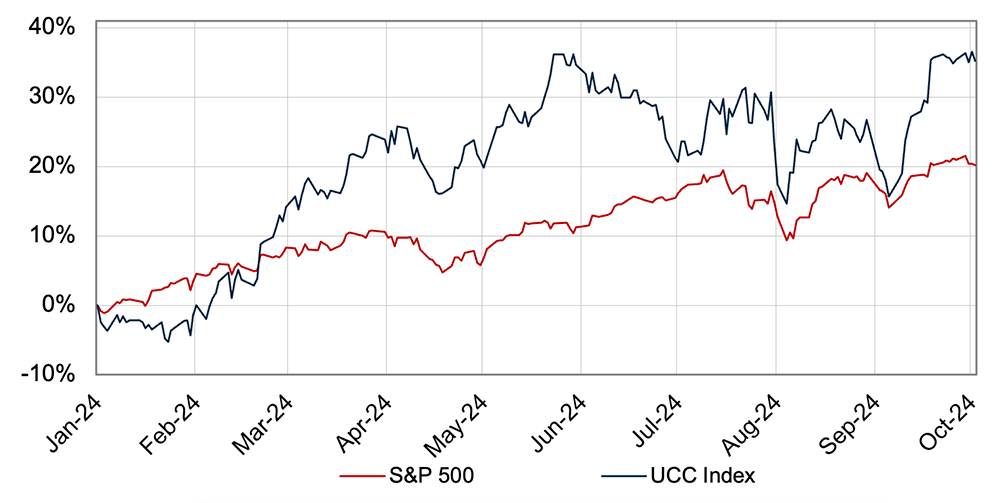

Figure 3: YTD UCC Index

Source: FMI Research, S&P Capital IQ; as of October 3, 2024

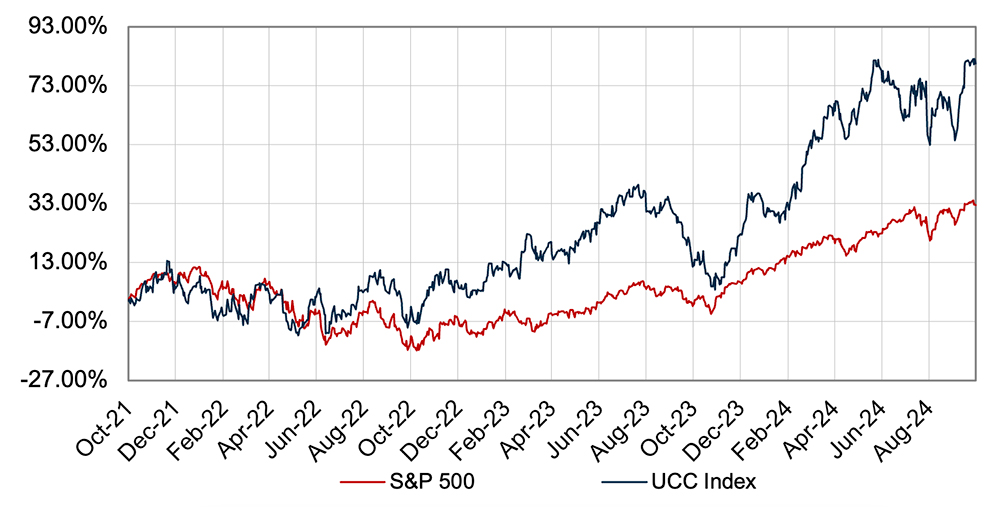

The performance of the UCCI companies over the past three years remains nothing short of remarkable. The UCCI companies’ price has grown 80.4 percent over the three-year period compared to 33.4 percent for the S&P 500. The strong investment by both investor-owned utilities and federal legislation led to strong growth and profitability for these companies. As the IIJA and other legislation is deployed, continued growth at comparable levels to address the nation’s infrastructure will require increased investment by utilities and communication companies.

Figure 4: Three Year UCC Index

Source: FMI Research, S&P Capital IQ; as of October 3, 2024

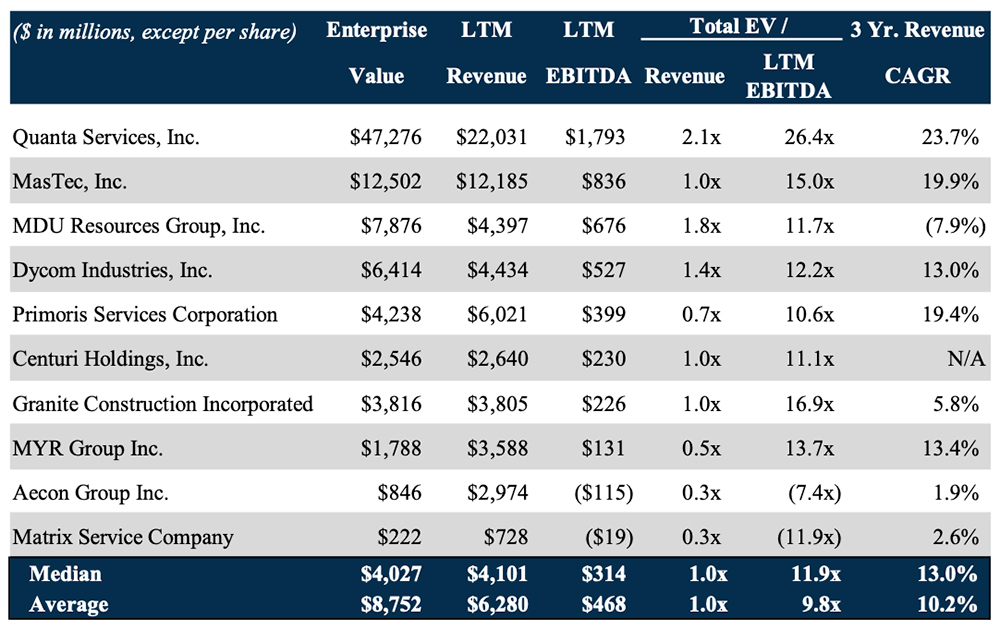

Companies in the UCCI have on average grown valuations and maintained consistent performance despite the high-interest rate environment and labor challenges. The double-digit growth by several companies in the industry illustrates the impact of the funding on the industry as well as the opportunity inherent to the energy transition. As the industry continues to address needs for repairing existing infrastructure while building resilient power infrastructure for the future, the underground construction segment will remain resilient.

Figure 5: UCCI Company Performance

Source: FMI Research, S&P Capital IQ; as of October 3, 2024

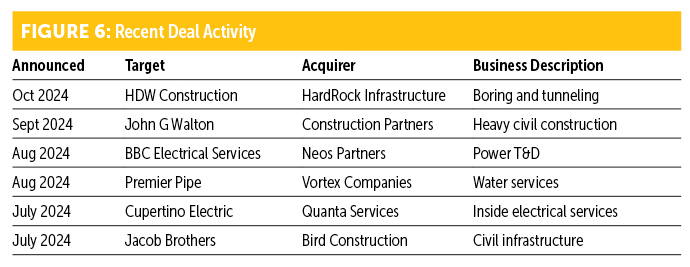

Several transactions occurred during the quarter as acquisition activity has begun to increase in the segment. Investments in civil infrastructure, power and water suggest that broad investment into the nation’s infrastructure remain a key point of interest for businesses looking for predictable growth.

Figure 6: Recent Deal Activity

As companies (both public and private) see interest rates decline, valuations and availability of funds for acquisitions will increase and should impact the number of transactions impacting the sector. We expect for the remainder of 2024 into 2025 to experience increased M&A activity as growth in the industry has been strong and investors look toward stable acquisition opportunities.

Comments