January 2024 Vol. 79 No. 1

Features

2024 utility & communications construction outlook, update

By Daniel Shumate, Managing Director, FMI Capital Advisors Inc.

Imagine the slow, methodical start to a classic roller coaster. The sound of the chain propelling the train carrying the riders is measured and predictable. However, as the train reaches the crest of the hill, the chain pushes the train into uncertainty.

What follows is highly variable, high highs and low lows – a path filled with loops, twists and turns. However, as the roller coaster moves further down the track, it begins to moderate, as the impact of gravity from the initial drop is further away.

This price roller coaster is one that the entire industry has been riding in the wake of March 2020. Prices for goods and services have been volatile in a market where labor felt impossible to find. The challenges did not alter customer expectations. They sought to do more mileage in an increasingly challenging market.

Price increases to address products, fuel and labor have impacted total budgets for projects and, thus, the amount of infrastructure that can be installed. Despite the challenge, there is an equilibrium at the end of the track. Prices moderate as more capacity comes online, utility commissions approve needed rate increases, and the service providers adapt to the complex environment.

Total engineering and construction spending for the U.S. is forecasted to end 2023 up 5 percent, compared to up 12 percent in 2022. FMI Research estimates that total construction put-in-place for 2024 will be almost flat, with residential building declining further due to both housing supply and the impact of sustained, higher interest rates by the Federal Reserve.

Despite the trend in residential construction, the nonbuilding structures segment of the built environment is projected to increase 11 percent in 2023 and over 8 percent in 2024. Positive trends in each of the infrastructure segments should sustain growth in 2024, even as other parts of the economy may feel stress from tighter monetary policy.

Within the underground utility and communication infrastructure segment, specifically, capital plans by owners of power, gas and water continue to grow at rates outpacing inflation (~5-8 percent on average). Investor-owned utilities continue to emphasize capital improvements to infrastructure systems through rate cases, and state and municipal governments have been proactive in funding needed to upgrade public water systems.

The communication sector may see some challenges going into 2024, as it has lowered capital investment to the lowest value in a decade. Publicly traded communication companies have cut their capital spending plans as the initial 5G infrastructure push has slowed. They are prioritizing fiber expansion to build out FTTH offerings in suburban and rural areas, where options for high-speed are more limited.

Going into 2024, we are paying attention to three themes. The first is one that remains on top of our minds despite recent investment: aging infrastructure. Water, power, gas and even segments of U.S. communication infrastructure are past intended useful life and need sustained reinvestment to function safely and efficiently.

The second theme is the impact of inflation on the products within the utility infrastructure segment. Prices for conduit, equipment and other infrastructure goods significantly outpaced inflation over the past three years. This results in the theme of “less for more” that contractors dealt with in 2023. As prices normalize and owners can gradually increase prices, we anticipate that the less-for-more challenge will find an equilibrium.

The last theme for the year will be the upcoming election. Significant policies from the Biden administration centered around electrification, climate-resilient infrastructure and clean-energy generation. A successful campaign for Biden will see continued focus on climate change and the shift to electric energy, while a Trump or other Republican victory could refocus on building energy independence with increased oil and gas focus.

Power distribution

The power distribution segment of underground construction is projected to grow at over 7.5 percent annually through 2027 to meet the requirements of both power demand and replacement of aging infrastructure. Population migration toward suburban areas and regional growth of select states are creating a greenfield need.

Additionally, undergrounding activity is a substantial part of resiliency and hardening programs that have grown, due to fire and hurricane events on both the East and West Coasts of the United States.

Investor-owned utilities are implementing the rate cases to harden their systems contributing to the distribution spend today. Retrofit activity (sub-transmission) is occurring to “upsize” the current line capacity to account for increased electrification associated with data centers, industrial facilities and electric vehicles.

Natural gas transmission, distribution

The outlook for the natural gas transmission segment diverges meaningfully from the other underground segments this year. The Biden administration has been noticeably clear about its desire to shift from fossil fuels and the likelihood for new oil and gas transmission infrastructure will be limited.

It is expected that repair and improvements to existing infrastructure will have a stable outlook, simply because we still need natural gas for both heat and the production of power to meet the increased demand from electric vehicles. Despite the generation stability need and the lower emissions from natural gas generation, the message from the Biden administration has been clear on this front and, therefore, growth is not expected from large opportunities.

For the gas distribution contractor, installation, repair and replacement will remain consistent at similar levels to 2023. Most LDCs in the United States are under some form of accelerated replacement program, with multi-year capital investments being made to address leak-prone infrastructure.

The industry made great improvements in the quality of the gas pipelines; however, thousands of miles of distribution mains and services still have near-term maintenance or replacement requirements. Over 410,000 miles of distribution pipeline were installed prior to 1970 and are nearing their projected life expectancy. The gas distribution contractor has experienced some pushback on price adjustments due to inflation, but there is no shortage of repair, replacement and installation opportunities in 2024.

Communications infrastructure

The communication construction segment will be steady in 2024, with a 4.4-percent growth rate projected through 2027. Publicly traded communication companies have been more conservative in their deployment of 5G to second- and third-tier markets, while emphasizing the deployment of FTTH.

There are some theories for the slow-down, concerns around satellite internet, customer pushback on rising phone plan pricing, and the potential for lead remediation to address groundwater questions that arose in 2023.

Spending in rural areas will be buoyed by the Broadband Equity, Access and Deployment (BEAD) program that invests $42.5 billion in communities to expand access to high-speed internet. BEAD funds can be used for a variety of activities, including deploying fiber optic cables, fixed wireless and other broadband technologies, as well as supporting middle-mile infrastructure projects that connect smaller communities to larger networks.

Coincidentally, the new infrastructure should create affordable broadband programs for low-income households. The program also supports conducting broadband mapping and data collection efforts to better understand the underground built environment.

Municipal water/wastewater

Narrowing in on the wet utility segment, a consistent narrative emerges, informed by population trends, industrial production and government spending. FMI research forecasts that sewage and waste disposal is projected to grow at over 7-percent annually through 2027 buoyed by federal funding programs and EPA requirements.

Additionally, the water supply construction spend over the same period is expected to average ~7 percent. U.S. water infrastructure requires substantial investment over the next decade, exacerbated by the continued population shift towards more urban, warmer climates.

This is being addressed through a host of federal programs including the Clean Water State Revolving Fund, the Drinking Water State Revolving Fund, the Rural Development Water and Environmental Program (WEP) and the Infrastructure for Recovering America program. These are on top of the more traditional grant and WIFIA programs. The emphasis on clean water and safe disposal of wastewater for all communities has materially altered the outlook for a segment that saw less investment and emphasis in years past.

Lastly, the guidance from the EPA regarding lead service lines could also significantly increase spending in this segment. Work through PHMSA on cast iron and bare steel materially improved gas infrastructure and similar impacts could be felt in the Northeast and Midwest, as the programs come online. The Lead and Copper Rule revisions that are pushing municipalities to act more quickly should begin to impact spending in 2024.

UCCI performance & updates

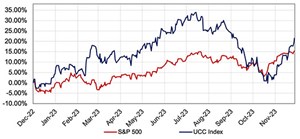

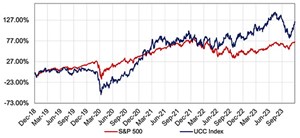

The Utility & Communications Construction Index (“UCCI”) presented below shows the stock performance of the sector’s publicly traded stocks over the past quarter (Figure 2), the past year (Figure 3), and the past five years (Figure 4). UCCI companies outperformed the S&P 500 greatly over the past five years, but the win streak on a quarterly basis ended, as the S&P 500 outperformed UCCI over the past three months. One would describe the price action as returning to a more normalized value based upon expected performance than a broader concern about the direction of the industry.

The one-year UCC Index is up 21.5 percent, with healthy performance over the S&P 500 at 15.4 percent. Recent statements by the Federal Reserve to hold rates steady in the short term, with expectations for rate cuts next year, should have a positive impact on public traded companies and on the cost of debt to finance new work or buy other companies.

Recent trends by UCCI companies to emphasize their power service offerings and renewable generation programs have improved analyst outlook for the companies – delivery on these growth avenues is the next step to maintain momentum.

The five-year UCC Index in Figure 4 is meaningful because you can see the decline (almost 50 percent) that occurred when oil price declines and COVID-19 hampered the energy industry. Since April 2020, the UCCI companies have greatly outperformed the market and have exhibited strong growth and resiliency during a challenging period.

Mergers & acquisitions

The final quarter of activity is potentially a bell weather for merger and acquisition markets, a thawing of the ice that had formed due to high rates and high value expectations. We anticipate an increase in market activity as companies continue to seek reasonable exit plans.

Interest in utility infrastructure service companies remains high based upon expressed interest by both strategic and private equity acquirors. As expectations and valuation converge, greater acquisition activity is expected in 2024.

Interestingly, two of the transactions announced in the quarter represent water utility infrastructure opportunities. MWH focuses on large-scale water and wastewater infrastructure projects across the entire lifecycle of water systems. J.R. Filanc was also acquired by St. Louis-based Alberici Constructors to grow its water and wastewater treatment facility offering. Continued investment in water infrastructure at the federal, state and municipal level could spur consolidation in the water markets.

Comments