February 2024 Vol. 79 No. 2

Features

North America 2024 Pipeline Construction Outlook: New LNG Terminals Lead Call for More Pipelines

by Michael Reed, Contributing Editor

It comes as little surprise to those in midstream that during the past year, we have continued to see LNG initiatives garner more attention than pipeline projects. However, terminal construction drives new pipeline construction.

While this is increasingly true in Europe, where pipelines are being developed to support new entry-points for gas, it’s also true in the United States, where new pipelines are needed to supply the liquefaction plants on the other side of the LNG supply chain. As LNG infrastructure continues to develop, pipeline construction will grow with it.

Similarly, thousands of miles of hydrogen pipelines are in development already, particularly in Europe, as the drive toward net-zero energy matures, and hydrogen finds a bigger role in the energy mix. This, too, will bring additional opportunities for pipeline construction and related work.

According to research by Underground Infrastructure and sister magazine Pipeline & Gas Journal, 41,999 miles of pipeline were under construction globally as we entered 2024. Another 80,557 miles of pipeline are in the planning stages, reaching a combined total of 122,552 miles worldwide. Overall, that figure represented a 9.3 percent increase over 2023.

NORTH AMERICA

Pipeline Miles Under Construction: 8,689

Pipeline Miles Planned: 11,143

Total: 19,832

North America is still developing as a major global supplier of LNG, through growing shipments from the Gulf Coast to Europe. Unfortunately, from the midstream perspective, pipeline construction to support future LNG expansions has been limited by a variety of factors.

Natural gas production growth in the Marcellus and Utica shale remains restricted due to pipeline bottlenecks from the region. Pipelines delivering Permian Basin and Haynesville gas to the Gulf Coast are catching up with near-term demand. Still, forecasts for North America indicate a total figure of 19,832 miles of pipeline either planned or under construction in the region.

Of that total, almost 8,689 miles are currently under construction – more than was the case a year ago. Planned project mileage also rose to 11,043. Overall, that represents a 9.5 percent increase from last year.

In the United States, more than 8 Bcf/d of pipeline capacity is either planned or under construction, from the Permian and Haynesville basins, as pipeline operators jockey for position around LNG growth markets on the Texas and Louisiana Gulf coasts.

Complementing these efforts, an ongoing wave of acquisitions is making some of the biggest midstream players even bigger, while embedding them more deeply in both production and demand markets.

Some of those acquisitions are expansions of gathering and processing footprints to support existing long-haul business. Others are aimed at positioning companies to capitalize on LNG demand growth, however, which requires that operators move ahead of the demand.

While much of the new capacity is a couple of years from becoming reality, the demand is there and will need to be supported by new natural gas pipeline projects. These projects range from new and expanded gathering systems, long-haul pipe construction, compression expansions and so-called “last-mile” pipe connecting large transmission systems to specific areas and facilities.

And, while the timelines for LNG expansion can be fickle, with underutilization of new pipelines being common, the effect of those gaps will vary.

Energy Transfer, for example, has already finished construction of the 1.65 Bcf/d Gulf Run pipeline to move gas from north Louisiana to the coast. That project, gained through acquisition of Enable Midstream in December 2021, is backed by a 20-year agreement with the $10 billion Golden Pass LNG export plant now under construction in Texas by QatarEnergy (70 percent) and Exxon Mobil (30 percent).

Permian Basin

While most of the Permian Basin natural gas pipelines built-out in recent years has targeted LNG export markets to the south of the Houston area, two proposed intrastate projects have emerged that will deliver Permian Basin gas to the Texas-Louisiana border region.

The larger of the two, Targa’s 562-mile Apex pipeline, was approved by the Railroad Commission of Texas in late March. It would originate in Midland County in West Texas to Jefferson County, along the Louisiana border near Sabine Pass.

WhiteWater Midstream’s proposed 190-mile Blackfin Pipeline, which filed for state regulatory approval in February, takes a different approach. Although Blackfin would originate at the eastern edge of the Eagle Ford shale, it would primarily serve as an extension of the 580-mile Matterhorn Express Pipeline that was sanctioned in May 2022 by a joint venture of WhiteWater, EnLink Midstream, Devon Energy and MPLX.

Additionally, the Matterhorn Express itself is scheduled to be in service in the third quarter of 2024 and will provide 2-2.5 Bcf/d of Permian takeaway capacity to the Katy area west of Houston. Blackfin would link with Matterhorn to help debottleneck the Katy area and, like Apex, deliver volumes east to the Texas-Louisiana border area.

These Permian “connectivity” projects will be getting pipe closer to the LNG liquefaction projects than some past projects, such as Gulf Coast Express, Permian Highway and Whistler.

Haynesville

Several natural gas pipeline projects are in-development to connect Haynesville gas producers to Gulf Coast LNG exporters.

One major project is DT Midstream’s three-stage Louisiana Energy Access Pipeline (LEAP) expansion. The existing LEAP Gathering Lateral Pipeline is a 155-mile, 1 Bcf/d line stretching from the Haynesville to the Gulf Coast region. DT midstream plans to increase LEAP capacity by 90 percent, through compression and construction expansions, to 1.9 Bcf/d.

The first stage of the expansion would add 300 MMcf/d of capacity, expected in-service by the end of this year. Stage two would add a 400 MMcf/d expansion, due online in the first quarter of 2024, and the final stage would add 200 MMcf/d, due in the third quarter of next year.

Momentum Midstream is currently developing the New Generation Gas Gathering project, dubbed NG3 from the Haynesville to coastal Louisiana LNG markets, with 275 miles of additional natural gas gathering pipelines with 2.2 Bcf/d of capacity. The system will be complemented with a Carbon Capture and Sequestration (CCS) solution to offer producers a net negative CO2 emission solution. NG3 is expected to be completed in 2024.

Additionally, Williams announced in May 2022 that it was committing $1.5 billion to expand natural gas capacity and grow market access, and followed up a month later by sanctioning its Louisiana Energy Gateway (LEG) project, which is designed to move 1.8 Bcf/d of Haynesville natural gas to several Gulf Coast markets. Tulsa-based Williams expects start-up of the LEG system by 2024.

Mexico growth

Further to the south, Mexico is developing 31 mtpa of LNG export capacity on its west coast. Unusually for an LNG exporter, these projects are looking to import most of their feed gas.

That’s welcome news for U.S. natural gas producers, who stand to gain easier access to Asian markets, as well as pipeline operators who deliver their gas to the border and planned export terminals.

Most of the terminals will make use of spare capacity on existing pipelines including the Sonora pipeline, Topolobampo pipeline and Samalayuca – Sasabe pipeline, with gas originating at the Waha gas hub via either the El Paso Pipeline System or the Comanche Trail and Roadrunner Gas Transmission Pipelines.

The biggest potential new project is the Saguaro Connector Pipeline. The pipeline will deliver natural gas to the Mexico Pacific’s, in-development, 14.1-mtpa Saguaro LNG export facility on the Gulf of California coast. In December 2022, a division of Tulsa-based ONEOK filed an application with the U.S. Federal Energy Regulatory Commission (FERC) to construct the 155-mile pipeline, which would run from the Permian Basin to Mexico.

The 48-inch, 2.8-Bcf/d pipeline would run to the border and interconnect with a planned Mexican pipeline, which would carry on to Mexico Pacific’s LNG terminal, although no details of the Mexican route are available.

FID on the Connector Line had been expected by mid-2023 but was pushed back to the end of 2023. The first 9.4-mtpa phase of Saguaro LNG is expected in 2025.

Canada pipeline projects

In Canada, one of the biggest positive developments for energy infrastructure developers in recent years has been that the First Nations is beginning to embrace the economic opportunities that pipeline and export projects can offer.

The growing technical and financial participation by First Nations represents a sea change in the relationship between Canada’s Indigenous leadership and midstream projects that has been years in the making.

One of the clearest indications of that evolving perspective was the creation of the First Nations Major Projects Coalition (FNMPC) in 2016, a coalition of more than 130 of Canada’s First nation communities that have committed to work toward economic advancement through such projects as TC Energy’s Coastal GasLink pipeline.

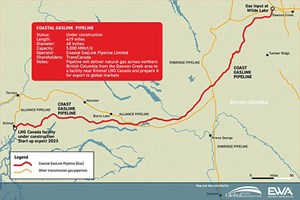

In an early success, the coalition was instrumental in helping First Nations members reach an agreement to take a 10-percent ownership stake in its Coastal GasLink pipeline project, which TC Energy said completed construction on Oct. 30.

Coastal GasLink project involves the construction and operation of a 48-inch, 416-mile pipeline from near the community of Groundbirch, in northeastern British Columbia, to the Shell-led LNG Canada Export Terminal – also scheduled for completion this year – near Kitimat, B.C. From there, the LNG will be exported to Asian markets, helping to reduce emissions by replacing high-carbon coal.

TC Energy is building the project in partnership with LNG Canada, Kogas, Mitsubishi, PetroChina and Petronas. The pipeline will be built to move 2.1 Bcf/d of natural gas with the potential for delivery of up to 5 Bcf/d, dependent on the number of compressor and meter facilities constructed. First Nations will assume its stake in the project upon completion.

Coastal GasLink will provide natural gas feedstock to the Shell-led LNG Canada liquefaction and export facilities currently under construction in Kitimat.

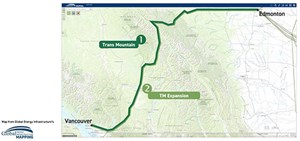

In another sign of growing First Nations involvement, Indigenous groups including Project Reconciliation, Nesika Services and Chinook Pathways, are contenders for an ownership stake in Canada’s other major pipeline project slated for mechanical completion by the end of the year –expansion of Trans Mountain (TMX) pipeline and related export facilities.

Trans Mountain was acquired from Kinder Morgan Canada in 2018 but the Canadian government plans to sell Trans Mountain after completion. The project involves the twinning of an existing 715-mile pipeline originating near Edmonton, Alberta, and extending to Burnaby, British Columbia.

The 590,000-bpd expansion will nearly triple the flow from Alberta’s oil sands to Canada’s Pacific coast, opening access to Asian markets. It includes more than 600 miles of new 36-inch pipe and 120 miles of reactivated pipeline, along with 12 new pump stations and 19 new storage tanks at existing terminals.

At this point, while the First Nations has continued to express interest in acquiring a stake in the project, potentially with Pembina, mounting costs for the project have raised concerns about a suitable return on the investment. Trans Mountain had been expected to start filling the pipeline months ago, but has once again run into a construction-related hurdle that could delay its completion by 10 months.

Also in Canada, Keyera Corp. completed the Key Access Pipeline System (KAPS), a 357-mile NGLs and condensate pipeline. It will transport 350,000 bpd of NGL and condensate from the Montney and Duvernay basins to Keyera’s processing hub in Alberta's Industrial Heartland, Fort Saskatchewan.

The pipeline will consist of a 16-inch pipeline for condensate and a 12-inch pipeline for NGL mix and handle 350,000 bpd.

Comments