April 2024 Vol. 79 No. 4

Features

Insights and trends: Latest developments in utility and communications construction

By Daniel Shumate, Managing Director, FMI Capital Advisors Inc.

(UI) — The beginning of 2024 is shaping up to be just as dynamic as we had expected going into the year. The election stage is set for November, the Federal Reserve is trying to thread the needle between fighting inflation and making the “soft landing,” and most distressing, we all witnessed a terrible tragedy in the collapse of the Francis Scott Key Bridge in Baltimore.

It is events like this that remind me not only of the importance of the role that contractors play in building infrastructure, but also of the impact when accidents occur. The safety report and number of factors that played into the accident will likely be quite long and remind me of the importance of safety and vigilance in everything we do.

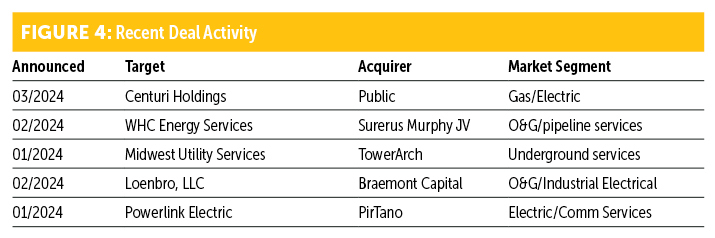

There are two key items to discuss in the UCC Update. The first is that we will probably have a new entrant into the UCCI after Centuri filed its S-1 on March 22 to go public. The company was previously owned by the public utility, Southwest Gas, and from a revenue perspective will be comparable in size to MYR Group at the time it goes public.

Centuri is one of the largest gas distribution contractors in the country and has also become a strong player in the power markets, as well. This likely gives Centuri the autonomy necessary to take on the appropriate levels of risk necessary to be successful in the utility services industry (rather than trying to be as stable as the public utility itself) and will provide the UCC industry some additional insight into how the public views both the gas and power markets in real-time.

The other item that we have seen expand lately in the acquisition markets is one of vertical integration by the contractor. This is likely common at your own company or your competitors with some services today. A contractor will not only do the pipeline repair, but may also do the street repair with asphalt or concrete after the job is complete. The shift is in what the contractor is integrating into. When Quanta Services acquired a transformer manufacturer, the integration went from purely service work (becoming truly a turnkey contractor) to also owning the material that would be installed on the site.

The next logical step that we have seen considered is securing the other elements that impact the potential growth of a business. Prior to 2020, equipment was viewed as nearly always available; however, due to supply chain changes and limits on chassis availability, equipment became a bottleneck to growth for the first time. Tooling for specific jobs can also be a challenge to get when needed, but manufacturing your own tooling to avoid the potential growth limitation could solve that challenge.

As the UCCI group of companies continues to grow and expand, I could see the line that formerly was clear between associate members and contractor members at association meetings begin to blur.

UCCI performance, updates

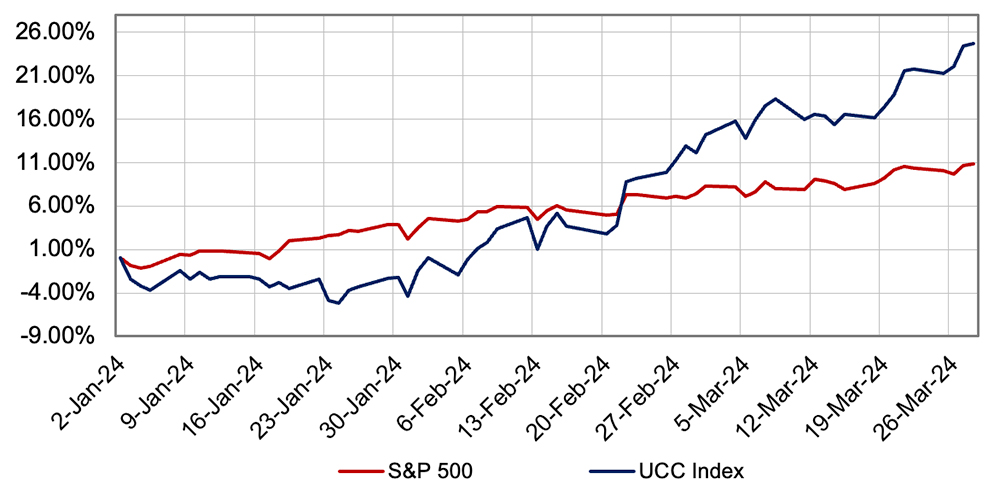

The Utility & Communications Construction Index (“UCCI”) below presents the stock performance of the sector’s publicly traded stocks over the past quarter and year. In the first quarter of 2024, the UCC Index has continued to experience strong growth relative to the broader market as it’s increased by over 24 percent year-to-date. Comparatively, the S&P 500 has risen only 10.7 percent over the same period.

Expectation for the sector is that investment and funding through federal sources should make the sector resilient to any market impacts caused by the financial sector’s volatility. That said, valuations continue to rise, and the market anticipates continued growth to meet valuation expectations that are near all-time highs.

Mergers & acquisitions

As rates have normalized and growth rates and expectations for growth continue to rise, we see an increase in M&A activity for 2024. The long-term trends of utility infrastructure repair and replacement, and electrification of the power grid continue to drive activity. Additionally, the amount planned to be spent in the water and wastewater segments has opened a new avenue of investment for private equity.

We expect stable, continuing interest in the underground infrastructure space, as sustained federal and state investment and investor-owned utility investment remain at peak levels.

Comments