October 2023 Vol. 78 No.10

Features

Utility and communications: Construction update

AI Impacts to be considered for underground projects

by Daniel Shumate | Managing Director, FMI Capital Advisors Inc.

With technology on full display at the Underground Infrastructure Conference, coupled with the ongoing labor challenges throughout the industry, artificial intelligence (AI) has been on the minds of contractors and investors alike.

Original fears of robotics and AI were all characterized as a threat to repetitive blue-collar work. In practice, the dynamic environment that utility infrastructure is placed in has proved quite challenging for automation and AI interaction. However, artificial intelligence platforms may have a lasting impact on the back-office, estimating and documentation that are a necessity to win work and ensure timely payment.

The potential starts with the plans for a project. Software applying machine learning, a form of artificial intelligence, can rapidly analyze blueprints and automatically quantify the areas, environment, objects and materials for a project. This process has the potential to save construction companies hours of time and helps them submit more accurate bids.

While estimating software has been around for decades, utilizing AI platforms such as ChatGPT, Google’s Bard or a specific construction product like Togal.AI to improve one’s processes could have material impact on takeoffs.

Another segment ripe for improvements for the underground contractor is effective documentation of a job, with complete review of the hundreds of units that may be applicable to a segment of work. By first introducing the requirements to bill the customer, then inputting the work package, pictures and documentation of changes to the original plan, AI platforms can quickly produce the documentation necessary to comply with customer requirements.

After a quick review and corrections, the platforms “learn” where there may be differences between what is expected from the customer and will retain those adjustments. The opportunity for time savings on mundane work and potential capture of available units that occurred during the work could have a big impact on contractor profitability.

As more of the underground is effectively documented, generative AI may also be able to significantly improve the safety and productivity of the job site through improved locating capabilities and a more thorough understanding of the history of a location. Even for those instances where the location of infrastructure was not well documented, a notification that a location previously had an 811 call can alert the contractor to be diligent when working in the area to avoid the installed product.

Generative AI helps capture the history of previous construction jobs, bring that knowledge forward and apply it. No human can remember the layout or a schedule of thousands of previous jobs, but a computer can.

Lastly, compliance with local codes is a huge task for project managers and legal departments, especially those who work in multiple states and localities. Products such as CodeComply.AI are in the early stages of being “taught” all the pages of code required for a site. By layering this alongside effective algorithms to review the appropriate codes for a job type, AI may be able to automate compliance requirements for project managers, so that they can spend more time focused on the most important part of their work – construction.

Stocks

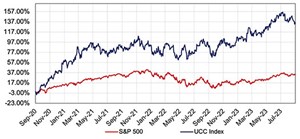

The Utility & Communications Construction Index presented below presents the price-weighted stock performance of the sector’s publicly traded stocks for the prior three years (FIGURE 1), one year (FIGURE 2), and the past three months (FIGURE 3). Companies in the UCCI have had an incredible three-year run in the public markets. The UCC Index is up 133 percent over the past three years, relative to the S&P 500 that has only increased by 32.6 percent over the same period.

Continued spend on aging infrastructure, the significant investments by the federal government through IIJA and the IRA, and the spending connected with an ongoing energy transition, provided the capital for continued growth from the UCCI companies. Additionally, the ongoing industry consolidation has also increased both the revenue and market capitalization of the broader index over this timeframe.

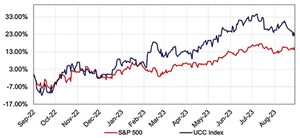

Over the last 12 months, the performance of the UCC Index relative to the S&P 500 remained strong. UCC Index companies experienced stock price improvements of 22.4 percent, while the S&P 500 grew 14.1 percent over the same period. The themes are largely the same as the potential for improvements in oil and gas transmission and distribution construction due to the rise in oil and gas prices.

The simple solutions of strategic oil reserve releases are not enough to counter the decrease in production that has occurred in the OPEC countries. U.S. oil and gas infrastructure construction could go a long way in tempering the price increases that the consumer will feel if the prices remain at elevated levels.

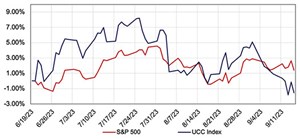

The last three months have represented a normalizing of stock performance relative to the S&P 500. Modest correction is expected after the last three years of significant growth. There is some concern that at sustained higher interest rates, infrastructure owners may find financing new projects to be more challenging, resulting in slowed opportunities for owners without access to federal programs.

On average, companies in the UCCI performed quite well and there is continued growth in enterprise value and profitability with strong growth rates. Opportunities to install, repair, or replace infrastructure remain significant and are expected to continue for the foreseeable future. This is layered with renewable energy opportunities that have begun to provide a quality margin component of the UCC Index companies.

Dycom Industries announced a share repurchase program during the quarter, suggesting that the Board believes the stock is currently undervalued relative to its earnings and growth potential. This follows both Quanta Services and MYR Group’s announcement of a share buyback program in May and provides increased confidence for sustained growth and profitability in the sector.

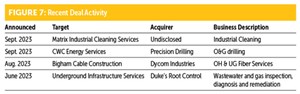

The pace of underground infrastructure mergers and acquisitions remained muted in the third quarter of 2023. The primary areas of interest for acquirers remain the communication and power markets – finding a way to participate in the federal spending on infrastructure remains a primary objective.

As interest rates rise and valuations decline, the gap between what a seller is looking for and what a buyer views as acceptable begins to widen and creates a more challenging acquisition environment. Expect deal activity in the remainder of 2023 to be down significantly from 2022, due to high costs of financing and recessionary concerns related to the Federal Reserve’s interest rate increases

Comments