January 2023 Vol. 78 No. 1

Features

Utility & Communications 2023 Construction Outlook, Update

Daniel Shumate | Managing Director, FMI Capital Advisors Inc.

(UI) — The captain of a large aircraft carrier sees what he believes to be the light of an oncoming vessel off the coast of Newfoundland, Canada. The captain of the ship then radios the vessel, urgently saying to divert your course 15 degrees to the north to avoid a collision with the ship.

The Canadians respond urgently and say divert your course to the south to avoid a collision. The captain then calls again stating that he is the captain of one of the largest ships in the U.S. Navy and demands the oncoming vessel divert its course. The Canadians then state, “this is a lighthouse, your call.”

In the example above, the public markets are the ship, and the Federal Reserve is the lighthouse clearly communicating the path it intends to take to combat inflation. The stock market has been impacted by the actions of the Federal Reserve, but continues to anticipate a pivot to avoid a recession.

The story of 2023 belongs to two actors – the Federal Reserve and inflation. The actions of the Fed, by raising short-term borrowing rates, will lower inflation by reducing the money supply; but raising rates has a real impact in the economy. It starts at the top with government financing into the commercial market for business borrowing and capital financing to individual households through mortgage and credit card rates.

Savers have a slight boon, though inflation is actively decreasing the value of their most liquid investment (cash). The Federal Reserve has clearly stated that a recession will occur, and that Americans will feel the pain of the policies, but those impacts are less painful than long-term price increases.

Inflation appears to have turned a corner from the highest rates during the summer of 2022, but an average above 7.0 percent is significantly greater than the target of stable monetary policy and a 2.0 percent inflation rate. The consumer felt the impact of inflation over the last 18 months, but if inflation holds at current levels, two-year price increases would be back above 14 percent. These are price increases reminiscent of the late ‘70s, early ‘80s.

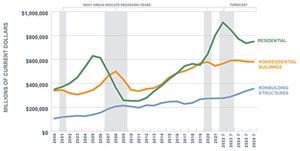

So, what does this mean for underground construction? The U.S. residential construction market likely peaked in 2022 and ended an incredible period of growth from the housing crisis in 2010–11. A decline in residential suggests that the site utility growth for residential development will slow as developers slow down their investment and delay projects.

However, while the Federal Reserve is working to constrain the money supply, investor-owned utilities continue to execute their capital programs and Congress has spent trillions on new infrastructure and repair programs for water, wastewater, fiber and power.

FIGURE 1 illustrates this phenomenon. While residential declines, the federal spending and infrastructure repair programs suggest that non-building structure construction markets should be resilient.

Economic factors influencing this forecast include domestic and foreign impacts of COVID-19; shortages of key materials and labor across various industries; ongoing strain on global logistics infrastructure; volatility across real estate, financial and equity markets with additional Federal Reserve rate hikes through 2022 and 2023; and continued inflationary pressures tied to heightened living expenses, elevated energy costs, strength in the U.S. dollar and rising wages.

FMI research also considered wartime and economic turmoil in various countries (e.g., Russia, Ukraine, China) adding to the strain and uncertainty on each of the items listed above.

Despite all these potential headwinds, capital plans by owners of power, gas and communication infrastructure continue to grow. Some of this comes from inflation – the ongoing theme of “more for less” is true. To fundamentally improve our nation’s infrastructure, we need investment that is growing faster than the rate of inflation or you’re simply spending more per foot of pipe.

Combining the Infrastructure Investment and Jobs Act, the Inflation Reduction Act, the Drinking Water and Wastewater Infrastructure Act, and private company investment, the dollars available for repair of utility infrastructure have never been more available. The bottleneck will likely be similar to what it has been for the past 10 years – finding qualified people to manage and construct the projects available.

Power distribution

The power distribution segment of underground construction will experience continued growth and investment in 2023. FMI Research projects that investor-owned utilities will grow capital expenditures at over 6 percent year-over-year and total capital expenditures could near $160 billion in the United States. Power distribution comprises about one-third of the expected spend and the emphasis for the IOU’s has been on adaption, hardening and resilience programs.

The loss of life and infrastructure damage that has occurred due to fires in California and hurricanes on the East Coast is transforming the way that infrastructure is installed, repaired and replaced. Underground power lines are becoming more prevalent, as the cost savings in these extraordinary events is significant and the ongoing maintenance cost is also much less. The effects of this were seen in a quick repair earlier this year following Hurricane Ida.

The second major trend is upgrading the distribution networks in cities to be able to handle a distributed generation network. Houses that are producing solar power are only helpful if the infrastructure can effectively utilize the energy. We also see storage of energy both in residential homes and at the utility scale becoming much more widespread.

Lastly, we will soon be at the point where the efficiency efforts will not outweigh the increasing demand on the electric grid, as more and more electric vehicles are now on the roadway. The increased load demand will require upgrades to infrastructure that in our largest cities was put in place over 50 years ago.

Natural gas transmission, distribution

The outlook for the natural gas transmission segment is less stable than the other infrastructure types. The Biden administration has been very clear about the desire to shift from fossil fuels, and the likelihood for new oil and gas transmission infrastructure will remain limited. However, the war in Ukraine and the volume of LNG shipments have kept the price of both oil and gas at levels that are strong for the industry.

FMI expects repair and replacement of existing infrastructure to have a stable outlook due to gas and energy prices and ongoing gas main distribution replacement programs. Despite the need and the relatively low emissions from natural gas, the message from the Biden administration has been clear on this front and we would not expect growth from large pipeline activities or significant new production.

For the gas distribution contractor, installation, repair and replacement will remain consistent at similar levels to prior years. North American gas local distribution companies continue efforts to remove cast-iron and bare steel in 20- to 30-year replacement programs addressing aging infrastructure. Nearly every LDC in the United States is under some form of accelerated replacement program with multi-year capital investments being made to address leak-prone infrastructure.

Interestingly, despite some counties in U.S. states limiting new gas appliances, discussions around hydrogen as a potential long-term fuel source that could be delivered through natural gas infrastructure have slowly begun. As energy supply and cost challenges continue, this technology and its applications could pick up steam in the coming years.

Communications infrastructure

The communication construction segment will experience meaningful growth to implement the 5G shift and power being implemented by the major communication companies. Current expectations are that by 2025, over half of all mobile users will be relying on 5G connections.

To facilitate this, micro cell deployment and the “densification” of the current network is a necessity. The underground segment will benefit as fiber is the backbone that makes the small cell network function. The emergence of 5G wireless technologies marks the next great shift in telecom infrastructure (i.e., from wireline to fiber).

Multi-year initiatives led by telecom service providers will create fiber installation, small cell deployment and on-going maintenance contract opportunities for those operators with the requisite fiber construction capabilities. The North American 5G infrastructure market is projected to grow from about $2 billion in spending to over $20 billion within the next 10 years, as the technology and dense network are rolled out throughout the country.

Additionally, funding for rural broadband has been provided after the disparities highlighted during the pandemic. The engineering and construction of this infrastructure to meet high-speed goals of the FTC will create opportunity in the underground communication segment.

Municipal water/wastewater

The wet utility construction market is expected to be one of the bright spots in the U.S. economy over the next two to four years. Federal spending and the Drinking Water State Revolving Funds will play a big role in financing both rehabilitation and new construction projects. Supply chain limitations for pipe and availability of labor have been the only limitations that have slowed this segment of the underground construction market. FMI Research projects 10- to 12-percent growth in both the water and wastewater construction markets in 2023 and 2024.

There are some key areas where federal funding is particularly attractive. Any programs to replace lead pipelines for water have no match requirements at the state level. Additionally, industrial wastewater restrictions are on the rise and there will likely be increased investment in decarbonization and decentralized water reuse technologies over the forecast period.

In states where drought remains a concern, the Pure Water programs that are taking full advantage of reuse have become an increasing percentage of the capital programs

While inflation may limit the mileage of pipeline installed over the coming year, the volume of infrastructure repair work that needs to be completed and has dedicated financing, is near record levels. The impact of climate legislation, while challenging for the gas markets, will benefit the power, communication and water segments as they spend to increase the quality of infrastructure and harden against the potential for climate events.

UCCI performance, updates

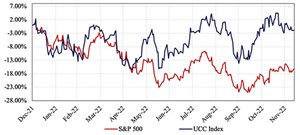

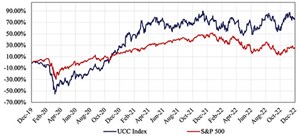

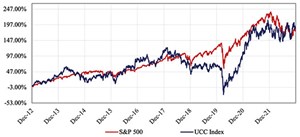

The Utility & Communications Construction Index (“UCCI”) presented below shows the performance of the sector’s publicly traded stocks over the past year (FIGURE 2), the past three years (FIGURE 3), and the past 10 years (FIGURE 4).

The UCC Index has seen consolidation in the market with the acquisition by Mastec of Infrastructure Energy and Alternatives (IEA). There were also large transactions in the sector, including the acquisition by Primoris of PLH Group.

Year-to-date performance of the UCCI is basically flat while the S&P 500 has declined over 16 percent year-over-year. Expectations for the segment are quite high, as investment is expected to begin to have an impact on both revenue and profitability in the coming year.

The three-year UCC Index captures just how quickly the market corrected from the COVID crisis and how well the UCC Index companies have done over that period. Companies in the UCCI were performing consistently, but they were not outperforming the S&P 500 leading into the pandemic.

Initial stock declines in the UCCI were steep because the market had the perception that profit in most of these companies was tied to the price of oil. With the optimism around investments in the space and real earnings growth tied to those investments, the UCC companies have done incredibly well.

The 10-year UCC Index in FIGURE 4 is meaningful because you can see the impact that depressed oil prices and lack of investment in utility infrastructure can have on the sector. The declines that occurred while the broader market was rising from 2017-2020 caused the UCC Index companies to lag the broader economy. However, FIGURE 4 illustrates even more impactfully the increase in stock price for the UCCI companies and the expectation of growth and profitability that now rests on this group.

Mergers & acquisitions

The final quarter of activity was starkly different than 2021 in the M&A markets. In comparison to the record number of deals last year, the impact of the Federal Reserve on interest rates that provide funding to buyers resulted in impactful changes to the market for companies.

The gap between seller valuation expectations and buyer’s willingness to pay has cooled a previously busy area for M&A.

The opportunity in utility infrastructure construction based upon expressed interest by both strategic and private equity acquirors remains high, but common ground on valuation has been more difficult to come by.

1 https://www.bls.gov/cpi/

2 FMI Q4 Outlook 2022

Comments