October 2022 Vol. 77 No. 10

Features

2022 Utility & Communications Construction Update

Daniel Shumate | Managing Director, FMI Capital Advisors Inc.

(UC) — Interpreting the direction of the economy in the middle of the volatility of the past three months is a confusing and uncertain exercise. However, after discussing the various scenarios with business owners, manufacturers and researching teams, my view is not whether the economy is in a recession but, rather, how long the downturn will last and what the impact might look like.

In our best-case scenario, inflation has largely peaked already and the cost of homes, energy and food decline, allowing for the Federal Reserve to adjust monetary policy in the near-term. This also limits the damage that inflation causes on the economy and delivers muted impacts to demand by the consumer. In this scenario, the labor market normalizes but there is not a large increase in unemployment.

Contrast the best-case to our severe-correction scenario and the picture is not as rosy. The Federal Reserve struggles to get inflation contained and must continue to raise rates to get prices under control. The tightening monetary policy reinforces economic contraction, resulting in a significant decline in asset prices and a meaningful increase in unemployment that could last two to three years.

The most likely result is something in the middle, yet painful for the average household. We anticipate an increase in unemployment due to layoffs in certain sectors, which may ease some of the challenges around finding help within the utility industry. We do not anticipate a broad market decline throughout all construction sectors.

Certain sectors will fare better than others, due to funding supplied by the federal government and the priorities for spending by both utilities and state governments. For example, new spend on data centers, life sciences, semiconductor fabrication and distributed power are expected to see an uptick, while big-box construction, office space, sports facilities and amusement parks are projected to decline. Additionally, residential markets expect broad declines due to the increasing cost of home ownership and the Federal Reserve’s stated aim to lower home prices.

Productivity improvements are the best way to fight inflation – increasing the supply to meet the demand and, thus, limiting price increases. In construction, this will be a significant challenge. Since 2009, the value of non-residential construction installed per person has decreased 21 percent, while the labor needed to install $1 million of product has climbed 27 percent.

Timelines are also condensing, bringing additional cost to meet the speed requirements of owners. Identifying means to install infrastructure efficiently will be necessary to meet the demands of customers repairing, upgrading and building new infrastructure in the coming years.

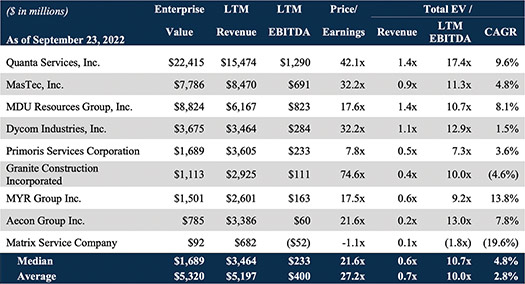

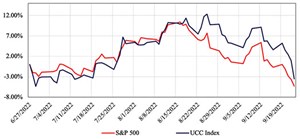

The Utility & Communications Construction Index (UCCI) presented below presents the stock performance of the sector’s publicly traded stocks year-to-date (FIGURE 1) and the past three months (FIGURE 2).

Year-to-date performance UCCI illustrates the impact that federal funding is expected to have on the utility services industry relative to a broader market that is more impacted by increasing costs to finance debt. The UCCI and S&P 500 are nearing the lows for the year and unless there is a turn in federal reserve policy, the most likely outcome is a bearish fourth quarter outlook for the publicly traded companies.

The third quarter experienced high volatility in the stock market and ended near the lows of the year, as inflation persisted and the Federal Reserve continued to increase the Federal Funds Rate. The result was a highly correlated third quarter of performance between the UCCI and the S&P 500, but UCCI remains well above the broader indices year-to-date.

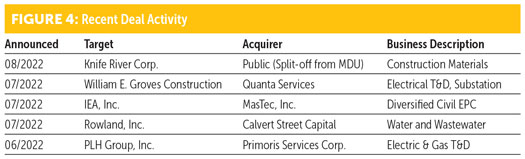

Deal activity within the third quarter resulted in meaningful updates to UCCI. The first acquisition of PLH Group by Primoris nearly doubled the power-delivery business of Primoris, increased the amount of revenue that Primoris receives from recurring master-service agreement work, and expands its presence geographically, as well. IEA, a former member of the UCCI companies, is being acquired by MasTec in a move that would meaningfully expand its renewable EPC capabilities.

The other change to UCCI was a split-off of the construction materials business from MDU that separated the utility and utility services companies. Deal activity in the fourth quarter for utility services is expected to remain consistent despite rising interest rates due to action by the Federal Reserve. Tailwinds supplied by Federal funding (Infrastructure Investment and Jobs Act & the Inflation Reduction Act), infrastructure repair and transition to renewables/electric infrastructure are expected to buoy the utility and utility services sectors.

Comments