July 2020 Vol. 75 No. 7

Features

Utility & Communications Construction Update

By Dan Shumate, Managing Director, FMI Capital Advisors Inc.

As the country emerges from its coronavirus-induced hibernation, guidance from the publicly traded companies of the Utility & Communications Construction Index (UCCI) is very limited due to limited guidance and general uncertainty of what the coming months will bring. With new information impacting the economic outlook occurring almost daily, I believe it is instructive to zoom out and look at where we are today in comparison with the multi-year growth period coming out of the financial crisis.

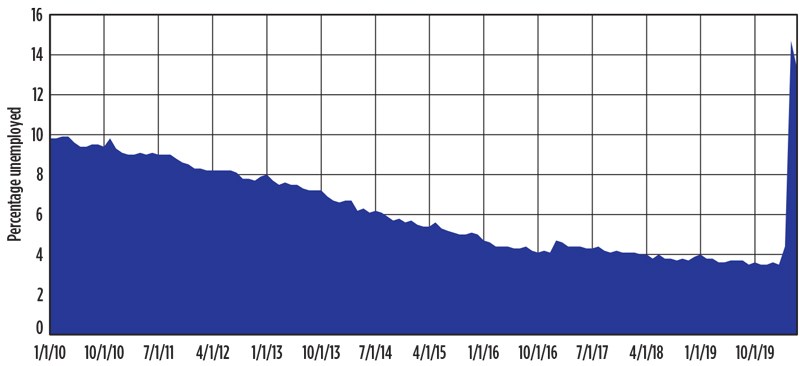

Our biggest concern is the level of unemployment. If the United States has a “V-shaped” recovery – quickly improving to return to prosperity – then unemployment will drop significantly over the coming months. Figure 1 illustrates just how dire the unemployment situation is as of May 2020. If, however, companies remain uncertain about the fall or have permanently adjusted their workforce, the unemployment levels will have trickle-down effects.

In March, the federal government, with the assistance of the Federal Reserve, essentially put the pause button on the United States economy. Actions included paying homes cash directly, requiring banks to put mortgages into forbearance without foreclosing, and even preventing you from turning off power or water if people choose not to pay their bills. Unemployed laborers also now make more than you would in a minimum wage job, due to the premiums added by Congress.

The result is a country that has not fully experienced the economic pain inflicted by high unemployment levels and limited productivity. The end of July will either bring a bigger pause button, through congressional action extending the benefits, or we will have to work through the challenges that are present.

In addition to coronavirus stimulus, there is another round of discussion about infrastructure investment. I hope Congress can look past party lines and recognize the funding mechanisms for our infrastructure have been impacted. Gas tax losses and the political will of utility commissions to increase the bill for customers in a recession will cause our infrastructure to need further repair. The end of 2020 into 2021 could be very light on new construction opportunities if the municipal, state and utility budgets are in disarray.

There are a couple of numbers that I look at, relative to the coronavirus, to determine where we are and if things are getting better or worse. The first is the trend of deaths related to the disease. This is unequivocally going down, but it also a lagging indicator. Based on information from the Journal of American Medicine Academy, the average time from contraction of the disease to death is 14 days, and you can be in the hospital for three to six weeks if you recover from severe symptoms.

Another number is coronavirus hospitalizations. In the United States this number is about 228,000, as of June 18, and represents the highest level since March. Time of stay also makes this a lagging indicator, but spikes in new hospitalizations have been on the rise since May 26 and are the reason for uncertainty as we begin to get back to “normal.” We are not out of the woods yet.

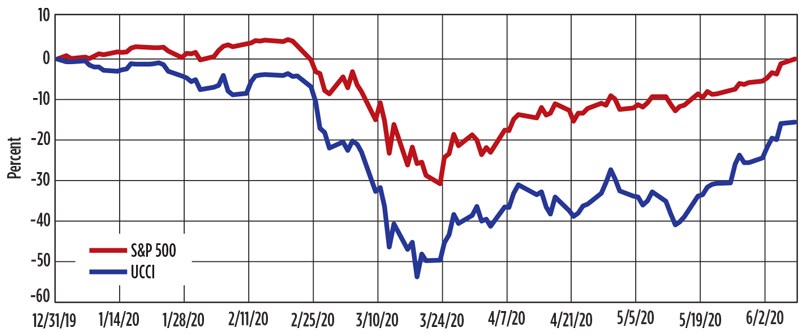

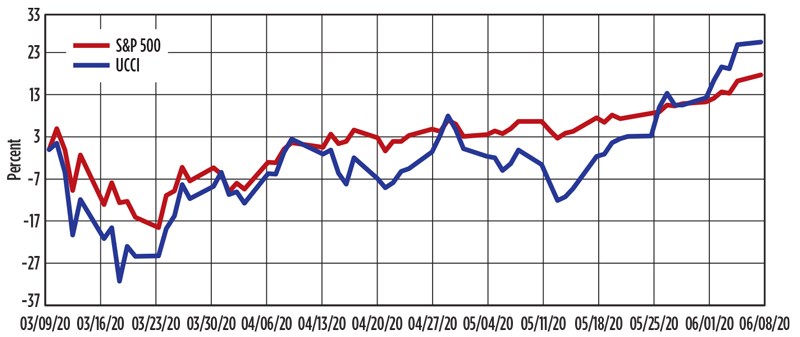

Presented below is performance of the sector’s publicly traded stocks year-to-date (Figure 2) and the past three months (Figure 3). Year-to-date performance shows the significantly greater impact the two-pronged attack of oil and coronavirus has had on the construction industry. March 18, 2020 was the low point, representing a 54 percent decline from the beginning of the year.

Because of the federal reserve and congressional actions, Figure 3 illustrates the fever pitch that the market has been on since March 18. Stock prices for UCCI increased over 23 percent during that timeframe and are buoyed by a Federal Reserve willing to buy the corporate debt of public companies.

The action of Congress and the progression of coronavirus are the two primary factors in whether we continue to return to valuations at the beginning of the year, or if the “V” becomes a “W”.

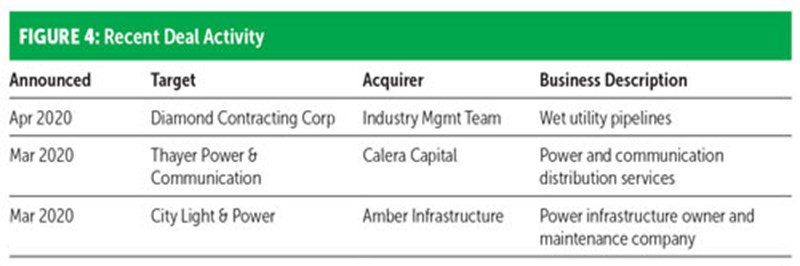

Second-quarter 2020 deal activity (Figure 4) was largely by companies that were almost able to complete the required diligence before the shutdowns put acquisitions on pause. The most notable of these was entry of a new private equity, Calera Capital, into the power distribution space with its acquisition of Thayer Power and Communication.

The buyer universe has expanded significantly for companies in the infrastructure construction space and continues to do so. Quite sadly, however, the number of both Chapter 7 and Chapter 11 bankruptcies rose as a result of coronavirus inactivity and low oil prices. We anticipate that as companies become increasingly cash-poor due to the coronavirus, those with significant exposure to oil and gas markets will continue to be impacted. •

Dan Shumate is managing director with FMI Capital Advisors. He focuses on mergers and acquisitions and business continuity transactions in the utility transmission and distribution sector.

Comments