January 2020 Vol. 75 No. 1

Features

2020 Outlook and Utility & Communications Construction Update

By Daniel Shumate | Director, FMI Capital Advisors Inc.

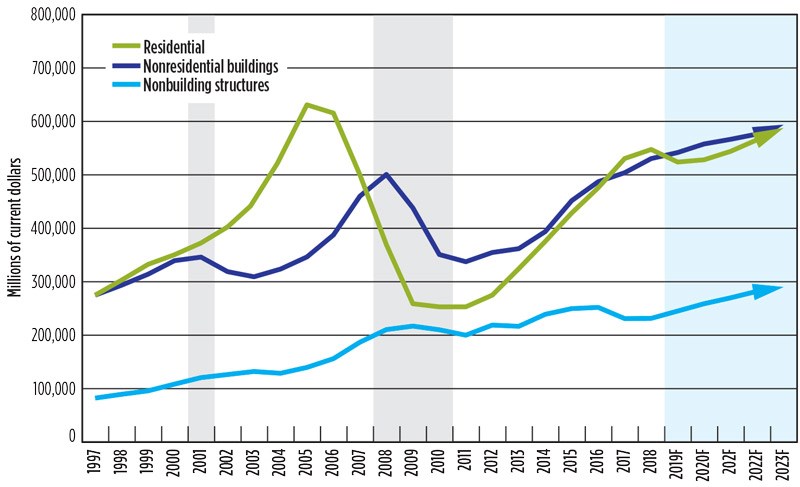

The United States construction market is steady and growing slightly amidst the second-longest period of sustained economic expansion since 1964. Despite fears of an impending slowdown, FMI Research projects that construction put-in-place will increase year-over-year by slightly less than 1 percent in 2019 (down from 3 percent in 2018).

The industry is weighed down by the residential and multi-family construction segment, but bolstered by near-full employment, wage improvement and strong non-building structure growth. Infrastructure construction spend – particularly related to transportation (e.g., airport, mass transit, railroad, water ports) and nonbuilding structure construction (e.g., power, highway, water, sewer) – has also contributed to 2019 growth.

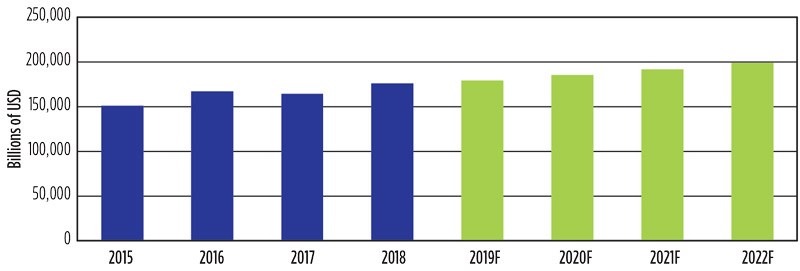

Within the utility and communications segments specifically, capital plans by owners of power, gas and communication infrastructure continue to grow. Figure 2 presents the total projected capital expenditures for major utilities and communication companies in the United States and Canada over the next four years. The picture is clear – substantial investment is being made in utility infrastructure.

As the underground construction industry has continued to grow, limitations and risk factors are present that could impact sector performance. The most significant is demand for labor to complete the work opportunities that exist. Massive training programs, and growth and modernization of union training programs are attempting to address the issue. However, wage increases have weighed on profitability for owners because labor remains scarce.

We expected interest rates to rise throughout 2019, but the Federal Reserve showed more caution and held steady, keeping inflation risk low. We expect little change in 2020 due to the volatility in the marketplace from ongoing trade negotiations between the United States and China. Lastly, costs related to risk mitigation by public utilities is a concern, especially in arid geographies that have the potential for fires. Insurance and pre-construction engineering requirements could slow construction activity.

Power distribution

The power distribution segment of underground construction will experience continued growth and investment in 2020. FMI projects investment on distribution infrastructure in excess of $34 billion, representing year-over-year growth of 8 percent. The long-term impact of the PG&E fires is that electric utilities nationwide are conscientiously assessing their current infrastructure. Accidents related to under-investment can cause terrible damage and loss of life. As such, high-consequence areas can benefit from undergrounding programs. FP&L, in Florida, is in the early stages of a 10-year program; Duke Energy is actively putting power infrastructure underground, where feasible, and many other utilities with either storm or fire hazards are running cost-benefit analyses.

The EIA Energy Outlook shows an ever-increasing use of electrical power and distributed generation that will require connection to the current grid. In addition, California, New Jersey, Massachusetts and other states have enacted renewable portfolio requirements that are in excess of 50 percent of total generation by 2030. Distributed generation infrastructure requires additional investment in the distribution of that power.

Natural gas transmission, distribution

The outlook for the natural gas transmission and distribution segment is steady for 2020. Demand for natural gas has increased in electric power generation, industrial use, exports and residential heating. New power generation will primarily come from natural gas or renewable sources, such as wind or solar. The drivers are continued, unconventional resource development and strong market demand, largely in response to the relatively low commodity prices. While 2019 represented a high point for pipeline mileage, 2020 will be more measured with estimates of 1,400–1,500 miles of transmission infrastructure constructed. Long-term demand will be driven by population need and will likely come from the Marcelles and Utica basins.

For the gas distribution contractor, North American gas local distribution companies continue efforts to remove cast-iron and bare steel in 20- to 30-year replacement programs addressing aging infrastructure. Nearly every local distribution company in the United States is under some form of accelerated replacement program, with multi-year capital investments being made to address leak-prone infrastructure. In the wake of the Merrimack Valley accidents of 2018, more scrutiny of natural gas pipelines necessitates additional investment. In addition, replacing current power and communication infrastructure and providing fiber for 5G, simply mean more potential hits, repairs and potential for accidents. The gas distribution contractor has no shortage of repair, replacement and installation opportunities in 2020.

Communications infrastructure

The communication construction segment will experience meaningful growth to implement the 5G shift currently occurring among the major communication companies. Expectations are that by 2025, over half of all mobile users will be relying on 5G connections. To facilitate this, micro cell deployment and the “densification” of the current network is a necessity. The underground segment will benefit, as fiber is the backbone that makes the small-cell network function.

Emerging 5G wireless technologies mark the next great shift in telecom infrastructure (i.e., from wireline to fiber). Multi-year initiatives led by telecom service providers will create fiber installation, small-cell deployment and ongoing maintenance contract opportunities for those operators with the requisite fiber construction capabilities. In 2020, the growth and investment will be centered around the major population centers. Rural area growth will require creativity at the municipal level to implement high-speed networks along existing power cooperative infrastructure.

Municipal water/wastewater

The water and wastewater segments will play a critical role in growing utility-related construction through the forecast period. FMI Research projects that both segments, taken together, will grow at an annualized rate of around 5 percent from 2019 to 2023. While water and wastewater construction spending won’t rise to the level of industry highs in 2008 (just prior to the residential construction collapse), it is expected to come close by the end of the forecast period. Demand in both segments will be driven by the replacement of aging infrastructure, population growth, residential and utility construction, and state and local government spending.

Reliability risks associated with aging water and sewer pipeline infrastructure are the primary reasons for investment. The renewal rate for water utilities is expected to increase sharply in response to recent EPA guidance that it will implement section 401 of the Clean Water Act to promote the building of pipelines, and ensure Americans have clean water for drinking.

In addition, EPA guidance related to accelerated replacement of asbestos cement pipe will encourage spending at the state and local level. The EPA is providing billions of funding for some of these projects and is combining them with WIFIA loans to create a powerful financing solution for major infrastructure projects.

The Water Infrastructure Act of 2018 provided some much-needed federal support in the near-term. The new law authorizes $3.7 billion for new Army Corps of Engineers projects and $4.4 billion for drinking-water projects. It also reauthorizes the Water Infrastructure Finance and Innovation Act (WIFIA) at $50 million and the Drinking Water State Revolving Fund (DWSR) at $4.4 billion. These funds can be utilized for loans, loan guarantees, bond insurance and project refinancing.

While this is certainly a positive development for the industry on its face, it remains a far cry from the influx of capital that organizations like the American Water Works Association believe is needed – especially considering the current administration’s expectation that local water utilities become self-sufficient over time, as a result of increasing deregulation. Information from the American Society of Civil Engineers suggests that by 2020, 44 percent of U.S. water pipe will be classified as poor, very poor or life elapsed. Because of this, 20 percent of treated water is lost each year and nearly 900 billion gallons of untreated sewage are discharged into waterways. There is a critical need for multi-decade investment and improvement of the U.S. water system.

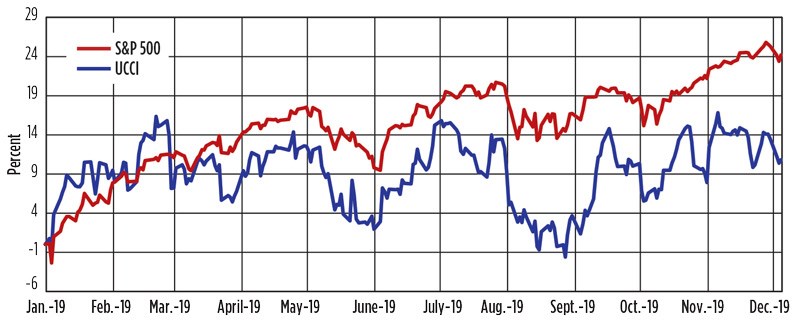

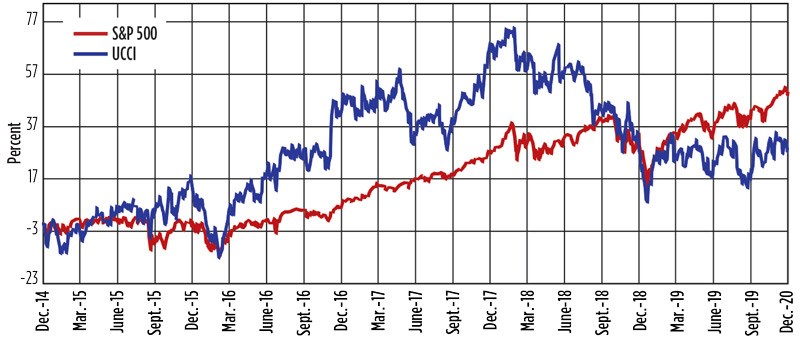

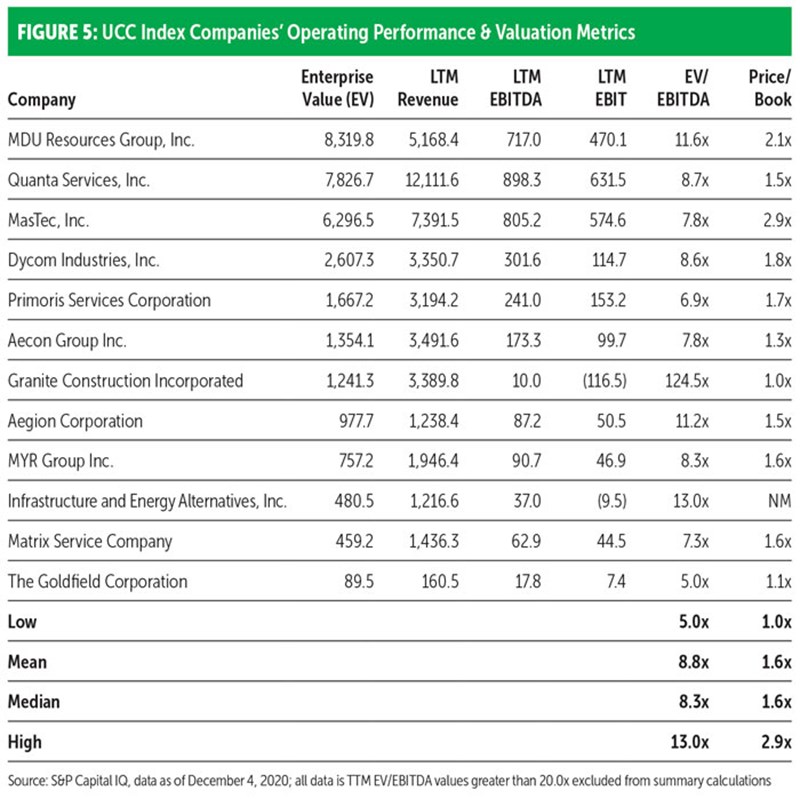

The Utility & Communications Construction Index (UCCI) presented below shows the performance of the sector’s publicly traded stocks over the past year (Figure 1) and past five years (Figure 2). We have included an additional company in the index for 2020 – IEA, which went public on March 26, 2018, and has a substantial utility infrastructure focus related to its subsidiaries in the power and civil markets.

Year-to-date performance of the UCCI is up 10.8 percent, but underperformed relative to the S&P500, which is up over 24 percent YTD. Revenue and earnings growth have exceeded expectations, but the public market has penalized those companies with exposure to oil and gas. Even the communication companies have depressed multiples relative to historic norms. Because the public’s perception of value does not align with management, we are again seeing several stock buyback programs being initiated by companies, such as Matrix, Primoris and Aecon.

The UCC Index is significantly more volatile than the S&P 500 and you can see the impact that oil prices, expectations for infrastructure investment at the federal level, and the ongoing tariff negotiations with China have had on the UCC companies. Going into an election year with limited prospects for federal investment, UCCI growth will be driven by investor-owned utility investment in existing infrastructure, and communication investment in 5G programs nationally.

2019 represented a relative slowdown in the M&A segment, as valuation expectations for private owners have increased beyond the appetite of some of the more active, strategic buyers. We expect increased activity in 2020 to drive growth and consolidation of key industries (primarily communication driven).

We also expect further consolidation of companies providing unique, high-margin services to the wet utility segment. While we anticipate little assistance from the federal government, the underlying drivers for the utility and communication segments remain strong and recession-resistant in 2020. •

Dan Shumate is a managing director with FMI Capital Advisors. He focuses on mergers and acquisitions, and business continuity transactions in the utility transmission and distribution sector.

Comments