February 2020 Vol. 75 No. 2

Features

23rd Annual Municipal Sewer/Water Infrastructure Forecast

Robert Carpenter | Editor-in-Chief

It’s a presidential election year and usually that spells trouble for public works funding programs. Political action is polarized by campaigning, mudslinging and bravado. The results are generally stalled or reduced spending plans, nervous investors and an uncertain future for underground infrastructure. However, for the sewer, water and stormwater markets, that doesn’t seem to be the case in 2020.

Politicians at the national level have their attention tightly focused on issues and crises – some contrived, some very real. State and local agencies/municipalities are struggling with their own set of sometimes common, sometimes unique problems. But through it all, infrastructure renewal is a common theme at both the national and local stages. Even better news is that going into 2020, municipalities are cautiously optimistic about funding opportunities for many much-needed projects, particularly involving rehabilitation.

The 23rd Annual Municipal Sewer and Water Infrastructure Survey & Forecast, conducted by Underground Construction magazine in October and November of 2019, queried municipal personnel about a variety of important subjects, among them projected spending for 2020.

It was slow start in 2019 for sewer/water infrastructure investment, but by summer, projects had ramped up for a strong finish to the year. Survey respondents felt, for the most part, that their increased work flow and project releases would continue through 2020, particularly in the traditionally strong economic states. While still very cautious, municipal personnel appear to believe that a prolonged stronger economy, combined with encouraging developments at the state and congressional levels, would support increased spending.

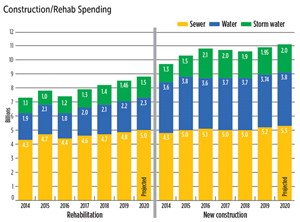

Spending plans

New installation of sewer infrastructure is projected to increase in 2020 to $5.3 billion with an increase to $3.8 billion for water construction – up from $3.74 billion. Rehabilitation continues to outpace new construction in its growth curve. Sewer rehab is projected to grow to $5.0 billion, with water getting a 0.5 percent ($2.3 billion) spending boost. In total, spending plans for sewer, water and storm water piping infrastructure are projected to be $19.9 billion in the U.S. for 2020.

The survey polled U.S. municipalities about their top concerns and issues, 2020 infrastructure spending plans, and working relationships with consulting engineers and contractors. This exclusive annual study also provides detailed insight of America’s cities with information and perspectives on industry topics and technology. The survey reflects only information regarding sewer, water and stormwater piping infrastructure and does not include figures or data on pumping stations, treatment plants, etc.

Respondents ranged in size from rural communities of less than 500, to mid-sized cities and a representative sampling of the nation’s largest cities.

Presidential hopefuls on the Democratic side of the aisle all have embraced infrastructure investment. Some have touted spending of a trillion dollars. Yet, like some of their other programs, details as to how such plans would be funded remain elusive. President Trump’s plans for infrastructure to date have been only moderately successful.

The good news is that in 2020, the Drinking Water State Revolving Funds (SRF) will be available at their 2019 funding levels. Congress turned down the Trump administration’s demand to reduce funding for the Drinking Water and Clean Water SRFs in fiscal 2020, which began Oct. 1, 2019. In the final fiscal 2020 appropriations bill, passed in mid-December, Congress gave the Clean Water State Revolving Funds $1.64 billion and the Drinking Water State Revolving Funds $1.13 billion.

The Water Infrastructure Finance and Innovation Act (WIFIA), which was revised in 2018, is beginning to have a major impact. The program is designed to accelerate investment in water infrastructure by providing long-term, low-cost supplemental loans for regionally and nationally significant projects.

While the SRFs provide revolving loans to the states and localities, the WIFIA provides credit assistance for large projects, with the expected FY 2020 appropriation increasing the 2019 $8 billion in loan capacity. President Trump’s policies are concentrating on putting the burden of maintaining and funding much-needed renaissance at the local level, with programs such as WIFIA.

Funding

Survey respondents clearly believe accessing funding is critical to the much-needed growth and restoration of their systems. “Our city is planning on seeking WIFIA funding in 2020,” said this West Coast respondent. “Our city council and budget director finally realized that waiting for grant money is pointless – it’s just not going to happen anymore. Our sewers are in rough shape in many spots and we’re going to get in trouble with the state and EPA if we don’t start fixing them.”

Said this respondent from the Northeast, “I believe our budgeting for 2020 is a bit more aggressive – which is a good thing.” From the upper Midwest came, “quite frankly I don’t know where we’ll get the money, but we’re in desperate need of investing in our water system.”

Added a Southwest municipal director, “We’re doing our best to move forward with projects. How far we’ll get in 2020 remains to be seen, but at least our council and mayor seem to realize that we’ve got to do something – now.”

When the Environmental Protection Agency comes calling on a city, panic sets in. If non-compliance of EPA regulations is being charged, a Consent Decree is a likely outcome. In 2019, Houston became the latest major city to go under a Consent Decree – its second since the ‘90s. The first one accomplished much towards addressing some of the city’s problems, but it was still more of a band-aid approach rather than solving key problems, which has, in turn, led to more problems.

The EPA remains active in pursuing cities, large and small, that are out of compliance with environmental standards and regulations. The agency also continues to monitor how effective past Consent Decree programs have been. That’s because, said one EPA official, the agency wants to better understand root problems and what is most effective in solving those problems.

About 39 percent of respondents said their 2020 budgets will be greater than in 2019, while 21 percent have smaller budgets. About 40 percent expect their budgets to be about the same.

When asked for a ballpark estimate of how much money was needed to update, expand or rehabilitate their infrastructure for 2020 plus the long term, many respondents didn’t hesitate to state their opinions.

“We’re basically treading water, doing just enough to maintain our system. But we’re not making any progress in addressing simmering problems and needs,” said this respondent from the Midwest. “We’ve got to get started investing enough money now, so that we can at least begin to catch up.”

A municipal spokesman from a Southeast city agreed. “We’re doing our best to keep the system working well. But to get it caught up and fix recurring problems, we need investment.”

Respondents estimated they would need $99 billion for sewer, $65 billion for water and $34 billion for stormwater to adequately meet their needs in 2020. In the next five years, survey participants anticipate needing more than $684 billion.

Many cities expressed their belief that a strong asset management program is key to developing long-term plans for assessing, planning and implementing programs to keep sewer/water systems functioning at maximum efficiency (assuming funding can be acquired). With that in mind, asset management continues to gain traction with America’s cities.

More than 46 percent of America’s cities report having an asset management program fully in place, compared to 44 percent in last year’s survey. About 35 percent now have a program in development and about 19 percent have no plans to implement an underground asset management program at this time.

“We’ve finally making progress in developing an asset management program and we think it’s going to really help us pinpoint our problems and implement a plan to address those issues,” stressed a Southeast respondent.

User fees

While user fee increases have historically been a rare occurrence, over the past 10 years there has been a dramatic climb in those cities finally adopting much needed rate increases. “Trash collection keeps going up, gas and electric rates go up regularly, cable and internet is through the roof, but our local politicians are scared to raise our sewer and water rates by a few cents,” complained this respondent from the Mountain West area.

“We just got a major rate increase in 2019 for the first time in four years, but it was still not enough. We should have small rate increases each year – kind of like inflation. Our costs keep going up,” observed this respondent from the Midwest.

Survey respondents reported an average of 2.8 years between rate hikes, down from 2.9 a year ago.

Another hot topic among municipalities, as it was last year, is workforce issues. “We’re not doing enough to retain our consulting engineers,” pointed out this Southwest respondent. “They’re all leaving for private jobs with consulting firms where their experience and talents are paid a lot better.”

Added a West Coast city representative, “we’ve already lost some key employees to retirement, with more hitting that age, and we’re struggling to replace them. We just can’t find employees.”

Municipalities rated several broad categories as to how much of an impact each had on their operations. As discussed earlier, funding remained the number-one concern with 82 percent of the respondents citing that issue. Regulations/EPA was cited by 71 percent of the respondents; hiring qualified employees was mentioned by 44 percent; safety concerns by 38 percent; and community relations by 33 percent.

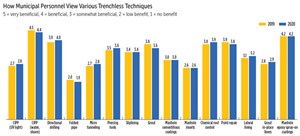

About 46 percent of those surveyed commented that they prefer to use trenchless methods when feasible, down from 50 percent last year, while 33 percent said it didn’t matter and 21 percent still prefer open-cut methods. “We have several trenchless products we like to use but it’s always a matter of cost-effectiveness and what’s the best solution for the job,” said a Mid-Atlantic area municipal manager.

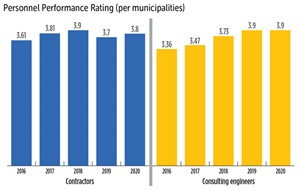

Rating engineers, contractors

The survey asked municipal personnel to rate the consulting engineering community – basically a confidence index. The overall rating was a composite from four categories: quality of work, timely project completion, fair pricing and dependability, based on a scale of 1 (worst) to 5 (best). The consulting engineer’s score for 2020 remained constant at 3.9.

When asked what are the most important values they look for in engineering firms, quality, by a wide margin, was again the top factor cited by municipal mangers. Other areas mentioned include “understanding of new technology,” by 79 percent of respondents; “cost” by 72 percent; and “productive relationships with contractors” by 30 percent.

Municipal personnel were also asked to suggest how engineers could do a better job for sewer and water agencies. A Southeast respondent asked that engineers “obtain some real field experience.” Indeed, over the many years this survey has been conducted, lack of field experience is always widely cited.

“We just need an engineer who has been in the field, understands issues and can adequately come up with options. Is that too much to ask of a consulting engineer?” queried this respondent from the Southeast.

Contractors

Municipal personnel also rated contractors, based on the 1 to 5 scale, in the same four areas. Fortunately, contractors’ composite score climbed for the first time in two years, from 3.7 to 3.8. That’s encouraging news for those contractors working hard to gain the trust of their municipal customers.

A common complaint about contractors was failure to accurately bid, or underestimating projects, relying on change orders. “It seems like every job we had last year was full of change orders,” said this respondent for the Southwest. Added another muni manager from the Midwest, “we don’t mind our contractors making a profit – just don’t try to do it through change orders.”

Another strong suggestion for contractors was to broaden their tool chest. “The contractor shouldn’t try to sell us a particular technology. There are lots of options out there today, let’s talk about those and what’s best for our project,” said a respondent from the Mountain West.

Comments