April 2020 Vol. 75 No. 4

Features

Utility & Communications Construction Update

By Daniel Shumate, Managing Director, FMI Capital Advisors Inc.

Sitting down to write the UCC Update in March of 2020 is one of the more challenging tasks I’ve encountered. Uncertainty pervades everything that we typically would analyze.

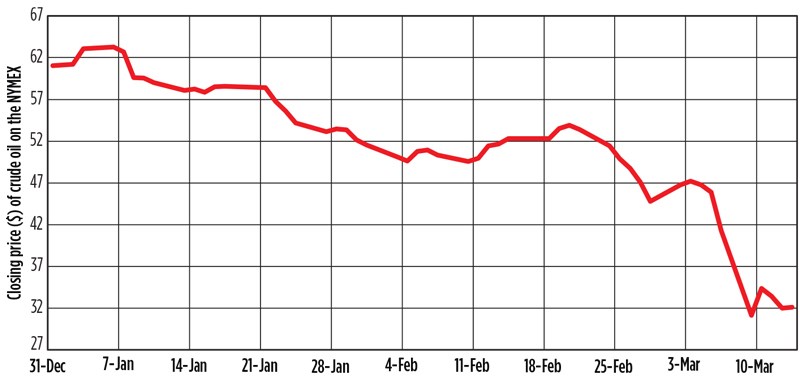

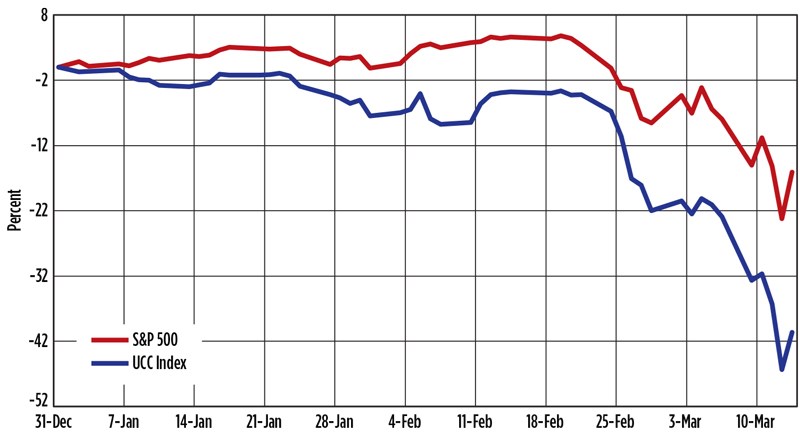

As of March 1, the stock market is down approximately 25 percent year-to-date. The price of oil (see FIGURE 1) has declined almost 50 percent, nearing lows last seen in January 2016. The Federal Reserve has made two emergency cuts

and rates have now returned to zero. Congress has also passed two emergency aid packages, with more likely to come.

The spread of the coronavirus has upended almost every staple of U.S. life, and businesses have no sense of what the next two weeks, much less the next two months, could look like. With these themes as the backdrop, there are some takeaways we can share for planning the next six months, as we consider both oil and the spread of the coronavirus.

Russia chose a pivotal time to begin one of the fiercest pricing wars that we’ve seen in the oil industry, taking aim at both Saudi Arabia and U.S. shale oil producers. The oil and gas industry is caught in the middle of a severe supply-and-demand shock. Analysts from both Goldman Sachs and JP Morgan expect oil to decline, then maintain in the $24-to-$27 price range through the second quarter.

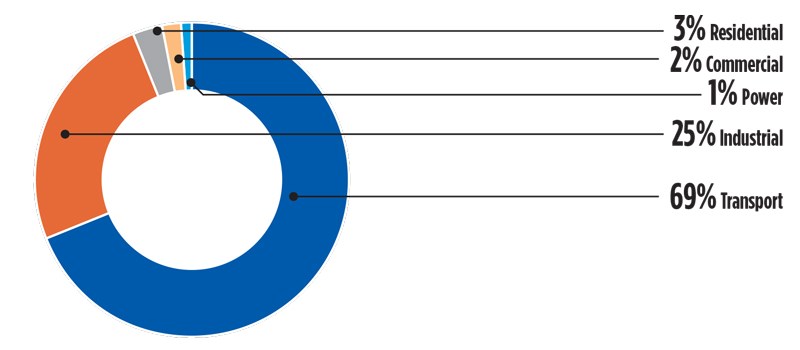

The oil market was vulnerable prior to the onset of the coronavirus outbreak, and work and travel restrictions will cause a substantial decline in oil demand. As you can see in FIGURE 2, per the U.S. Energy Information Administration, the primary user of oil is the transportation sector. A substantial decline in tourism, working from home and a major decline in airline travel will severely impact the price of oil.

Without the effect of the coronavirus, Russia and Saudi Arabia could withstand several months of low oil prices, during which time U.S. production would lag.

Any prolonging of an oil price war will have a substantial effect on the largest oil producers and, due to current debt levels, could result in bankruptcies.

Because of the exposure to both the midstream and select discretionary projects, the UCC Index companies have experienced a severe drop in price, as well. As of the March 16, the UCCI is down over 40 percent and we expect further declines as the market digests what the lasting impacts of the coronavirus are on the economy.

Currently, all the companies are trading as if they are directly exposed to oil, and that is simply not the case. We would expect those companies that are reliant on utility spending and communication to see pricing improvement, especially as infrastructure to ensure reliability of power, gas and communication networks, will remain critical throughout this time.

Deal activity in the second and third quarter of 2020 will likely be very limited. Central banks are exercising every tool to ensure liquidity remains in the financial system, and we would not expect growth-oriented M&A during this time. Companies with substantial exposure to the oil midstream markets will likely experience severe hardship over the next 12 to18 months and we could see restructuring transactions, if solvency becomes a concern.

There is one very notable transaction that occurred in the first quarter of the year: the sale of MVerge (Miller Pipeline and Minnesota Limited) to PowerTeam Services, a portfolio company of Clayton, Dubilier & Rice, for $850 million. The sale vaults PowerTeam Services into one of the 10 largest utility contractors in the United States and further consolidates the gas distribution industry in the Southeast and Great Lakes regions.

With all of the current challenges, we do expect underground contractors to remain relatively busy throughout this time. Most of the work for 2020 is already contracted and much of it is for regulated improvements of existing infrastructure. Additionally, if there is a prolonged “stay-at-home” environment, the need for additional communication bandwidth will become quite clear and the backbone of those networks is fiber placement.

We would also expect spending associated with both power and gas distribution networks to remain relatively steady, as utilities are some of the safest investments and should remain so throughout this period. •

DAN SHUMATE is managing director with FMI Capital Advisors. He focuses on mergers and acquisitions and business continuity transactions in the utility transmission and distribution sector.

Comments