June 2013, Vol. 68, No. 6

Features

15th Annual Horizontal Directional Drilling Survey

Despite pockets of negativity, the majority of horizontal directional drilling contractors continue to enjoy a robust business atmosphere for 2013, and most expect that environment to continue for the foreseeable future.

Indeed, most contractors commenting in the survey seemed bullish on HDD opportunities. A contractor from Idaho went so far as to predict that “the directional drill will be as common on a job site as a backhoe.”

An Oklahoma contractor said that various market conditions should keep HDD strong for some time. “The long term looks to be even better with our current infrastructure reaching the end of its life span. Most of the infrastructure is in highly congested areas where open-cut will not work. Environmental reasons are bringing the cost of open-cut higher than HDD.”

Said this mid-Atlantic contractor, “We have been involved in HDD for 20 years and find it necessary for us to survive in today’s market. We are going to keep expanding in the HDD field with the feeling the market will only continue to need more HDD than in the past.”

Of course, the outlook is not without risk, many concede, especially in areas where cutthroat competition has kept prices too low.

Cautions this California survey respondent, “It seems like the ‘fiber boom syndrome’ is coming back to our industry, only this time it is centered around energy (gas, oil, solar, etc.). The prices seem to be hurt by a glut of new, unqualified contractors. If you are an HDD contractor with an excellent reputation and specialize in tougher work, this doesn’t hurt as bad as if you are a company with a not-so-good rep that drills easy dirt projects.”

[inline:Survey – common pipe.jpg]

A Florida contractor lamented that in his area, HDD could be in trouble if market prices are not improved. “There is so much price gouging that you cannot afford new equipment. If prices do not come up above open-cut than the HDD market will no longer exist.”

Several survey respondents complained that too many of the new entrants into HDD are causing negative ripple effect issues for others. Observed this Michigan respondent, “New contractors are unaware of proper pricing and procedures.”

This information and much more are detailed in the 2013 15th Annual Underground Construction HDD Survey of the U.S. market. This exclusive industry research was conducted during March and April. Surveys were sent via both U.S. Postal Service and email to more than 5,800 contractors or organizations that actively own and operate HDD drilling units. The number of completed surveys allowed for an accurate statistical portrayal of the market. Survey responses came from all 50 states plus Puerto Rico.

Challenges

Even as the industry continues to mature and overall the market is strong, HDD is not without its fair share of challenges and growing pains.

According to this Pennsylvania contractor, their biggest challenge is finding “professional, qualified operators and locators.” That same problem was echoed by contractors throughout the country. In fact, a North Carolina contractor stressed that not being able to find qualified personnel inhibits his company from expanding.

While low-ball pricing schemes, often by inexperienced or desperate companies continue to be a hot-button issue for many, this Florida contractor shared another perspective. “HDD should never cost less than it would to open-cut whatever is being crossed. If it is a road, then plan, profile, engineer; allow for maintenance of traffic, back filling soil in lifts, proctor, testing, temporary pavement, then milling and permanent asphalt and striping. Then add 10 percent to that amount for the convenience of HDD. The same goes for water crossings. We do this work way too cheap for the risk that we take every day.”

Added this mid-Atlantic contractor, “Even though our pricing is not among the lowest, our knowledge and experience allows us to carry a reputation of completing the HDD jobs we take on. That permits us to continue to receive HDD jobs at our current pricing. Adequate pricing is needed in the HDD process for expansion and due to all the unknowns when HDD is used.”

As underground utility corridors become more crowded, often an easy-out is to simply drill deeper. But that strategy is coming back to haunt the industry, says a Missouri respondent. “These existing utilities are becoming harder to expose due to the depth they were bored.”

This Oklahoma contractor agreed. “We spend more time looking for missed locates than most bores take to drill. We are also facing new problems of congested easements where previous HDD activity occurred and a less than professional approach was taken. They drilled deep and crooked and took up all the room.”

An Arizona respondent summed up his company’s biggest challenge in two words: “Still rock.”

The disposal of drilling fluids remains a major industry challenge, especially in certain states with restrictive policies such as New York, complained several contractors.

For many respondents, however, continuing education is key for the growth and survival of the long-term HDD market. “I really believe that the future of HDD hangs with educating and getting the information into the hands of the decision makers, the city managers and engineers,” related this West Coast-based contractor. “I have been very aggressive in doing presentations for groups of engineers and most recently for the city of Portland, OR, Water Works, I also met with 20 different water districts in California and was quite surprised that most did not know what HDPE pipe was and that you could pull in ductile iron with HDD as well. If we do nothing they will continue to open trench because it is what they are comfortable with.”

Big is better?

Rig sizes continue to adapt to an ever-increasing market evolution. No doubt the shale gas and oil boom has prompted many contractors to increase the size of their rig fleet with mid to large unit additions.

But demand for larger, more challenging applications has spread much further than energy. HDD use in the water market is becoming common place along with all types of pressure pipe applications, including sewer. Even gravity sewer installations have seen a marked increase in the use of directional drilling though understandably at a much slower rate. However, while companies continue to introduce products aimed at the gravity sewer market, it is still a tedious and challenging process.

As the HDD evolution continues, the challenging projects have become routine; the once-believed impossible projects, merely difficult. The industry continues to gain experience in virtually all imaginable market niches, no matter how narrow.

That’s not to say risk has been eliminated. Indeed, the survey reveals a general feeling that many contractors, especially those newer to the industry, often fail to conduct a proper risk assessment and thus undercharge or fail on a project. That leaves a bad taste for the owner and sometimes creating a barrier to market growth.

With the various HDD market landscapes continuing to change, most contractors (77.1 percent) believe competition is increasing as more seek the greener grass of directional drilling.

This California respondent explained that inexperienced contractors have become a major issue. “Everyone looks at what we do, what we charge and they say ‘I’m getting into that, you guys make so much money it is a crime.’ Then they get a rig and find out it is a little tougher than it looks. The first time they need a new stack of drill pipe they say ‘Wow, that is expensive! How am I supposed to afford that with the low prices I am getting paid?’ The low prices are self-inflicted wounds, of course. It seems like this HDD industry should be fully matured after the last 20 years, but I do not think it is yet. The most shocking thing I find is when I ask other contractors what their cost is to run their rigs. You get wildly varying answers.”

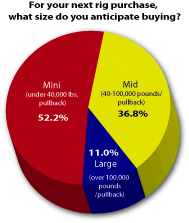

Nonetheless, the industry marches forward to generally good market conditions. Demand for more pullback strength and torque to compete more effectively and a variety of applications has contributed to a spike in the mid-sized market. While mini-rigs (defined by having 40,000 pounds or less of pullback force) still account for the largest portion of rigs in use today at 60.6 percent, that number continues to shrink on an annual basis. On the other hand, mid-size rig ownership (between 40,000 and 100,000 pounds of pullback) has climbed to 30.2 percent of the market compared to just 27.2 percent a year ago. More drilling companies are also going big. Large units (greater than 100,000 pounds of pullback force) climbed from 8.1 percent of the market in 2012 to 9.2 percent today.

To further substantiate the growth of the mid and large rig markets, contractor buying plans for 2013 reflect interest in rigs with more “muscle.” Only 40.1 percent of contractors indicated they were going to buy mini rigs in 2013. Of course, they will tend to purchase multiple units or about 50.2 percent of all rig purchases. Roughly 49 percent of contractors said they were going to invest in mid-sized rigs, accounting for 33.8 percent of all rig purchases. About 10.9 percent of contractors intend to add large rigs to their equipment fleets in 2013 which equates to 11 percent of the market. Overall, almost 62 percent of HDD equipment owners plan to purchase at least one new rig in 2013.

Defining the fleet

Another major indicator of the continued overall strength of the HDD market comes from ownership numbers. For those contractors operating primarily small rigs, they own an average of 3.7 rigs per company. For those who also own/operate mid-sized rigs, generally in addition to small rigs, their fleets typically include 1.8 medium rigs. For contractors focusing on big rigs, they typically own 2.4 units.

The age of the HDD fleet provides an interesting dynamic. While the number of rigs operating that are more than 10-years old continues to increase (15.7 percent), so does the number of rigs that are less than two-years old (17.1 percent). While on the surface that may seem confusing, in reality is makes perfect sense when reflecting overall market conditions. For some time now, the hardware of HDD rigs has remained relatively stable, more durable and advances have concentrated on drive systems, tooling and electronics. Plus, manufacturers were going through a crash engineering period in the 1990s and early 2000s as they were still learning what worked best in the field. Those manufacturers that survived the telecom crash have learned how to make long-lasting, high quality rigs. Contractors are simply able to get more out of their units for longer periods of time.

[inline:Survey – size, age, bore.jpg]

On the other hand, market growth over the past few years, substantially fueled by telecom and energy, continues to drive contractor expansion and subsequently increased buying habits. That dynamic was reflected in the number of rigs in the two to five year range. Last year 43.5 percent of rigs were five to 10 years old and 26.6 percent two to 5 years of age. But in 2013, all the recent purchases by existing contractors joined with newcomers have resulted in several years of buying new equipment. Now, 40.7 percent of rigs fall into the two to 5-year-old category while 26.5 percent are five to 10-years of age.

As much discussion as there has been regarding contractors bulking up their fleets for projects requiring more pullback and torque power, the fiber optic market remains strong even though stimulus dollars are all but used up. AT&T was the latest major provider to announce plans to further expand their fiber-to-the-premises networks. This type of work is frequently accomplished with HDD equipment but requires smaller units that are easy to transport and set-up, plus ideal for short shots of 100 – 500 feet. Manufacturers have been adding new products or revamping exiting products to fill this steady niche. Subsequently, average bore lengths for small rigs dropped from 354 feet to 279 feet.

[inline:Survey – units manufactured.jpg]

For mid-sized rigs, bore lengths stayed about the same at 632 feet per bore. However, large rig drilling increased substantially from 1,040 feet to more than 2,000 feet per average bore.

Market composition

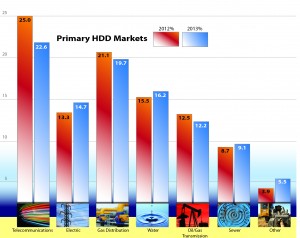

The HDD market composition remained relatively similar to the past two years though there were subtle but tell-tale shifts in market shares. For example, as the telecom stimulus packages finally played out in 2012, a small shift downward in market share resulted for the industry. However, while a telecom “dip” was widely forecast by industry experts for 2013, the market has showed remarkable strength and continues to be a robust niche – even without stimulus investments. Telecom accounts for about 22.6 percent of the HDD market.

Gas distribution is another market whose HDD share has decreased slightly. Several years of recession have just now resulted in slight increases in the housing market and manufacturing output. This is an industry that while already very busy with maintenance and integrity management work, stands to experience a major boost in new installations over the next few years – assuming the economy regains its health. For gas distribution, HDD accounted for 19.7 percent of the market, primarily in new or replacement projects.

Steadily creeping up in market share are the water (16 percent) and sewer (9.1 percent) markets. HDD is widely accepted now as a viable installation method for water. While HDPE has always been popular because being able to fuse pipe into a long string suitable for pullback, PVC pipe has made great strides as well with fusible pipe and restrained joints. Count ductile iron as another common water pipe material that has a joint system suitable for HDD work. All these advancements will continue to drive HDD as a key construction element of the water market in the future.

While gravity sewer installation still represents a challenge for contractors due to tight line and grade tolerances, it can be accomplish via a variety of methods and systems currently on the market. But for pressure pipe, HDD is a ready-made solution that is increasingly being utilized and is reflected in market growth.

The “other” category jumped again in the 2013 survey to 5.5 percent. Geothermal continues to grow along with countless other niche applications. The fact is, potential HDD work is limited only be our imaginations.

For any directional driller, the more effective operational life they can get out of a rig, the more profitable the company can become. Before replacing or rebuilding a rig, survey respondents said they generally are able to get 3,662 hours of operation from mini drills, 4,956 from mid-sized units and 6,700 for large rigs.

Not a lot of changes were reported in the use of various types of pipe materials. HDPE was still the most commonly used pipe in conjunction with HDD, being utilized on 41.8 percent of projects followed by PVC at 22 percent, steel at 16.8 percent, ductile iron at 12.5 percent and other pipe types accounting for 6.9 percent of the market.

Used rig market

A by-product of longer rig life is the proliferation of the used HDD drilling market. Several companies have delved into that market for many years. But it has been primarily just since the turn of the century that rigs, lasting longer due to many factors, enabled contractors to begin seeing used rigs as viable products, not unlike a traditional back-hoe. Subsequently, a more mature market has seen demand for used rigs explode. In fact, 55.5 percent of the survey respondents have purchased used rigs. For their next used rig purchase, 57.7 percent of contractors indicated they would be shopping for a mini rig, 23.1 percent a mid-sized rig and 19.2 percent would be seeking a rig over 100,000 pounds. Truly, the used rig market covers all niches.

The two largest rig manufacturers in terms of unit volume, the Charles Machine Works (Ditch Witch) and Vermeer Corporation, each purchased market-leading used rig marketing companies over the past two years. This has greatly facilitated their dealers’ ability to work with customers on trade-in rigs.

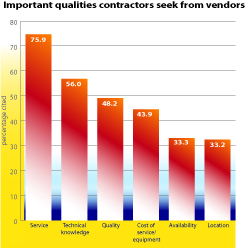

As always, contractors have definite opinions on what they’ve come to expect from their HDD equipment and service providers. Almost 76 percent cited service as the most important quality of their vendors followed by technical knowledge at 56 percent, quality was cited by 48.2 percent and the cost of services and equipment was cited as very important by 43.9 percent.

Comments