December 2013, Vol. 68 No. 12

Features

Despite Higher Costs, Electric Utilities Increasingly Favor Undergrounding

The question invariably is asked after severe weather or other disasters knocks out electrical power and communications services: “Why don’t they put those overhead lines underground where they’re protected?”

That question has been asked many times in many places over the past few years as heavy winter storms, tornadoes and hurricanes have affected much of the country, knocking out power, communications and other vital services.

Without going to the record books, most people believe the intensity and duration of storms these days are more intense than in past years. In October 2012, Hurricane Sandy alone affected 24 U.S. states, killing 285 people, caused tens of billions dollars of damage and left more than six million customers without power for weeks and in some cases longer.

Immediately after a major storm is not the time to replace aerial plant with underground infrastructure – the immediate need is to restore services. However, for many, the question remains why there is no concentrated effort to replace overhead cable with new cable buried in the ground.

Construction goes underground

For more than 40-years, cable in new residential developments, commercial complexes, educational and government campuses and other facilities have been placed underground.

In older neighborhoods of most American cities, distribution lines – many long past due for replacement – remain suspended from utility poles, often in areas with many trees, and these are the lines usually most vulnerable to wind and ice storms. Even when aerial lines are replaced because they no longer provide dependable service, they often are again suspended from poles, rather than being buried. The reason is simple: cost. Billions of dollars would be required to move existing communications and power cable from up to under. Who would pay that cost?

The Edison Electric Institute (EEI), an association of shareholder-owned electric companies, conducts an ongoing study and gathers data about “undergrounding,” replacing overhead power cable with underground cable. Cost figures in EEI studies relate specifically to power cable, but the methods of placing electric cable and communications cable in the ground are basically the same and it is reasonable to expect cost for undergrounding for each would be similar.

EEI has released Out of Sight, Out of Mind 2012, an updated study of undergrounding overhead power lines. The report was prepared for EEI by Kenneth Hall, P.E., Hall Energy Consulting Inc.

The report covers customer expectations, storms and damage, reliability of overhead and underground electrical systems, utility infrastructure, benefits and challenges of undergrounding, costs of undergrounding, state policies and utility approaches to undergrounding, and state undergrounding studies. There are appendices about preparation of the study, utility policies for new underground construction, utility policies for converting existing overhead facilities to underground and additional details about state undergrounding studies.

Cost figures of previous EEI underground studies have been frequently used by various organizations – often out of context to emphasize the greater cost of underground construction compared to overhead construction. Many times these cost comparisons have been used to justify not initiating undergrounding programs.

The 2012 report includes various cost variables and comparisons and recognizes multiple other factors that affect the practical feasibility of undergrounding.

The EEI report’s executive summary observes that following any major storm where a large percentage of the electrical grid is affected for an extended period, utilities, customers, public officials and the media will undoubtedly study the performance response of any utility impacted by the storm. It is not uncommon for this focus to turn to discussing whether plans on migrating from an overhead to an underground electrical infrastructure would resolve or substantially mitigate weather related outages.

Costs of undergrounding

Conversion costs can vary significantly depending on location-specific issues. “While some recent data suggests that conversion costs are not much higher than initial installation costs (largely because of the salvage value of equipment),” says the report, “these numbers do not take into account other costs associated with conversions: the cost of converting individual customers’ services/metering points so they can be connected to the new underground facilities and the substantial disruption caused by the undergrounding construction process (avoiding conflict with or limiting the damage to existing trees, walls, fences and other underground utilities).”

Undergrounding proponents would be quick to point out that horizontal directional drilling has proven it can mitigate much of such damage, offering substantial cost savings compared to open-cut construction and plowing.

“The economics of undergrounding utility infrastructure has always been the overarching challenge for the utility and its customers who wanted lines put underground,” says the report. “If the cost of undergrounding were nearly the same as overhead construction, the decision would be easy, but that is not the case.”

The 2012 EEI survey also collected data on the estimated cost per mile for new overhead construction, new underground construction and the cost to convert from overhead to underground. The survey collected data on the percentage breakdown of these costs between material and labor to determine if underground construction is a more labor intensive and costly process.

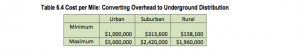

Collection of data was based on customer density: Urban, 150-plus customers per square mile; Suburban, 51 to 149 customers per square mile; Rural, 50 or fewer customers per square mile.

The study’s cost-per-mile estimate for converting power distribution and transmission lines from overhead to underground are in the charts below:

Salvage value of the overhead system replaced would offset a portion of the conversion costs.

“Because each construction project is unique due to load, number of customers served and various construction parameters, there is no precise cost per mile to build utility facilities of any type for any utility,” the study points out. “The cost data in this report is not meant to be the absolute range in which utility construction costs must fall; rather, it is intended to provide a range of cost data that utilities have estimated on various projects. Also, because of the complexity of calculations involved with these costs, they are not typically updated frequently.”

Benefits and challenges

The survey sought the perspective of utilities about how they perceive the value and issues associated with undergrounding facilities. “In the 2012 survey,” says the report, “utilities were asked, ‘What benefits does your utility derive from your underground system?’ Their answers clearly reflected a perceived value, with examples including improved reliability, improved system performance, more effective routing of multiple feeders in confined areas and in the enhancement of the visual aesthetics of roadways and streets in residential and business communities.”

However, there are challenges. “It is worth reiterating,” says the report, “that underground utility systems take longer and cost more, both to install and to repair. Utilities do seek to provide the best service at the lowest cost; however, from a cost perspective, placing infrastructure underground seems to go counter to this basic objective.”

The EEI survey identified several other disadvantages of having power lines and other equipment underground. In addition to higher costs for underground facilities, disadvantages include longer repair times, difficulty making system changes or upgrades and damage from dig-ins.

“Underground cable mitigation tends to be very expensive compared to other types of equipment repairs/replacements. This is due to the labor intensive nature of locating faults and repairing cable, the need for specialty contractors for replacement or mitigation work and the need for additional crew resources to restore customers’ power when a failure occurs.”

The study says one component that is not always discussed in the conversion process is direct costs individual customers must pay to have their electrical service connection point converted. “For most customers,” the report says, “a conversion will require them to hire an electrician to replace the overhead meter base with an underground meter base. In some cases, additional work may be required to bring the customer’s service up to current electrical code requirements.”

Willing to share costs

Surveying electric customers, the EEI reported 39 percent of those responding already have underground services with the figure rising to 49 percent for those living in suburban areas.

It may surprise many that of those still served by overhead cable, some are willing to share the costs of underground – but not all of the cost.

Respondents from across the country answered the question: How much more, as a percentage of your electric bill, would you be willing to pay to have the electric wires that serve your neighborhood placed underground? Participants were given the choices: no increase, 1−10 percent increase, 11−20 percent increase, 21-plus percent increase, or Don’t Know.

“For the entire country,” the survey found, “34 percent of the respondents were willing to pay between 1−10 percent in additional costs on their electric bill to have utility facilities placed underground, with an additional 26 percent willing to pay more. The rural section of the polled participants had the largest group, 40 percent, who were not willing to pay anything for undergrounding.”

There is a wealth of information in the 24,541-word EEI Out of Sight, Out of Mind report – far too much to include in this brief summary of its highlights. In addition to portions of the report summarized in this article, there are other sections that include basic information about the nation’s power infrastructure and its growth, data about outages caused by storms, a comparison of the reliability of overhead and underground electric systems, state policies utility approaches to undergrounding, and undergrounding studies completed by several states. The complete study can be downloaded from the EEI web site (http://www.eei.org).

Future of undergrounding

The report concludes that while state commissions will continue to be pressured to study the feasibility of undergrounding electric facilities following major outage events, it is highly unlikely that any commission will ever mandate the complete undergrounding of any utility.

Summarizing key points of the study’s conclusions:

“No study has ever come close to showing an economic justification for undergrounding,” says the report. “However, that does not mean that utilities, customers and commissions should not work together to develop undergrounding approaches where funding, resources and support are available and in agreement to support undergrounding projects.

“For customers, improved aesthetics and the hope that underground electrical facilities will provide greatly enhanced electric reliability will continue to be the driver for their desire for undergrounding of utility facilities.

“This study has demonstrated that utilities see value in and are open to undergrounding their overhead facilities. However, the challenge for utilities and customers is the high cost for building new or converting existing facilities to an underground electrical system. Data has shown that underground versus overhead costs can be between five to 10 times greater for transmission and distribution construction.

“Given the cost impact of converting existing overhead distribution facilities to underground and customer concerns about utility cost increases, a wholesale move to undergrounding most existing utility distribution facilities is probably prohibitively expensive. However, a few states and utilities have developed policies and procedures designed to encourage the utility and the local municipality to work together to convert select overhead areas to underground.

“The available data has demonstrated that utilities are investing significantly in the construction of new underground facilities, spending over 4 percent of transmission dollars annually and over 20 percent of distribution dollars annually on underground construction.

“The future of such conversions will hinge on the ability of customers, utilities and utility regulators to work together to find viable funding approaches that meet customer expectations and compensate utilities for the cost of placing electrical facilities underground.”

Comments