June 2012, Vol. 67 No. 6

Features

14th Annual Horizontal Directional Drilling Survey: Telecom, Energy Drive Market, But Is It Sustainable?

Depending upon where you are located and what niche drives your business, the horizontal directional drilling market for 2012 is a mix of strong, mediocre and stagnant. But where business is good, it is very, very good.

This information and much more is detailed in the 14th Annual Underground Construction 2012 HDD Survey of the U.S. market. This exclusive industry research was conducted during March and April. Surveys were sent via both U.S. Postal Service and email to more than 5,800 contractors or organizations who had indicated they actively own and operate HDD drilling units. The number of completed surveys allowed for an accurate statistical portrayal of the market.

For those contractors whose niches have hit the market “sweet spot,” they are understandably optimistic about their industry.

“I believe the HDD market for gas distribution will be expanding exponentially over the next decade, based on the turnaround in the engineering departments at the gas companies and the knowledge of the quality of work available using HDD,” said this Northeastern contractor.

One respondent went so far as to speculate that “the trencher will be a thing of the past.” A New York contractor added that “in the long term, I believe that directional drilling will more than double.”

But those strong HDD market areas are not without challenges. “There is a good amount of work, but not much profit margin,” observed this Maryland contractor. “We’re busy, but with a lot of competition,” agreed a Florida respondent. “I see the work picking up, but it seems the price per foot is still challenged,” said another contractor. A Texas contractor “work is good if we can keep the low-ballers out.”

An Iowa contractor cautioned that while “the near-term looks bright, there is a tremendous amount of money going into the telecom and gas markets. This should keep up for three to four more years. However, I believe there will be another big shake-out of HDD after that.”

A Virginia contractor also voiced an increasingly common complaint: “It is becoming more difficult in the Northern Virginia area due to over-crowded, existing systems already in place.” In New Jersey, this respondent indicated that while HDD work is growing, “longer and more technical drills are becoming common.”

Concerns

Of course, there are still many areas of the country where HDD took a nosedive with the economy and there is a dearth of stronger market niches to pull their work out of the doldrums. “It is slow to rebuild in Arizona,” pointed out this contractor.

A Midwest respondent said that “the near-term will continue to be stagnant with the continued influx of competition and sluggish increase in pricing. The long-term continues to be difficult to judge with the constantly changing economic environment.”

This contractor echoed a perceived problem of several survey respondents: “I’m concerned that the market will get flooded with subcontractors buying equipment and trying to get rich just like during the fiber boom. If that gets out of hand, we’ll be buying barely used rigs for pennies on the dollar again.”

Along that same train of thought, this contractor voiced a strong concern about quality in the market place. “The biggest problem with the HDD market is the mass production of drills. There are too many contractors that think buying a rig makes them a driller. All the drillers at my company are competent and quality-oriented. But I have worked with and around many contractors over the years, mainly in telecom projects, that use old, used, breaking-down equipment that damages property and utilities. They are struggling to survive because of lack of caring, lack of quality and underbidding wars to stay alive.”

With the strength of several key market niches in different areas of the country and the number of contractors jumping into the HDD arena increasing, almost 82 percent of the survey respondents indicate their competition has significantly increased in recent years.

All about rigs

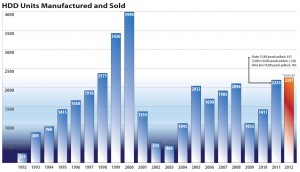

While rig manufacturers are operating their factories at accelerated rates, there still seems to be understandable caution as to just how much money and resources will be devoted to expanded production lines. The fiber bust of the early 2000s is still etched on most manager and executives’ minds. HDD manufacturing and services growth is accelerating but at a subdued pace – sometimes causing consternation by contractors who want a new rig or equipment immediately and finding out they are on a months-long waiting list.

World-wide HDD rig sales are anticipated to be even stronger in 2012. Much of this industry’s market strength is running counter to other segments, i.e. sewer and water. However, the actual number of rig sales per contractor is projected to drop from 2.1 in 2011 to 1.9 per company in 2012. That contrasts with production estimates of rig manufacturers who anticipate selling slightly more units in 2012 (2,397 units compared to 2,233 in 2011). When considering the continued expansion of the HDD universe, that is probably a reasonable expectation: some contractors will be buying less in 2012 but that will be offset by new companies competing in the marketplace and purchasing both new and used equipment.

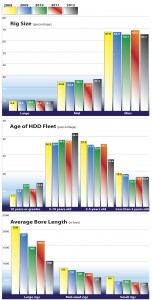

In 2011, rig sales remained relatively constant. Units with less than 15,000 pounds of pullback force accounted for roughly 20 percent of sales while rigs in the 15,000 to 50,000 pullback category captured 72.4 percent of the market. The strength of telecom – and electric in some areas – has been a key market driver. Larger rig sales accounted for about 8.6 percent of the market.

Of those contractors who actively own and operate drilling rigs, 21.2 percent list HDD as their primary (more than 50 percent) business.

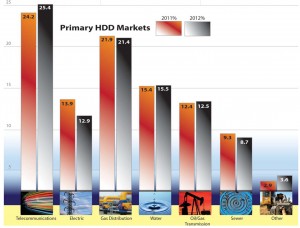

In the U.S., various HDD market shares didn’t change significantly compared to 2011. Telecommunications should account for about 26.4 percent of market activities followed by gas distribution at 20.8 percent, water at 15.5 percent, electric at 12.9 percent, energy transmission at 12.5 percent, sewer at 8.9 percent and “other” at 4 percent. Geothermal constitutes a very small, but actively growing portion of the HDD market.

Rig ownership in the three primary sizes has shifted significantly towards rigs in the mid-sized category (40,000 to 100,000 pounds of pullback force). While rigs less than 40,000 pounds still dominate with 62.7 percent of the market, the trend is towards larger rigs with increased diversity for a variety of market and project challenges. Mid-sized rigs have climbed to a 27.2 percent market share. Large rigs remain constant at 8.1 percent of the market. In fact, when purchasing their next rig, almost 30 percent of contractors have indicted their preference for a mid-sized unit.

Before replacing or rebuilding a drilling rig, contractors average 3,440 hours of use for small rigs, 4,545 hours for mid-sized units and 7,896 hours for big rigs.

About 56 percent of the survey respondents have purchased a used HDD rig. Roughly 47 percent will consider a used rig for their next purchase.

Drivers

As one might expect, much of that market growth is being generated by energy and telecom work. However, the survey revealed that an increasing number of water and sewer contractors are seeing the value of adding HDD services to their technology toolbox.

But that does raise an increasingly asked question: how long can the telecom and energy markets persevere at high levels? Telecom, a market seemingly made for HDD, has been driven by many factors the past few years, but foremost has been the oft-delayed stimulus program that finally kicked into high gear in late 2010. As that work wraps up in 2012, will the telecom market be strong enough to make up for the anticipated drop-off in stimulus fund? Most experts seem to believe that while there may be some decline in the volume of work in 2012-13, it will probably not be substantial enough to cause much disruption to the telecom construction market. The good news here is that demand for telecom and related products has seemingly taken on a life of its own and should keep helping to stimulate the HDD market even while other areas may suffer.

As for energy, oil and gas shale extraction and the subsequent need for new pipelines (i.e. crossing work) has driven demand for medium and large HDD services and equipment. Indeed, new offices for dealers and manufactures have been springing up all around the nation’s shale plays to accommodate the demand. At first it was the Marcellus Shale in Pennsylvania (now spreading into Ohio and West Virginia) and Barnett in Texas, followed by the Bakken work in the upper Midwest along with Eagle Ford in South Texas. Today, several more areas are in play and older, established oil and gas fields like the Permian and Anadarko Basins are back in play due to new technology making extraction once again practical. Through it all, new pipeline infrastructure has been needed.

Energy dynamics are incredibly complex. The price of domestic oil is now tied into foreign pressures and pricing. At press time, oil prices has dropped to a six-month low. Prognosticators expected that pricing to hold true throughout the summer if not slightly lower – but still in a profitable range. Meanwhile, the natural gas shale plays grew so fast and are generating so much product that the nation has literally become awash in gas – a bubble has formed. The price had fallen below $2 per btu. However, also as press time, gas prices had crept back up to $2.80. But again, forecasters expect it to be a two- five years process before gas will reach the desired $5 btu range again.

For oil, the price could skyrocket in a flash if Iran starts saber rattling, the Chinese economy shows new signs of strength or any number of scenarios play out on the national stage. The good news for the U.S. is that we’re producing more oil and our domestic refiners are importing less as the result. As for gas, to deflate the bubble several things need to happen. First, the economy must improve so that power generation demands will increase and new housing starts climb back to healthy levels. Also, the push for natural gas as a fuel for trucks and cars needs to gain traction.

The best guess at this time is that there will be an overall slowing of the oil and gas infrastructure construction market in 2013 and 2014, but far from the dramatic drop in activity typical of past cycles. Work will still continue but at a more realistic pace as dictated by the market. However, 2015 could be the start of another boom cycle. Much will depend upon the fall U.S. elections and future attitudes towards petrochemical-based energy.

Other markets

The gas distribution market also continues to be strong for HDD. In fact, several utilities have expressed concern that when the housing market starts to grow, they won’t be able to find enough contractors to accommodate that growth. Some contractors have also expressed frustration at not being able to find enough skilled laborers for their needs.

Water continues to be a good market for HDD contractors though that niche growth has slowed since 2008 due to funding restrictions. The good news is that an increasing number of water utilities have acknowledged that HDD is a powerful tool for waterline installation. However, contractors looking to expand into that niche from private utility work must learn to deal with layers of consulting engineers and tighter markets. It’s a niche that is not for everyone, but once the municipal market begins a more substantial rebound, projects for water authorities should be increasing.

Sewer work also has carved a niche for HDD applications, albeit for specific applications such as pressure pipe. Obtaining line and grade for gravity sewer installations remains an inexact – and expensive – science. Until a quicker and more cost-effective method of grade control is established, sewer will be a bit more elusive.

Suffice it to say, that until the municipal industries begin to finally realize revenue increases for infrastructure, those markets will remain stagnant or show limited growth at best.

Alternative market niches continue to be discovered on a regular basis. Alternative energy has begun to play a more significant role in the HDD marketplace, particular geothermal installations. One contractor indicated that as much as 55 percent of his business was now centered on geothermal. Several other survey respondents noted that geothermal work was a growing part of their business.

HDD challenges

Four areas clearly were on the mind of contractors responding to this survey:

• Price-cutting and poor work by irresponsible contractors;

• Crossbores and damage prevention;

• Mud disposal; and

• Lack of skilled labor which remains an unfortunate constant for much of the HDD industry.

This Northeast contractor stressed that “incompetent competition is giving the HDD business a bad name.” Along the same train of thought, a Midwestern contractor said “the biggest challenge for HDD is the competition from inferior contractors that continue to put out inferior work and give quality drillers a bad name.”

A contractor from Iowa raised the question “do we need state licensing to curb fly-by-night contractors?” Another contractor suggested that “we need to bring the price back up to where it was at the birth of our industry. People have forgotten that this is a specialty business not made for convenience.”

This Mid-Atlantic contractor believes the industry’s biggest challenge is “thinning out the competition and getting prices back to a decent level. “There is a definite lack of knowledge,” added this Virginia contractor. “Everybody thinks they are a driller. The jobs have to be done right or else we are going to get a bad name and ruin it for all drilling contractors.”

A Northwest contractor expressed anger at “cowboys who just like to ‘blow and go’ with no regard to the conditions of the site.”

The influx of inexperienced HDD contractors in busy market sectors has essentially meant that while many contractors are busy, they are not really making money.

Damage prevention

As the HDD market accelerates in several areas of the country, installing pipes/conduit in already densely-packed areas is a source of frustration and concern for many survey respondents.

“There is such a large amount of underground facilities that it now requires a very skilled drilling crew with high quality locating equipment to avoid costly damages to existing structures,” observed this Texas contractor.

Another contractor is afraid of “bad press caused by drilling before all other utilities are located, then causing spectacular accidents when another utility is hit.”

This respondent voiced a complaint that “cross bores continue to be a problem as municipalities will not locate sewers.” Said another contractor, “I think the biggest challenge in our area is getting other parties to mark their lines. Most of our time is spent finding other utilities rather than actually boring.”

“Everyone seems to bore deeper to avoid hitting existing utilities if they can’t find them. That doesn’t work anymore,” emphasized this contractor.

Comments