U.S. Water, Wastewater Costs on Rise

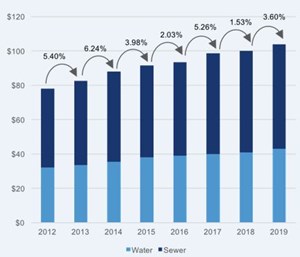

HOUSTON (UC) — U.S. municipal water and wastewater utility bills grew at an inflation-adjusted 3.6% during the past year to an household average $104 per month, according to a new index that has raised concerns about both affordability and regional volatility.

The new "U.S. Municipal Water & Wastewater Utility Bill Index" from Bluefield Research revealed wide discrepancies in municipal rate structures and service fees across the country. Of the top 50 U.S. metropolitan areas analyzed by Bluefield, 35 demonstrated increased rates from 2018 to 2019, while another 15 decreased or kept their rates constant during the same period.

“While water rates are rising overall, the year-to-year rate volatility and varied approaches by utilities is striking,” says Erin Bonney Casey, Research Director at Bluefield. “Given the escalating annual capital and operating expenditures currently exceeding US$110 billion nationwide, and the fact that rates represent a critical source of water infrastructure funding, one would expect to see more consistency, nationally and locally, over time.”

The volatility is evidenced nationally over the last eight years with annual average rate swinging from a 6.0% high in 2014 to a 1.5% low in 2018. This past year, the biggest changes occurred in El Paso, Texas and Riverside California, where average customer bills increased 33.3% and declined -22.0%, respectively.

There is also a wide discrepancy in the resulting customer bills based on estimated household water usage, which varies across regions. In 2018, combined water & wastewater bills ranged from a low of $30.16 in Memphis, Tennessee to a high of $226.62 in Seattle, Washington. The average combined bill for all cities analyzed topped $96.35.

In addition to ongoing customer management and volume-based charges, the survey found, utilities are employing more complex, tiered water rate structures to address swings in customer demand, including conservation, regulatory enforcement and "non-revenue" water, such as leakage, customer non-payment.

At the same time, Bluefield reported, water rate increases are often politically charged and cause for year-to-year rate volatility.

To account for declines in revenues, utility rate structures have relied more heavily on fixed rate structures. As an example, since 2012, fixed wastewater rates have increased by 60.9%, while variable rates have risen only 39.1%. The impact is that low volume users, often the lowest income households, are most affected by rate increases.

“Some utilities are addressing affordability challenges head-on with unique programs,” says Ms. Bonney Casey. “Going forward, we expect to see more tailored programs, like Philadelphia’s TAP pricing model that accounts for affordability in its pricing model rather than more standard, post-billing rebate programs.”

Related News

From Archive

- Glenfarne Alaska LNG targets late-2026 construction start for 807-mile pipeline project

- U.S. water reuse boom to fuel $47 billion in infrastructure spending through 2035

- $2.3 billion approved to construct 236-mile Texas-to-Gulf gas pipeline

- Major water pipe break in Puerto Rico hits over 165,000 customers

- Potomac River Tunnel project enters construction phase beneath Washington, D.C.

- Pennsylvania American Water launches interactive map to identify, replace lead water service lines

- Trump's tariffs drive $33 million cost increase for Cincinnati sewer project

- Utah city launches historic $70 million tunnel project using box jacking under active rail line

- Tulsa residents warned after sewer lines damaged by boring work

- Fatal trench collapse halts sewer construction in Massachusetts; two workers hospitalized

Comments