February 2024 Vol. 79 No. 2

Features

Funding still flowing despite economic headwinds, challenges

27th Annual Municipal Sewer/Water Infrastructure Forecast & Market Analysis

By Robert Carpenter, Editor-in-Chief

The last two years in America’s municipal infrastructure industry have seen tremendous increases in project activities driven primarily by significant boosts in government funding. If you happened to be a consulting engineer, contractor or manufacturer/supplier, business has been good. Now, 2024 has the potential to be a great year for many in infrastructure.

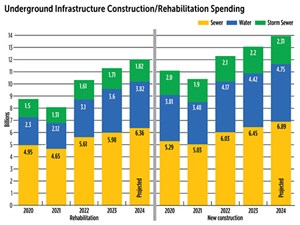

Underground Infrastructure’s forecast anticipates spending in 2024 to increase an additional 7-to -8 percent over what was a record 2023. UI’s data is based on projections from direct municipal responses.

Key indicators reveal that 2024 is on track for what could be one of the best years on record for the construction and rehabilitation of the sewer/water piping infrastructure. Continued increases in federal funding should pump several billion dollars into the market. Combine that with substantial state investments and a funding boom has firmly taken hold across the nation.

“We were fortunate to receive a major grant,” said this Northeast municipal manager. “It enabled us to take on a couple of projects that desperately needed to be done, but we were having a hard time finding the money.”

The much-ballyhooed 2021 Infrastructure Investment & Jobs Act (IIJA) is just now reaching fruition in terms of actual shovels-in-the-ground projects, as engineering work is finalized and the public bidding process is completed.

This data, and much more, was the focus of Underground Infrastructure magazine’s 27th Annual Municipal Sewer/Water Infrastructure Forecast & Market Analysis. The survey polled U.S. municipalities about their top concerns and issues, 2024 infrastructure spending plans and working relationships with consulting engineers and contractors.

This exclusive annual study also provides detailed insight into America’s cities with information and perspectives on industry topics and technology. It reflects only information regarding sewer, water and stormwater piping infrastructure and does not include figures or data on pumping and lift stations, treatment plants, etc.

Respondents ranged in size from rural communities of less than 1,000, to mid-sized cities up to 500,000, and a representative sampling of the nation’s largest municipalities. Survey results came from all 50 states and were weighted for regional population density and city sizes to develop a nationwide benchmark that would allow for statistical extrapolation.

Impact of federal funding

Since 2022, the IIJA has been delivering heretofore unheard-of quantities of funding throughout infrastructure markets including underground sewer, water and storm water systems. The industry is on track to complete distribution of $44 billion in project funding by 2026. Billions have already been allotted, with the remainder hitting city coffers over the next three years.

IIJA funding initiatives are designed to be over and beyond what is allotted to the Clean Water and Drinking Water Revolving Funds (SRFs), which typically receive between $1 and $2 billion annually from the appropriations committees. However, there have been Congressional attempts to trim those program funding levels while the record IIJA funds are being released on an annual basis.

The IIJA also allocated $10 billion for addressing emerging contaminants like per- and poly-fluoroalkyl substances (PFAS), a family of manmade chemicals found in many consumer products, which the Environmental Protection Agency (EPA) says can negatively impact human health and the environment.

Further, the IIJA contains $15 billion to replace all service lines covered by the EPA’s Revised Lead and Copper Rule. That means lead lines and galvanized pipe downstream from a lead pipe. Congress has been under extreme public pressure since the Flint, Mich., lead-poisoning disaster a few years ago, and investing in lead pipe replacement has been a high priority. Much of that funding was allocated in 2023 but, still, several billion will be doled out in 2024 and 2025.

Market consolidation

Another change in the sewer/water markets is the continual roll-up of businesses. Engineering firms have seen consolidation for many years and that continues today. But now, contractors and manufacturing firms, alike, are being gobbled up in the market.

For example, in January, Vortex acquired Applied Felts. Even notable big-money investment management firm BlackRock has raised billions to pursue underground related infrastructure acquisitions in what it perceives as a robust growth market.

“It is getting to the point that we don’t know who we’re really dealing with anymore,” said a Midwest respondent.

An inadvertent bonus of the Infrastructure Act funding bonanza is that it has changed the average citizens’ perception of public works projects. Attacking sewer and storm sewer issues are now viewed in a favorable public light, rather than being ignored for such “important” political items as pocket parks in a local politician’s neighborhood.

“When we start to setup projects around our city, we’re finding people aren’t quite so nervous about what we’re doing – they’ve all heard about the infrastructure bill, lead pipes and how underground pipes are in bad shape,” said a Southwest municipal manager.

As mentioned, water construction and rehabilitation are receiving additional funding, as lead pipe replacement continues to be a major driving force, while water main and distribution improvements, expansion and rehabilitation are peaking.

Further, the acute drought conditions in the western U.S. continue to force states and cities to scramble for solutions, including enhanced transportation and storage systems, expanding water reuse programs and improving water capture programs. Pipeline transmission plans continue to be developed to better transport water to dry or drought stricken areas – assuming additional water supplies can be found or developed.

Many of the survey respondents felt a sense of relief when their cities were awarded grants for water or sewer projects. “We’ve been falling further behind each year with our projects,” said a Midwest municipal employee. “Finally, we can make a little progress and we plan on continuing to apply for funds.”

Still, overall, this major influx of funding has given municipalities a much greater confidence in spending for 2024, compared with recent years. Most survey respondents (72 percent) will be seeking project funding generally distributed through states as it comes down the federal pipeline. Plus, consulting engineering companies have increased their engagement in aiding cities of all sizes to find funding options, whether federal grants or matching funds, SRFs or state options.

Several survey respondents also point out there is concern that it is important to launch much-needed projects sooner rather than later, as high inflation and supply chain disruptions over the past three years have generated skyrocketing equipment and materials costs.

Said this West Coast municipal officials, “the effective yield of the funding we received will effectively be less than when we submitted our request two years ago, so we’re already having to trim some of our expectations.”

Funding needs

Respondents report that their city governments are still reluctant to raise user fees, especially as many either have received or hope to receive IIJA funding. However, the cumulative backlog of work necessary to bring sewer and water systems up-to-date is overwhelming, and many survey respondents admit increasing rates is a necessity.

Perhaps due to the COVID years causing tight money for communities, municipal survey respondents reported an average of 3.8 years between rate hikes – an increase from 3.2 in 2023 and 3.0 in 2022.

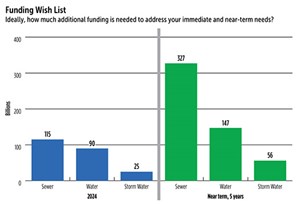

City personnel were asked to, assuming a perfect world, put a price tag on their near-term funding needs to address all their system issues. Respondents believe they would need $115 billion for sewer, $90 billion for water and $25 billion for stormwater. When asked the same question but for five years or more, the amounts increased to $327 billion for sewer, $147 billion for water needs and $56 for storm sewers.

With all the federal and even state funding being generated since 2022, it seems ironic that municipal personnel are increasing their short- and long-term funding needs assessment. However, one respondent from the Northeast explained that “we only thought we had a good handle on the condition of our systems. But once we got to work using some of the infrastructure bill money, we kept discovering more problems and issues that we need to contend with.”

Municipalities rated several broad categories that impact their operations. Not unexpectedly, funding still tops the survey as the number-one concern, cited by 75 percent of respondents. Regulations/EPA was cited by 73 percent of the respondents; hiring qualified employees was mentioned by 58 percent; safety concerns by 36 percent; and community relations by 29 percent.

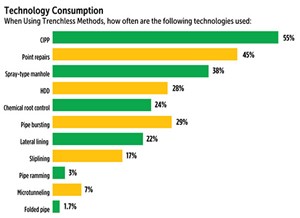

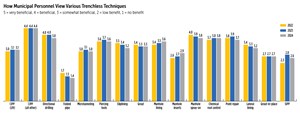

The percentage of those surveyed who said they prefer trenchless methods when feasible held stable at 45 percent. A slight increase was noted for those who have no preference as to open-cut or trenchless, coming in at 40 percent. Those still preferring open-cut methods dropped to 15 percent.

Rating engineers, contractors

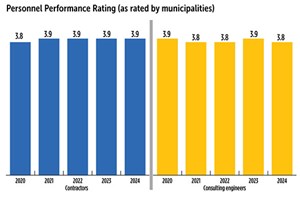

The survey also asked municipal personnel to rate the consulting engineering community based on the 1-to-5 scale, with five being the highest approval rating. Basically, this number provides a confidence benchmark. The consulting engineer score receded from 3.9 percent in 2023 to 3.8 percent in 2024.

For the most part, respondents were pleased with the efforts of consultants. Asked as to how engineers could increase their relationship and effectiveness with cities, “quality” again stood out, with 79 percent citing that factor. Other areas included “understanding of new technology” (76 percent of respondents), “cost” (70 percent of respondents), and “productive relationships with contractors” (42 percent).

The survey also asked municipal personnel to rate contractors. The overall rating was a composite from four categories: quality of work, timely project completion, fair pricing and dependability, based on a scale of one (worst) to 5 (best). Contractors saw their composite score hold steady at 3.9.

Like engineers, quality was the number-one desired trait for contractors, cited by 81 percent. On-time project completion was also highly coveted by 70 percent of respondents.

Comments