November 2023 Vol. 78 No.11

Features

Midstream consolidates, expands ahead of LNG export demand

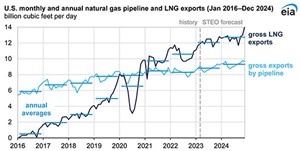

U.S. midstream companies would be hard-pressed this year to approach the record earnings that many achieved in 2022, but the sharp decline in oil and natural gas prices from last year’s highs hasn’t blunted their expansion efforts.

More than 8 Bcf/d of pipeline capacity is either planned or under construction from the Permian and Haynesville basins as pipeline operators jockey for position around LNG growth markets on the Texas and Louisiana Gulf Coasts.

Complementing these efforts, an ongoing wave of acquisitions is making some of the biggest midstream players even bigger while embedding them more deeply in both production and demand markets.

Some of those acquisitions are expanding gathering and processing (G&P) footprints to support existing long-haul business. Others are aimed at positioning companies to capitalize on LNG demand growth, however, which necessarily requires that operators move ahead of the demand actually materializing.

And some of the LNG expansions that are creating demand growth may arrive later than hoped, leaving pipeline assets underutilized in the interim.

LNG projects may lag

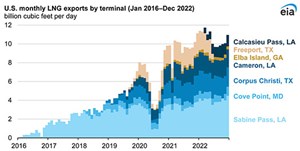

The drive to increase U.S. LNG exports gained sudden urgency last year when Russia invaded Ukraine and the West imposed sanctions on Russian pipeline gas exports to Europe. Prior to the February invasion, Refinitiv data showed natural gas supplies to U.S. LNG export plants had reached a record 13.3 Bcf/d.

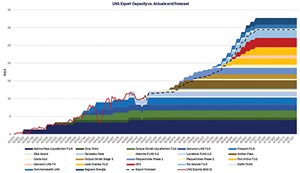

Golden Pass LNG and Plaquemines LNG Phase 1 are expected to come online in the second half of 2024. “But after that, we see nothing until maybe mid to late 2026,” Ajay Bakshani, director of analytics at East Daley Analytics, observed. “Then, you have a lot of projects that are expected to come online or that are currently still going through contract but haven’t reached FID (final investment decision) yet.”

Golden Pass, which began as an import project in late 2003, received its first LNG cargo in 2010. FID was made in 2019 to build three 6 mtpa liquefaction trains. The project is a joint venture formed by affiliates of QatarEnergy (70 percent) and ExxonMobil (30 percent).

There also have been expectations that Tellurian’s Driftwood LNG project and Freeport LNG’s Train 4 could come online as soon as 2025, but East Daley sees them taking longer.

Tellurian is still pursuing FID on its project, and analysts such as Bakshani expect that it and numerous other projects will get built. In fact, projections call for 32 Bcf of total U.S. LNG export capacity by 2029 compared with around 12 Bcf in early 2023, lower than in early 2022 as Freeport LNG gradually ramps up production after its lengthy shutdown.

The LNG capacity additions include New Fortress Energy’s 2.8-mtpa Louisiana FLNG, expected for 2024 completion; the construction of a third 4.5-mtpa train at Cheniere’s Corpus Christi LNG, expected by 2025; the 2026 completion of Delfin Midstream’s 13.3 mtpa deepwater floating LNG (FLNG) port off the Louisiana coast; and Commonwealth LNG’s proposed 8.4-mtpa liquefaction and export facility near Cameron, Louisiana.

Seven more projects are slated for completion by late 2027, including Phase 2 of Venture Global’s approved 20-mtpa Plaquemines LNG and planned 20-mtpa nameplate capacity CP2 LNG facility; Energy Transfer’s Lake Charles Trains 1-3, with a capacity 5.5 mtpa each; NextDecade’s planned 27-mtpa Rio Grande Trains 1 and 2; two trains at Port Arthur LNG capable of producing up to 13.5 mtpa each, and Cameron LNG’s 6.75 mtpa Train 4.

“I think some producers got a little bit ahead of their skis last year and maybe didn’t really appreciate how long some of these facilities would take to come online,” Bakshani said. “But that helps from a midstream angle, because these pipeline projects are also going to take some time to come online.”

Pipelines take lead

Natural gas pipeline projects supporting Gulf Coast LNG markets range from new and expanded gathering systems, long-haul pipe construction, compression expansions and so-called “last mile” pipe connecting large transmission systems to specific areas and facilities.

“There is still some growth from industrial demand, and some expected growth in continued higher natural gas exports to Mexico,” Eugene Kim, Wood Mackenzie’s research director for Americas gas, said. “But the real driver on the demand side is LNG, and the drivers on the production growth side in the near term is going to be from the Permian and the Haynesville.”

Kim agrees that LNG expansion timelines can be fickle, and there will generally be initial periods of underutilization for new pipelines built or expanded to supply them, although the impact of those gaps will vary. Energy Transfer, for instance, has already finished construction of the 1.65 Bcf/d Gulf Run pipeline to move gas from north Louisiana to the coast.

That project, which Energy Transfer gained via its acquisition of Enable Midstream in December 2021, is backed by a 20-year agreement with the $10 billion Golden Pass LNG export plant now under construction in Texas by QatarEnergy and Exxon Mobil.

“Golden Pass will not be completed until the second half of 2024, but Gulf Run is already online, so there’s a mismatch in timing,” Kim said. “As a result, Gulf Run is not fully utilized right now, and you might get a similar situation with some of these other pipelines that are intending to deliver into those LNG facilities – and there are a lot of them.”

Pipelines that don’t have a large percentage of their capacity tied to a single producer, as with Gulf Run and Golden Pass, might be keener to time project completions more closely with the onset of demand, but it’s essential to get supporting infrastructure in place first.

“They want to make sure that when the LNG terminal is turned on, that there’s dedicated piped supply that can flow into it,” Kim said, “because the capital investment on the liquefaction is much greater than a pipe project would be.”

Permian heads east

While most of the Permian Basin natural gas pipelines built in recent years have targeted LNG export markets south of the Houston area, two proposed intrastate natural gas pipeline projects have emerged within the past six months to a goal of delivering Permian Basin gas to the Texas-Louisiana border region.

The larger of the two, Targa’s 562-mile Apex pipeline, was approved by the Railroad Commission of Texas in late March. It would originate in Midland County in West Texas to Jefferson County, along the Louisiana border near Sabine Pass.

WhiteWater Midstream’s proposed 190-mile greenfield Blackfin Pipeline, which filed for state regulatory approval in February, takes a different approach. Although Blackfin would originate at the eastern edge of the Eagle Ford shale, it would primarily serve as an extension of the 580-mile Matterhorn Express Pipeline that was sanctioned in May 2022 by a joint venture of WhiteWater, EnLink Midstream, Devon Energy and MPLX.

The greenfield Matterhorn Express is scheduled to be in service in the third quarter of 2024 and will provide 2–2.5 Bcf/d of Permian takeaway capacity to the Katy area west of Houston. Blackfin would link with Matterhorn to help debottleneck the Katy area and, like Apex, deliver volumes east to the Texas-Louisiana border area.

“These Permian projects are getting pipe closer to the actual LNG liquefaction projects rather than some of these other pipes that we’ve seen historically – Gulf Coast Express, Permian Highway, Whistler, for example – that get you nearby, but you still need additional pipes or an existing pipe network to get you into that LNG facility,” Kim said.

“So, there is a trend right now toward developing connectivity projects such as Whitewater Midstream’s Blackfin project, as well as Targa’s Apex Pipeline, which would be delivering from essentially the Midland Basin all the way directly into that Port Arthur area,” he said. “These Permian pipes are similar to the Haynesville pipes, which are north-to-south pipes that are directly connecting into the LNG demand centers. Now, the Permian pipes taking a similar approach.”

The two other natural gas capacity expansions out of the Permian are being accomplished via compressor expansions, which can increase capacity quickly, but at a higher operating cost, because squeezing out that extra deliverability with higher compression requires more fuel. Since fuel rates are based off a percentage of product prices, the downturn in natural gas prices since last year’s highs will bring some cost benefit.

WhiteWater announced in May 2022 that it would expand the Whistler Pipeline’s mainline capacity through the installation of three new compressor stations. The new compressor stations will increase the pipeline’s mainline capacity by 500,000 MMcf/d, to 2.5 Bcf/d from 2 Bcf/d). The expansion is scheduled to be in service in September 2023. The Whistler Pipeline is owned by a consortium including MPLX, WhiteWater and a joint venture between Stonepeak and West Texas Gas Inc.

Kinder Morgan’s Permian Highway Pipeline (PHP) expansion project has been sanctioned to increase capacity by 550 MMcf/d. The project adds compression on PHP to increase natural gas deliveries from the Waha area to multiple mainline connections and Gulf Coast markets. Kinder Morgan has noted supply chain issues are resulting in delays and expects startup in December 2023.

Haynesville aims south

There are currently a half-dozen natural gas pipeline projects in various development stages to connect Haynesville gas producers in the north to Gulf Coast LNG exporters to the south – that is, if the three-stages of DT Midstream’s Louisiana Energy Access Pipeline (LEAP) expansion are counted separately.

The existing LEAP Gathering Lateral Pipeline is a 155-mile, 1 Bcf/d line stretching from the Haynesville to the Gulf Coast region. DT midstream plans to increase LEAP capacity by 90 percent through compression and construction expansions to 1.9 Bcf/d. The three phases include a 300 MMcf/d addition with expected in-service by the end of this year, a 400 MMcf/d expansion due online in the first quarter of 2024 and a final 200 MMcf/d due in the third quarter of next year.

Momentum Midstream is currently developing the New Generation Gas Gathering project, dubbed NG3 from the Haynesville to coastal Louisiana LNG markets, with 275 miles of additional natural gas gathering pipelines with 2.2 Bcf/day of capacity. The system will be complemented with a Carbon Capture and Sequestration (CCS) solution to offer producers a net negative CO2 emission solution. NG3 is expected to be completed in 2024.

Williams announced in May 2022 that it was committing around $1.5 billion to expand natural gas capacity and grow market access and followed up a month later by sanctioning its Louisiana Energy Gateway (LEG) project, which is designed to move 1.8 Bcf/d of Haynesville natural gas to several Gulf Coast markets, including interconnection with its Transco gas pipeline from Texas to the U.S. Northeast, as well as industrial consumers and Gulf Coast export plants. Tulsa-based Williams expects start-up of the LEG system by 2024.

Trends

Permian to Pacific – While most of the Permian’s natural gas projects aim father east to Gulf Coast LNG markets, there is also an appetite for Permian gas to fuel LNG exports from the West Coast of Mexico primarily to Asian markets.

ONEOK filed a Presidential Permit application with the Federal Energy Regulatory Commission in December 2022 to construct its proposed Saguaro Connector Pipeline for natural gas export at a new Mexican border crossing in Hudspeth County, Texas. The 2.8 Bcf/d project from the Waha hub would extend 155 miles to the border, where it would connect with an as-yet unannounced Mexican pipeline to that country’s west coast.

While no details of the potential Mexican pipeline project or its ownership have been released, it is expected to deliver Permian gas to a new Mexico Pacific Limited LNG liquefaction and export facility recently renamed Saguaro LNG. In addition to the shorter distances for cargoes to travel to LNG-hungry Asian markets, the development of LNG export facilities on Mexico’s would also avoid the crowded Panama Canal.

Integration by acquisition – Across both crude oil and natural gas pipeline systems, Bakshani expects midstream acquisitions to continue – not just for growth’s sake, but as a tool to consolidate around key basins and achieve greater vertical integration.

“As far as the Permian acquisitions go, I think a lot of it is just about being able to source supply and support your long-haul assets so you’re really benefiting from vertical integration, in a sense,” he said. “That way, you collect a fee at pretty much every point of the midstream value chain, so you’re collecting a fee to gather, process, to ship on your pipe, to fractionate and then to export. And so, I think that’s where the markets see a lot of value right now.”

Bakshani points to three significant transactions as examples: Energy Transfer’s acquisition of Lotus, which owns the huge Centurion crude gathering systems in the Permian, Targa’s acquisition of Lucid Energy and Enterprise Products Partners’ acquisition of Navitas Midstream.

“Some of the players who are big on the NGL side, as far as long-haul pipelines, fractionation and transportation, are buying something closer to the wellhead. I wouldn’t be surprised if we continue to see more of that.”

OK then! – While it pales in comparison with the Permian and Haynesville basins, East Daley’s Bakshani sees growing opportunities for Anadarko Basin producers to connect to Haynesville systems to supply Gulf Coast LNG markets.

As an example, he notes that Energy Transfer’s acquisition of Enable gave Dallas-based ET a big G&P system in both Haynesville and Anadarko. It also bought Woodford Express, which also expands their presence in the Anadarko.

“I feel like the Anadarko sometimes is written off, but as LNG demand comes online, we expect a big supply ramp coming from the Anadarko because the Haynesville is not going to be able to meet all that demand,” Bakshani said. “As we see it right now, it’s going to be pretty hard to get Permian gas all the way across the border to Louisiana, whereas Anadarko currently has a lot of that plumbing already in place where they can send it down to Carthage [Texas].”

Comments