July 2023 Vol. 78 No. 7

Features

Utility and communications construction update

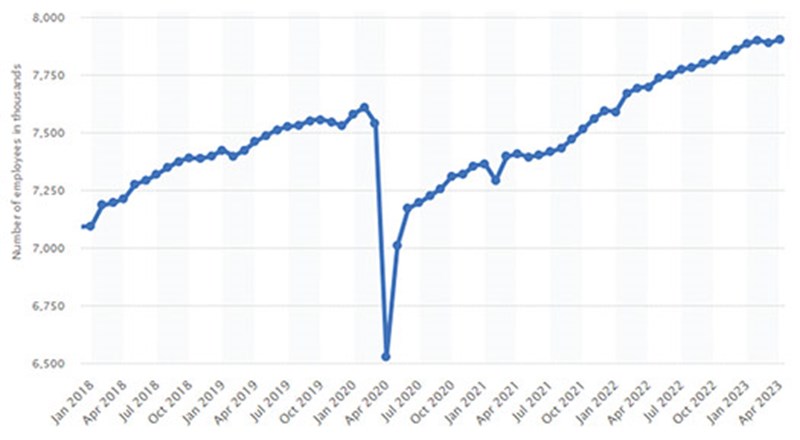

As the construction season jumped into full swing, the impacts of labor, equipment and government regulation on the contractor are highly impactful. After another month in June of construction employment gains (25,000 new jobs) in the U.S. economy, the challenge of finding labor to complete the potential work remains high.

The U.S. Bureau of Labor Statistics projects that employment of electricians, plumbers, pipefitters and steamfitters will grow 10 percent from 2020 to 2030, much faster than the average for all occupations. This growth is expected due to the need to maintain and upgrade the nation’s aging infrastructure, as well as the increasing demand for renewable energy sources. Additionally, there is a significant demographic challenge due to an aging workforce and a hesitation by current generations to enter the field.

As of May 2023, over 500,000 jobs remained unfilled. FIGURE 1 demonstrates the growth in construction industry employment post-pandemic and that attracting new workers is becoming increasingly more difficult.

The labor shortage creates some negative effects including:

- Increased costs of construction

- Project delays for critical infrastructure projects

- Reduced quality and productivity due to inexperience

The construction industry is working to address the labor shortage, but it is a difficult problem to solve. Some of the strategies being used include improving the image of the construction industry by highlighting the opportunities for advancement and the competitive pay and benefits.

Additionally, providing training and apprenticeships helps workers develop the skills they need to succeed in the industry. Lastly, attracting more women and minorities to the industry have the potential to help close the labor gap.

Governments are also setting ambitious goals for renewable energy deployment. For example, the United States has set a goal of achieving net-zero emissions by 2050, and the European Union’s goal is a 55 percent-percent reduction in greenhouse gas emissions by 2030.

These goals are driving governments to adopt policies that support the development of renewable energy. Due to the emission targets, investor-owned utilities are investing in these projects. This is due to several factors, including the falling cost of renewable energy, the increasing demand for renewable energy, and the need to comply with government regulations. For example, the European Union has set a goal of requiring all new construction equipment to be zero-emission by 2035.

As a result, the global share of renewable energy in the electricity mix is increasing. In 2021, renewables accounted for 28 percent of global electricity generation, up from 21 percent in 2010. This trend is expected to continue in the coming years, as governments and investor-owned utilities continue to invest in renewable energy.

To build the infrastructure with decreasing impact, efforts are being made – by governments, manufacturers and construction companies – to shift construction equipment from gas to electricity.

The shift to electric construction equipment is still in its early stages, but is gaining momentum. As technology continues to improve and the cost of electric equipment comes down, we expect to see a more widespread adoption of electric construction equipment in the years to come.

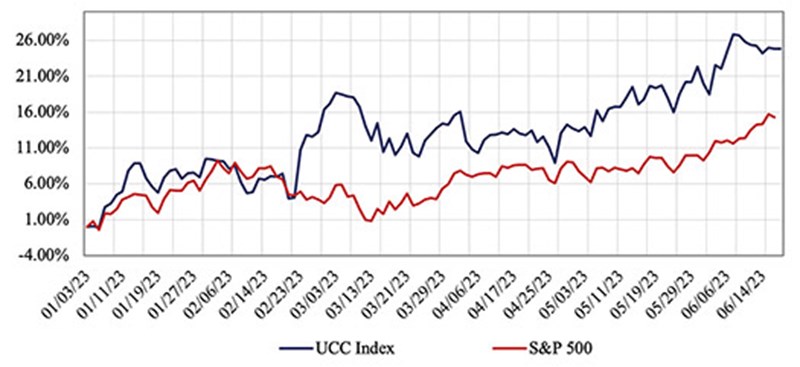

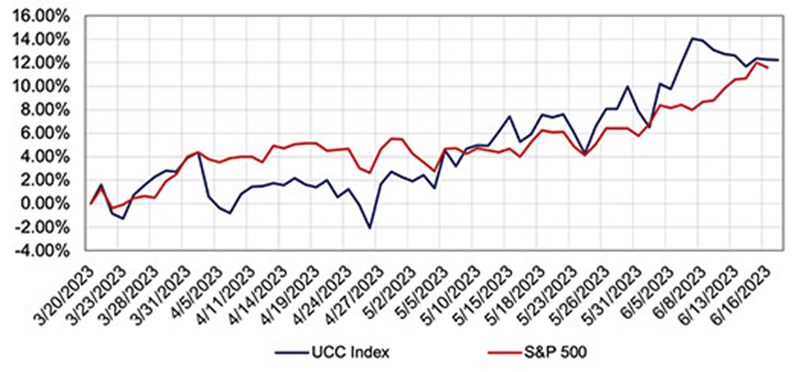

The Utility & Communications Construction Index presents the stock performance of the sector’s publicly traded stocks year-to-date (FIGURE 2) and the past three months (FIGURE 3).

The S&P 500 is up almost 15 percent year-to-date, due to sustained spending and growth of the U.S. economy. The Federal Reserve continues to be concerned about inflation, but the most recent rate pause suggests it is willing to sustain a rate environment for some time to determine if there have been sufficient impacts to the underlying economy to slow inflation.

Due to infrastructure and utility expenditures, and expected government spending to address the energy transition, the UCCI companies continue to outperform the broader market. UCCI is up over 24 percent YTD [see FIGURE 2] though most of the delta between UCCI and S&P 500 did occur in the first quarter. UCCI moved much more in-line with the S&P 500 in the past three months [see FIGURE 3].

Companies that comprise the UCCI have held valuations and maintained consistent performance, despite the headwinds that are facing other industries. We would expect the service companies to experience pushback on price increases from both investor-owned utilities and municipalities, as their customer base struggles with rising utility bills. Thus, margin pressure from labor, limited price increases and fuel prices may impact performance in the remaining months.

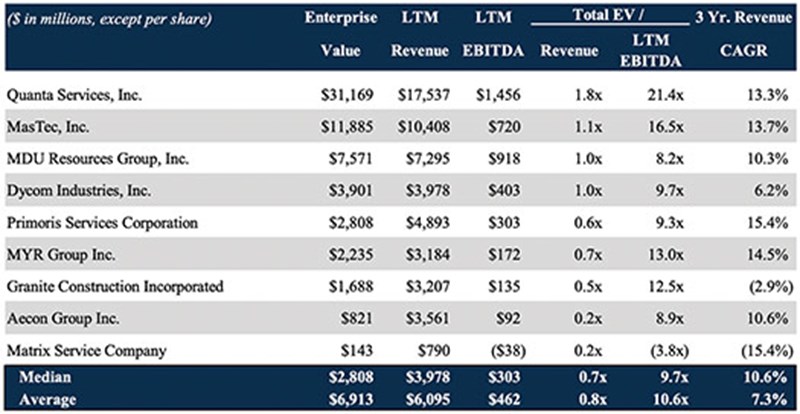

At the beginning of June, MDU successfully executed the spinoff of its construction materials subsidiary, Knife River, to the public markets, creating two companies that are more focused on their respective end markets. This allows management at MDU to focus efforts on growth in the utility services and construction markets.

Despite the public activity, the pace of underground infrastructure mergers and acquisitions remained muted in the second quarter of 2023. The primary areas of interest for acquirers remain the communication and power markets – finding a way to participate in the federal spending on infrastructure remains a primary objective.

As interest rates rise and valuations for public companies decline, the gap between what a seller is looking for and what a buyer views as acceptable begins to widen and creates a more challenging acquisition environment. We expect for the second half of the year to lag deal activity in 2022 due to high costs of financing and recessionary concerns by the Federal Reserve’s activity.

Comments