April 2023 Vol. 78 No. 4

Features

Utility and communications: Construction Update

Daniel Shumate | Managing Director, FMI Capital Advisors Inc.

What a difference a week can make. At the beginning of March, testimony by Jerome Powell regarding interest rate policy suggested that fighting inflation remained the number-one priority of the Federal Reserve.

Following an old-fashioned run on Silicon Valley Bank and an awakening to the interest rate risk sitting on regional bank balance sheets, meaningful stimulus has once again entered the market. In one weekend, the Federal Reserve grew its balance sheet by nearly $300 billion. To cap the week, UBS acquired Credit Suisse in a forced transaction, at a steep discount, to limit the risk of a global banking crisis.

All these national banking crises lead to a simple question. So, what does this mean for me?

First, if you are a company with substantial cash deposits held at an institution, where most of the deposits are not FDIC insured, then it is worthwhile to ensure the health of the bank you’re working with is strong. Most underground contractors keep high cash balances, due to the bonding requirements of municipal work, that leave them more exposed than other industries to a bank that could fail.

Second, the ability of the Federal Reserve to fight inflation aggressively is limited by the regulatory mandate for financial stability. Thus, we could see the cost of goods continue to rise and interest rates either temper or decline, due to the banking challenges that are ongoing. The Federal Reserve has already slowed the pace of interest rate hikes and the likelihood of increases declines, as the banking system becomes more volatile.

Lastly, the cost of financing equipment and other elements of the business are likely to remain at similar levels throughout the year. While rates may no longer be increasing, they are not yet falling. Thus, financing will likely remain at current levels through 2023, until there is stabilization for the price of goods and services.

While these challenges affect the financing and price of goods, supply chain challenges have eased in the last two quarters and the sustained investment in the utility infrastructure sector has resulted in strong backlogs and work opportunities for utility contractors.

Coming out of conference season, sentiment remains high, and supply of labor is the one constraint that is keeping the industry in check. We continue to see consistent investment in existing infrastructure and a healthy pipeline of bid opportunities for new construction.

The only utility market that is feeling the pinch is new construction tied to residential construction. Many new home developments have slowed due to reduced demand in a high-rate environment. Though this market appears to be loosening, as homeowners adjust to the new normal, it is still significantly lower than 2021–‘22 levels of activity.

UCCI performance & updates

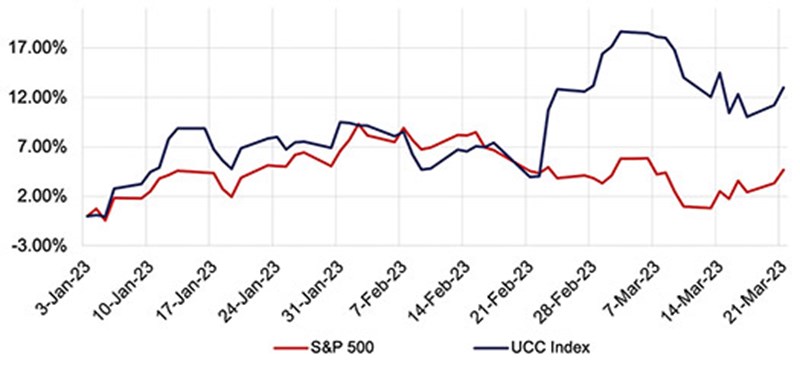

The Utility & Communications Construction Index (UCCI) below presents the stock performance of the sector’s publicly traded stocks over the past quarter and the past year.

In the first quarter of 2023, the UCC Index has experienced healthy growth relative to the broader market, as it’s increased by over 13 percent year-to-date. Comparatively, the S&P 500 has risen only 4.7 percent over the same period.

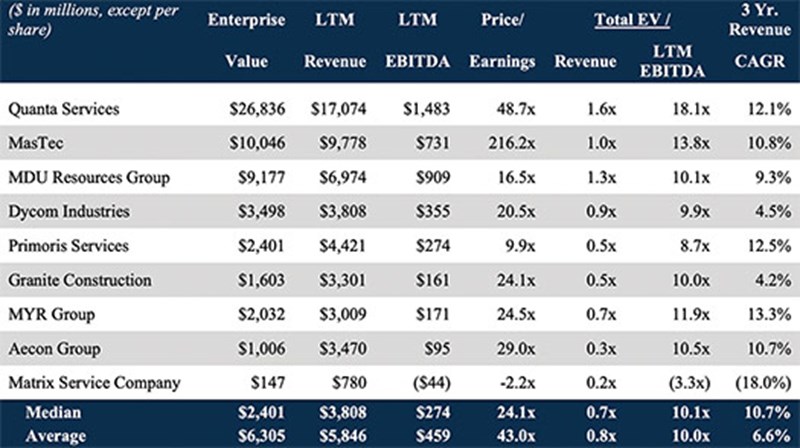

Expectation for the sector is that investment and funding through federal sources should make the sector resilient to any market impacts caused by the financial sector’s volatility. That said, valuations continue to rise, and the market expects continued growth to meet valuation expectations that are near all-time highs.

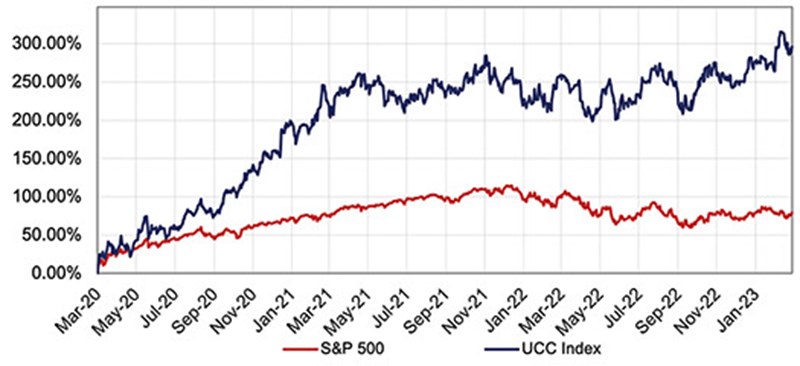

I also found it interesting to take a look back at the three-year performance of UCCI. Those who had invested near the downturn that occurred, due to COVID-19, and held throughout this period, would have tripled the value of their investment. UCCI is up almost 290 percent over the three-year period and grew significantly more than the S&P 500 that increased roughly 80 percent over the same period.

The Infrastructure Investment and Jobs Act, along with expectations for increased spending to fuel the transition to renewables, benefited UCI companies over the period. UCCI reached its all-time high in March of 2023, so expectations for continued growth and profitability will be challenging, especially with all of the factors outside of the contractor’s control.

Mergers & acquisitions

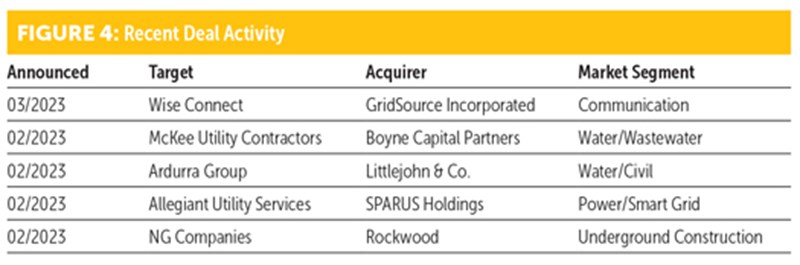

Despite the relative quiet M&A market in most industries, due to increasing debt cost from rate increases at the Federal Reserve, the utility and infrastructure M&A markets have continued to be active. Long-term trends of utility infrastructure repair and replacement, and electrification of the power grid continue to drive activity.

Additionally, the amount planned to be spent in the water and wastewater segments have opened a new avenue of investment for private equity. We expect stable, continued interest in the underground infrastructure space as sustained federal and state investment and investor-owned utility investment remain at peak levels.

Comments