February 2022 Vol. 77 No. 2

Features

Rare Funding Bonanza Stimulates Much-Needed Muni Projects

By Robert Carpenter, Editor-in-Chief

It’s been 25 years since Underground Construction initiated detailed research into the spending plans of America’s cities and government agencies, with the annual Municipal Sewer and Water Infrastructure Forecast & Analysis Survey. As the industry enters 2022, at no point in the past 25 years have federal dollars flowed as freely or in such high numbers

This major influx of funding has given municipalities a much greater confidence in spending for 2022, compared with recent years. Most survey respondents (68 percent) will be seeking a piece of the suddenly abundant federal funding pie.

In fact, the research reveals an anticipated overall 16.4 percent increase in sewer and water funding for 2022 by municipal and related organizations, or new, replacement and rehabilitation infrastructure spending of $22.83 billion. This level of funding is expected to be sustained through 2026. All this comes after a sluggish 2020-‘21.

The survey polled U.S. municipalities about their top concerns and issues, 2022 infrastructure spending plans and working relationships with consulting engineers and contractors. This exclusive annual study also provides detailed insight into America’s cities with information and perspectives on industry topics and technology. It reflects only information regarding sewer, water and stormwater piping infrastructure and does not include figures or data on pumping and lift stations, treatment plants, etc. Respondents ranged in size from rural communities of less than 1,000, to mid-sized cities up to 500,000 and a representative sampling of the nation’s largest municipalities.

High hopes

After a year of partisan politics at their worst, against a continued backdrop of the COVID pandemic, the public good rose above the fray. In late 2021, Congress finally passed the much- anticipated and desperately needed Infrastructure Investment & Jobs Act (IIJA). While spreading masses of money throughout many infrastructure markets, the sewer and water industry is set to receive $44 billion over five years, beginning with fiscal year 2022. Several billion dollars have already been earmarked for many areas of the country.

These funding initiatives are designed to be over and beyond what is allotted to the Clean Water and Drinking Water Revolving Funds (SRFs), which typically receive between $1 and $2 billion annually from the appropriations committees.

The infusion of funding is spread over several of new programs but also includes $11.7 billion over five years for both SRFs: $1.902 billion in FY22, $2.202 billion in FY23, $2.403 billion in FY24, $2.603 billion in FY25, and $2.590 in FY26. The first two years (FY22 and FY23) have a reduced state match of 10 percent but reverts to 20 percent for FY24-26. The other main concession is that states are required to spend at least 49 percent of these funds in the form of grants or 100 percent principal forgiveness – a much higher share than usual not needing to be repaid.

In addition, the bill distributes another $10 billion over five years for addressing emerging contaminants like per- and poly-fluoroalkyl substances (PFAS), a family of manmade chemicals found in many consumer products, which the Environmental Protection Agency (EPA) says can negatively impact human health and the environment. The money is divided into three areas:

- $4 billion to address emerging contaminants in drinking water, focusing on PFAS. It will be appropriated evenly, at $800 million per year, from FY22 through FY26. The funds will be provided to states via the DWSRF, with no required state match. All these funds must be awarded by states as grants or principal forgiveness loans.

- $5 billion to help small and disadvantaged communities address emerging drinking water contaminants. The funding will be appropriated evenly, at $1 billion per year, from FY22 through FY26, and provided to states for projects that address emerging contaminants in communities eligible for assistance under section 1459A of the Safe Drinking Water Act.

- $1 billion to help wastewater systems address emerging contaminants. The first $100 million will be appropriated in FY22, and an additional $225 million per year will be made available for FY23-FY26. Funds will be distributed through the Clean Water SRF and will not be subject to state matching requirements.

Lastly, the IIJA contains $15 billion to replace all service lines covered by the EPA’s Revised Lead and Copper Rule. That means lead lines and galvanized pipe downstream from a lead pipe. Congress has been under extreme public pressure since the Flint, Mich., lead-poisoning disaster five years ago, and investing in lead pipe replacement has been a high priority. While this $15 billion allotment will be a major step towards that goal, it still falls far short of the $60 billion the American Water Works Association estimated is needed to fully replace all lead pipes in America.

Just a start

The irony is that even with the new federal dollars, it falls short of the amounts necessary to fill the spending gap between what is needed to expand, replace or rehabilitate sewer and water systems, and what is actually being spent. It’s simply not enough. Cities have not kept up their sewer/water systems over the last 50 years. Unfortunately, many municipal officials don’t comprehend the growing spending gap and merely see the new federal dollars as an excuse to avoid strong mitigation measures to attack a comprehensive and complete system upgrade.

For example, two different respondents from mid-sized municipalities in the Midwest, one an elected official and the other a member of the public works department, had radically different perspectives of the new funding measures.

“We recently were told that we will receive funding from a state SRA,” said a city councilman. “This should really help us solve our sewer system problems and avoid rate hikes.”

Conversely, the public works official for that same city commented that “while thankful for the funding, we’ve still got a very long way to go before we finally have our systems upgraded – and that will take a lot more money.”

Thus, the paradox is reflected between increased short-term funding and what is actually needed over the next several decades for cities of all sizes across America.

Further, the funding will not be universally spread among all municipalities. There is just not enough money to help everyone, despite the high-fives and smiles from politicians. Further, small cities have trouble getting recognized in the pool of much larger organizations.

“We’ve struggled with getting grants before,” said a public works director of a small town in the Midwest. “I guess because our needs are so small in contrast to the bigger cities – the squeaky wheel gets the oil. But nonetheless, our needs are just as real.”

On the bright side, a large number of cities will be able to meet many goals to resuscitate dying and decaying systems. Work that has been delayed or ignored for many years can now proceed. Those delays can be attributed to many factors, but chief among them has been poor political leadership – not just federal level but state and local, as well. It’s been too easy to invest limited tax dollars into “popular” projects rather than the out-of-sight, out-of-mind underground infrastructure; too easy to keep user fees low and thus community goodwill high; too easy to put off until tomorrow what was desperately needed today; and too easy to blame other government agencies for funding problems.

“It’s been too easy for our city council to put in biking and jogging trails and overlook our leaky sewers,” griped a Mid-Atlantic respondent. “We’re hoping now we can qualify for some of that SRF money and finally get some things addressed.”

Consent decrees

The result has been a decrepit and failing sewer and water systems for much of the country, wildly out of compliance with EPA rules and regulations for the public safety of America’s citizens. Since the late 1980s, EPA has forced many cities into compliance by filing lawsuits and ultimately negotiating “consent decrees” which generally means a city agrees to invest a certain amount of dollars over a finite period of years to upgrade, repair and rehabilitate systems to modern standards. In essence, a consent decree forces cities to do whatever it takes financially to reinvest in their sewer and water systems.

And it’s not as if city managers and public works directors are not aware of their often-substandard systems. A U.S. Department of Justice attorney who was part of a team assigned to prosecute out-of-compliance cities for the EPA, once revealed to Underground Construction that in 99 percent of all legal filings, cities may employ their legal teams to negotiate more favorable terms or buy time, but the cities rarely claim they are erroneously being prosecuted.

“About the only people who may be shocked when the EPA comes calling is city councils or officials who have mistakenly ignored information from their public works personnel over the years; the cities know they are out of compliance,” the DOJ attorney explained.

So why worry about consent decrees now, in the new federal funding land of milk and honey? It’s all about the numbers. This survey revealed, again, how much additional money is needed to fully bring systems up to standards. Comparing that to how much funding is available – even with the new Infrastructure Bill amounts – the country’s cities are still operating at a deficit. Many will receive precious relief in 2022 through 2026, but for only a few will it be enough money to solve their layers of sewer and water system problems. And in 2027, the subsequent spending gravy train will expire.

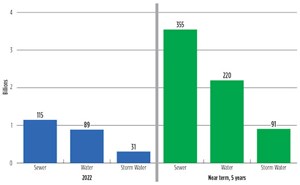

For example, city personnel themselves project their near-term funding needs for sewer, water and stormwater at $235 billion dollars and $665 billion long-term. That’s a far cry from the $44 billion in new government funding over the next five years. But it’s an important start, as long as cities realize the need to continue aggressive funding schemes.

“We’re partially through consent decree program and it’s going well,” explained one muni official. “But it’s a shame we waited until we got on the south side of the EPA – we all knew the consequences.”

COVID-19 has had a major impact on markets since 2020. As of this writing, the Omicron variant was raging across the country and the world. But its health impacts upon most people were relatively meek compared to previous iterations. Expectations are for Omicron, as highly infectious as it is, to quickly burn itself out by spring, if not earlier. According to many experts, COVID is on its way to becoming endemic, but will not carry the threat that it did in 2020. Most city personnel responding to this survey felt that their operations were or would largely return to normal early in 2022.

Optimism

As we enter 2022, there is legitimate reason for hope among the sewer and water communities of owners, consulting engineers, contractors and vendors, as more market dollars are now available than ever before. COVID is fading, but other problems remain. Supply chain issues linger, and a lack of workforce could slow work. However, all things considered, municipalities across the country expressed optimism.

“Even with the flare-up of Omicron, the fallout has been pretty mild,” said a Southwest muni manager. “We’re finally looking forward to a pretty normal year for a change.”

Another official from the Pacific Northwest agreed. “Omicron is not hitting us hard like other versions – we think this will eventually become a normal year – at least from the city’s point of view.”

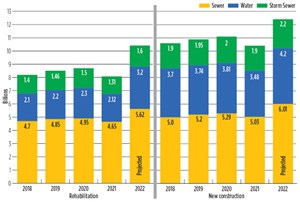

With the substantial increase in federal dollars, America’s cities estimated spending, for new and replacement constructions, at $4.2 billion on water (an amount which could jump dramatically, depending upon how fast cities developed lead pipe replacement plans and how nimbly agencies can react in allotting those funds); $2.2 billion on stormwater; and $6.01 billion for sewer.

For rehabilitation, $3.2 billion is expected for water, $1.6 billion for storm sewer and $5.62 billion for sewer, or an increase of 16.6 percent. In total, projected underground infrastructure spending for municipalities in 2022 is $22.83 billion, an increase of 16.4 percent from 2021.

Dream dollars

With the pandemic largely putting the brakes on local cities’ economic growth in 2020-‘21, it was no surprise that survey respondents are excited about the opportunities to play catch up in 2022 through 2026. However, as cited earlier, the available funding still falls far short of actual needs or the capacity for cities to ramp up to that level of work. To grasp the magnitude of the spending gap that exists, respondents were asked: how much funding is necessary to bring your sewer, water and stormwater systems up to date over a five-year period? Survey participants estimated that, collectively, more than $665 billion would be required.

Still, dealing with the major increase in dollars has been made easier for many cities through aggressive asset management programs they have in place, providing them with a much better grasp of their system status and needs. City officials report that asset management continues to play a strong and growing role in project planning. More than 49 percent of America’s cities report having a program fully in place, compared to 48 percent in last year’s survey. About 38 percent now have a program in development.

User fees

Not unexpectedly with COVID-related economic slowdowns, political turmoil and other disruptions to the economy over the past two years, U.S. cities have been reluctant to increase user fees, even though their sewer and water systems are in desperate need of investment. Survey respondents reported an average of 3. years between rate hikes, an increase from 2.8 years in the 2021 results.

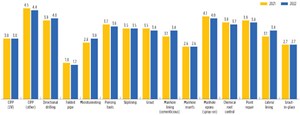

Municipalities rated several broad categories in terms of level of impact on their operations. Funding remained the number one concern, with 82 percent of the respondents citing that issue. Regulations/EPA was cited by 70 percent of the respondents; hiring qualified employees was mentioned by 55 percent; safety concerns by 36 percent; and community relations by 36 percent.

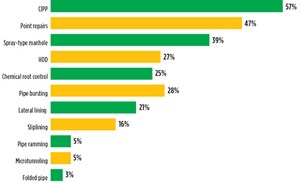

About 47 percent of those surveyed commented that they prefer to use trenchless methods when feasible, roughly the same as in 2021, while 36 percent said it didn’t matter and 17 percent still prefer open-cut methods.

Contractors

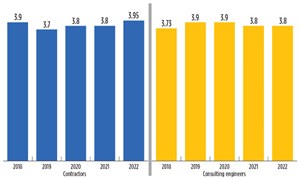

The survey also asked municipal personnel to rate contractors. The overall rating was a composite from four categories: quality of work, timely project completion, fair pricing and dependability, based on a scale of one (worst) to 5 (best). This number provides a confidence benchmark. Contractors saw their composite score climb for the third year in a row to 3.95, slightly ahead of consulting engineers.

While most of the city respondents praised contractors as “valuable partners,” several comments were cited as areas of concern. “Change orders,” again, were mentioned by many respondents. “We’re drowning in change orders,” lamented a muni employee from the Northeast.

Another respondent from the Mid-Atlantic agreed: “We consistently have what we feel are an excessive amount of change orders.” A city engineer from the West Coast suggested that “we need to work more closely with consulting engineers and contractors to avoid unnecessary change orders.”

Several city personnel also suggested that contractors should expand their portfolio of available methods to better attack projects. “We read and hear about all kinds of methods of repair or rehab. And we understand many of these technologies aren’t right for a particular project. But we would like to be able to consider options whenever possible,” explained a Mountain West area muni manager.

Rating engineers, contractors

The survey also asked municipal personnel to rate the consulting engineering community on the 1-to-5 scale. The consulting engineer score for 2021remained constant at 3.8.

For the most part, respondents were pleased with the efforts of consultants. “We couldn’t possibly turn out the amount of work – and do the project management – without a strong hand from the engineering firms we work with,” said this Southwest muni official.

Still, a familiar theme was cited for suggestions as to improvement for engineers.

“We really need them to be able to work with multiple technologies – there is new tech coming out all the time,” observed this Southeast representative. “Knowing our options is critical for us – especially when we’re trying to stretch dollars,” added this Northeast city official.

Another area cited as a shortcoming for engineers was lack of field experience. “Too many of the engineers working on our projects know little about field work,” complained a respondent from the Midwest.

When asked about the most important values when considering engineering firms, quality, by a wide margin, was again the most-cited factor by 82 percent of municipal mangers. Other areas included “understanding of new technology,” cited by 77 percent of respondents; “cost” by 72 percent of respondents; and “productive relationships with contractors” was mentioned by 35 percent.

Comments