April 2022 Vol. 77 No. 4

Features

Utility & communications construction update

By Daniel Shumate, Managing Director, FMI Capital Advisors Inc.

As I look back at the past two years, I never would have anticipated that we would be coming out of the global pandemic with optimism only to be confronted by a potentially greater global crisis, following Russia’s invasion of Ukraine. The pandemic exposed the frailty that exists in current supply chains and the war in Ukraine has placed those concerns into overdrive.

The result is that most investor-owned utilizes, municipalities and developers will likely do less for more. For underground contractors, the primary impact will be tied to fuel costs. Efficiency with crews and minimizing windshield time will become more important, as gas prices have increased 47 percent year-over-year and almost 70 cents in the last month (about 21 percent). There is little expectation that prices will decrease as the sanctions on Russia will likely not subside in the short-term and OPEC has not exhibited a willingness to increase production.

The second area that has been materially affected by the invasion of Ukraine is the metals market. Russia is among the top five global producers of steel, nickel and aluminum and the reduction of supply will have an impact on the industry, as those products are harder to come by for manufacturers.

The price of nickel is currently up over 56 percent year-to-date (though it has been up over 130 percent at one point since the invasion). Nickel is not only used in the batteries for electric vehicles, but also is the primary metal in the production of stainless steel. Consequently, the price of steel has increased 45 percent since January, as well.

Lastly the price of aluminum has risen almost 20 percent year-to-date and will have a profound impact on the price of transmission lines. The impact of these raw material prices will affect the availability and price of materials used on jobs and the equipment used to install them. Protecting the bottom line through appropriate material and equipment price increases in contracts has likely never been more important.

Within the United States, the Federal Reserve has been hawkish on its communication about interest rate increases and fighting inflation. In March, the Federal Reserve began the process of raising the Federal Funds rate to fight the inflationary pressures.

The initial rate increase was 0.25 percent, but Jerome Powell has stated that the Federal Reserve is open to 0.5-percent increases later in the year if the desired effect on prices is not being achieved. When compared to the consumer price index of 7.9 percent in February, the rate increase feels like a drop in the bucket, but the Federal Reserve is hopeful that market pressures can weigh on prices and bring them back into line.

Despite the challenges to the supply chain, the amount of funding available for infrastructure has increased through the Infrastructure Investment and Jobs Act, alongside public utility spending, and the population has seen the effect of reliance on nations controlled by dictators to produce oil. A return to energy independence policies could have a positive impact on the underground oil and gas segment and improve the outlook for contractors with O&G exposure in the UCCI.

UCCI performance & updates

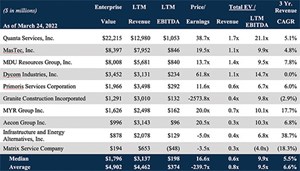

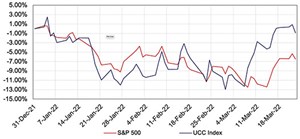

The Utility & Communications Construction Index (“UCCI”) below presents the stock performance of the sector’s publicly traded stocks over the past quarter and the past year. In the first quarter of 2022, the UCC Index has experienced some resilience relative to the broader market, as it’s down only 0.88 percent on the year, versus the S&P 500 being down 6.5 percent over the same period.

The rise in oil prices is generally positive for those companies with exposure to the oil and gas markets and the Infrastructure Investment and Jobs Act growth opportunities have helped to maintain prices of the UCCI companies. Increases by the Federal Reserve of the Federal Funds Rate could have a negative impact on equity valuation alongside supply chain challenges in the upcoming quarter.

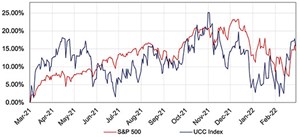

The one-year performance of the UCCI is up 15.8 percent, slightly greater than the S&P 500’s 14.7-percent increase over the same period. The Infrastructure Investment and Jobs Act, along with expectations for increased spending to fuel the transition to renewables, benefited the UCI companies over the period. The UCC Index reached its all-time high in November 2021, so expectations for continued growth and profitability will be challenging, especially with all of the factors outside of the contractor’s control.

Mergers & acquisitions

After a flurry of activity to end 2021, the UCI M&A markets took a slight breath in the first quarter of 2022. Last year ended with a particularly meaningful transaction in the sale of one of the largest privately held underground construction contractors to one of the UCI public companies, MasTec. The transaction adds significant expertise, scale and capacity to the second-largest U.S. company in the segment.

In the first quarter of 2022 Southwest Gas also announced a split-off of the Centuri Construction business from the parent utility company. This will likely result in a new member of the UCCI companies and add to the public listing of large infrastructure service businesses.

Comments