October 2021 Vol. 76 No. 10

Features

Utility and Communications Construction Update

By Daniel Shumate, Managing Director, FMI Capital Advisors Inc.

Working in the competitive bid-based underground construction segment often means juggling bits of information to make the most informed choices. The volume of information impacting the decisions of contractors has only increased in a challenging political and economic environment. Publicly traded companies of the Utility & Communications Construction Index (“UCCI”) have performed very well due to the volume of infrastructure spending and expectations for the infrastructure bill.

The $1 trillion infrastructure bill passed by the Senate in July 2021 will reach large metropolitan centers and rural communities alike, with earmarks for roads and bridges ($110 billion), passenger and freight rail ($66 billion), broadband ($65 billion), electric and power infrastructure ($73 billion) and environmental remediation ($21 billion)1. While there will be a lot of competition bidding on these projects, contractors who understand the dynamics of their regional markets will be poised to capture work. Additionally, the use of federal funds to match state and local spending often means the impact in terms of projects generated can be much higher than the stated federal appropriation.

Despite the potential boon from infrastructure spending, the supply of labor and materials to complete the work remain an ongoing battle for the industry. The single largest challenge to contractor profitability in the current market is material prices where the contractor is at risk. While owners have been accommodating of project delays due to supply shortages and changed contracts to remove the material cost from the competitive bid value, this accommodating stance will likely change as pressure to complete the work and stay on budget increases. FIGURE 1 shows the change in producer prices of final demand items through July 2021. The percentage change is striking and will likely continue due to supply shortages and demand imbalances.

As mentioned in previous discussion, there are a couple numbers to review as it relates to the coronavirus to determine where we are at and if things are getting better or worse. The first is the seven-day average trend of deaths related to the disease. Following the surge of the delta variant, this lagging indicator has now turned and is going down. The second value that we pay attention to nationally is coronavirus hospitalizations. The United States is at a seven-day average of 10,210 as of Sept. 19 and this represents a meaningful decline from August highs.

The Utility & Communications Construction Index presented below presents the stock performance of the sector’s publicly traded stocks year-to-date (FIGURE 2) and the past three months (FIGURE 3). The year-to-date performance demonstrates the sizeable increase in valuation that the UCCI companies have experienced, over 28 percent through September. The negative impacts of rising prices, potential changes to tax law, and the risk of political stalemates have kept the lid on the growth for the prior three months. The action of congress and the progression of coronavirus are the two primary factors in whether we continue to maintain strong valuations of the UCC Index or experience a post-election expectation decline like 2016 and 2018.

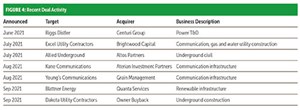

Transaction activity in 2021 is nearing 2007 levels of activity. The first three quarters were among the busiest on record and there is meaningful activity that will further shape the underground construction landscape to occur before the year ends. The primary motivation for the activity has been potential changes in capital gains tax laws prompting owners to decide whether the time is right to sell. When you combine this motivation with the frenzy of the public markets and the cost of financing, owners are taking advantage of a seller friendly position.

1 “The Senate Approves $1 Trillion Bipartisan Infrastructure Bill in a Historic Vote.” NPR. Aug. 10, 2021

Comments