June 2021 Vol. 76 No. 6

Features

23rd Annual Directional Drilling Survey: HDD: A Tale of Two Markets

As the Time of COVID draws to a welcome close, a new president and Congress present both a carrot and a stick to underground infrastructure. The result is that for small to mid-sized rig owners/operators it is good to be an horizontal directional drilling (HDD) contractor.

The overall buildout of communications services never seriously slowed during the pandemic and continues to heat-up so telecom contractors, principally using HDD, generally have seen an increase and few, if any, interruptions to their workloads. That trend should continue for the foreseeable future.

On the other hand, for those large rig HDD contractors who historically have heavily relied on oil and gas related projects, 2021 has become a scramble to find work, or diversify.

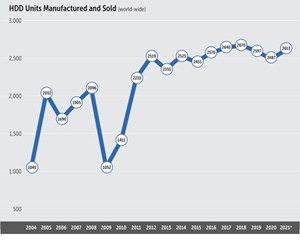

This information and much more is revealed in the 23rd Annual Underground Construction HDD Survey. The research, which reflects upon the incredible versatility of HDD, in a variety of essential markets, that continues to demonstrate amazing growth potential – even as markets continue to recover in an unsure economic future.

The exclusive Underground Construction industry research was conducted during March and April. It surveyed contractors and utilities that actively own and operate HDD units to enable a statistical portrayal of a market that has proven as disruptive to established construction practices as the backhoe did.

The carrot

Prior to 2020, the United States and indeed, much of the world, was already racing to construct widespread, high-speed broadband systems. Demand for broadband services and benefits have been growing for years. But with the influx of the COVID pandemic, the absolute need for fiber-capable communication services drove demand to extreme highs.

Businesses now relied on programs like Teams and Zoom, virtual education from pre-school to college required high-speed internet, streaming entertainment networks experienced phenomenal growth, with no end in sight. The medical industry, already experimenting with it, now found virtual doctor visits a way of life. And that’s not to mention the overwhelming need for the medical profession to have digital accessibility to gigabytes of medical data and records.

The world changed forever in 2020, making the accelerated installation of fiber, even into rural areas, a massive and popular priority for every elected official in the country. As such, an additional $5 billion funding bill was passed by Congress in late 2020 that emphasized bringing fiber to rural and underserved markets. That funding, in addition to the billions already being poured into the buildout by private companies, was essentially pouring gasoline onto the fire.

Further public funding options are still being included in the latest round of infrastructure proposals being discussed in Washington. That’s the carrot being extended by the Biden administration and new Congress.

When the continued build-out of 5G cell networks are considered, contractors are almost overwhelmed. And of course, the most popular and effective way to install fiber conduit remains HDD. It ever a technology was perfectly matched with a market need, that’s surely the case for HDD and fiber optic installation. “No doubt, it’s a great market,” stressed a contractor from the Southwest.

The stick

When oil prices went tumbling down into negative territory on April 20, 2020, there was actual exaltation by radical environmental groups. While the price has since rebounded strongly, the scare did give oil and gas firms pause in terms of pushing forward development plans. That was reinforced when perceived anti-oil candidate Joe Biden defeated pro-business/pipelines/oil and gas incumbent Donald Trump for president.

The Biden administration’s antipathy to the traditional oil and gas industry was well established both before and during his campaign. Biden’s actions appear to support the latest strategy for bringing that industry to its knees by cutting of transportation options via pipelines. Indeed, on his first day in office, President Biden nixed the Keystone Express Pipeline and has since supported efforts by environmental groups to delay or outright block other major interstate pipeline projects.

All these developments have created an all-out war on interstate pipeline construction and, thus, many large HDD projects affiliated with these projects have been delayed or cancelled. Large-rig HDD contractors have been struggling to find other projects. Fortunately, smaller intrastate projects have been pushed forward by many companies, as they require less regulatory burdens (depending upon the state) and tend to encounter less public resistance.

Interestingly, in a move to create “green” energy and minimize reliance on the oil and gas industry, many energy companies are investing heavily in the development of hydrogen as a possible replacement fuel for power generation. Of course, liquid hydrogen would still require substantial pipeline infrastructure work, so it remains to be seen how that will be received by environmentalists.

Large rig drillers have also been exploring other markets. Said this Southwest contractor, “We had done a couple of water projects and have been pursuing more of those. It seems that is becoming more popular with directional drilling.”

Stumbling block

As telecommunication contractors scramble to keep up with demand, two areas emerge as major inhibitors to growth.

Workforce has been an issue for all underground infrastructure markets for several years. Industry associations, such as the Distribution Contractors Association, Power and Communication Contractors Association, NASSCO and many others, have all launched and supported innovative and creative programs to promote and attract people to the labor pools.

But still the shortage remains. With the worldwide retreat to homes in 2020, attracting workers to outside careers – even if they are high-paying jobs – has become all-the-more difficult.

“One would think that with unemployment still running high in so many parts of the country, people would be knocking at our doors wanting high-paying careers – but that’s not the case,” observed this Southwest contractor.

“Where have all the workers gone?” this Midwest contractor complained tongue-in-cheek. “Acquiring skilled labor is almost impossible.” Said another contractor from the Southwest, “It doesn’t matter much even when we’re prepared to pay people while we train them – people still aren’t interested in us.”

Further, a West Coast contractor pointed out that “apparently, working outside just isn’t acceptable or a ‘cool’ career anymore.” Added this contractor from the Southeast, “We’ve even offered bonuses to both new hires and our workers that bring in someone. We’ve had some luck with that, but not nearly what we had hoped for.”

The second hiccup slowing down telecom is the manufacturing supply chain. For small to mid-size rig and equipment manufacturers, the labor crunch has hit them, as well. But it goes much further than just assembling a rig, mud system or tools. Distribution of key components has been disrupted as well.

Continued refinements to small rigs best-suited for telecom and electric work continue to enhance and improve performance of equipment and increase productivity for contractors. Yet, it’s still not enough. Manufacturers are struggling to churn out rigs fast enough to meet demand. Waiting for rigs is often a problem for dealers and contractors alike.

“We’re scared to commit to much more work until we’re confident we can get the equipment in a timely fashion,” stressed this Northeast contractor. Said a Southeast contractor, “we generally are a loyal customer … but we checked out competitive equipment back in March when we found out how long it was going to take us to get two new rigs. Problem was, other manufacturers were just as backed up.”

A Mountain states contractor had better luck getting a new rig. “We didn’t have to wait on our new rig – I think our dealer had really stocked-up on equipment last year. But from what we hear, they’ve now just about cleared out their yard. We’ve got enough work to justify another rig late this year or early next year, so we’re concerned.”

Other markets

What could very well turn into another major market driver is the electric industry. HDD has been utilized heavily for installation of electric distribution lines, especially small-to-medium rigs. Now, the record February deep freeze of Texas and much of the southern U.S. slammed the electric grid and states are still working with utilities trying to figure out how to prevent such a power outage disaster from ever happening again.

That means “hardening” of electric lines and renewed emphasis to place plants underground. Even electric transmission lines are being pushed to go underground as installation costs, primarily via HDD, continue to become more competitive.

Water is steadily becoming a solid growth market for HDD of all sizes. The survey revealed that market segment continues to gain in popularity and contractors are learning that the public works markets are offering opportunities, both in water and sewer.

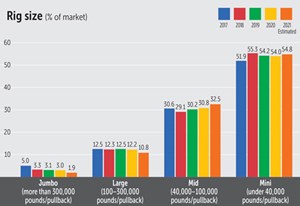

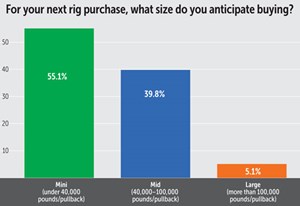

For the past several years, medium-sized rigs have been a hot commodity. Survey respondents say that while some of their work for pipelines has dried up for the time being, they are still able to utilize those rigs for multiple applications. And the price point, combined with diversity offered with mid-rigs, continues to drive their popularity.

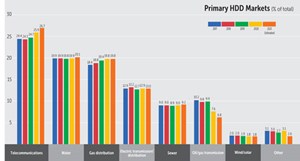

As the pandemic eases, the HDD market composition has changed somewhat in 2021. Predictably, telecom work gained a larger percent of project market share at 26.7 percent; water grew to 20.1 percent, gas distribution held steady at 13 percent; sewer grew to 9.2 percent; and oil and gas pipeline work fell to 6.8 percent. Wind and solar applications held steady at 1.8 percent, while varied and often innovative uses of HDD came in with a 2.6-percent market share.

When asked about future prospects for continued growth of HDD, most respondents strongly agreed the technology has a bright future. “We love this industry – it’s been very good for us,” exclaimed a Midwest contractor. “There should be strong applications for HDD for years to come.”

A Southeast contractor agreed. “When we first got into HDD, we felt like we were doing so because we had to for competitive reasons, not because we wanted to. But now, I can’t imagine running our operation without HDD playing a major role.”

New guys

Contractors have complained for years about recent entrants in the HDD market jumping in without adequate knowledge to perform the projects they were winning by underpricing and subsequently, frequently under-performing on jobs.

Mud disposal of drilling fluid remains a major issue for many contractors and was again referenced frequently in the survey comments.

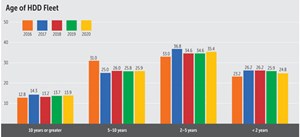

The average age of a contractor’s HDD rig fleet increased slightly in 2020. Rigs 10 years and older comprise about 13.9 percent of active units. Contractors cautiously hanging onto rigs was not a surprising development during the height of the pandemic.

On the other hand, rigs less than two years old declined slightly from 25.9 to 24.8 percent. Reasons cited were caution during the pandemic, but also scarcity of certain rig sizes.

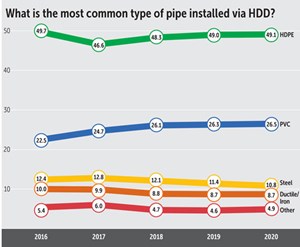

The most common pipe installed via HDD remains HDPE, with a 49.1-percent market share; PVC followed at 26.5 percent.

Original equipment manufacturers (OEMs) in the HDD tooling and drill pipe sectors play a vital role with many contractors. About 43.9 percent of downhole tooling is purchased from OEMs and 48.5 percent of drill pipe.

Used rigs remain a major factor for contractors, especially those needing to augment their existing fleets, and for new contractor entrants into the market. For 2021, 68 percent of the respondents have bought used units at one time or another. About 57 percent of used rig purchases are anticipated to be in the smaller rig market rigs (under 40,000 pounds of pullback force).

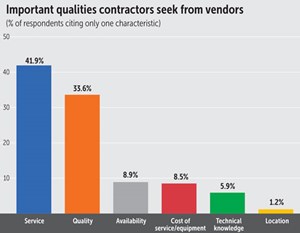

The survey also asked about the most important qualities contractors seek from their manufacturer and supplier partners. As it has been for several years, “service” is the most coveted attribute, cited by 41.9 percent of respondents, followed by “quality” at 33.6 percent.

Comments