July 2021 Vol. 76 No. 7

Features

3rd Quarter Utility & Communications Construction Update

By Daniel Shumate, Managing Director, FMI Capital Advisors Inc.

While the underground construction industry performed admirably throughout 2020 and into the second quarter of 2021, there is an air of uncertainty for what the second half of 2021 will bring. While the challenges to the oil and gas market weigh on the full potential, most underground companies have full backlogs and are struggling to find the right people.

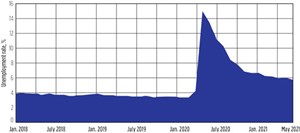

We are also seeing legitimate material pricing and supply issues that could impact the back of the year. The United States was not quite able to produce a “V-shaped” recovery as was suggested by economists about a year ago, but the path back to a low unemployment rate has been impressive. FIGURE 1 illustrates just how dire the unemployment situation was in April of 2020 and how much progress the country has made since. The remaining 2 to 3 percent improvement is quite challenging to solve and if obtained would represent an economy at “full” unemployment.

In March of 2021, the federal government, with the assistance of the federal reserve, put the pause button on the United States economy. Over the past 12 months, additional stimulus packages have prevented some of the worst-case scenarios but may now be limiting the recovery. Multiple theories exist as to why the recovery in the unemployment market has slowed. Potential reasons include limited childcare options, increased unemployment benefits, fear of returning to the office and select states maintaining lockdown regulations. The increased unemployment is likely

a combination of all of these, but because of the decreased workforce participation, childcare seems to be high on the list. One is not included in the unemployment statistics if they are not actively looking for a job.

The challenge in getting people back to the workplace has created a surprising rise in the employment cost index (total compensation for all civilian workers). The three-month percentage change had its largest rise in the past 10 years and is odd juxtaposed against the current unemployment rate. Individuals are choosing to stay home rather than take a job that is paying higher wages. The rise of the ECI shows that employers are having to lure people back to the workforce and pay current employees higher salaries to retain them.

We discuss all the unemployment concerns because the federal reserve chairmen, Jerome Powell, has stated on multiple occasions that they are willing to “look past” the transient rise in inflation to achieve full employment. The CPI increased another 0.6 percent in May (above consensus), and we are seeing significant increases in the cost to operate. Labor, equipment, inventory and fuel have all increased their cost over the past six months. Supply issues are a concern for almost all underground contractors suggesting the price pressure is not likely to subside in the back half of 2021. The hope of the federal reserve is that as the economy comes up to speed that the prices hold at current levels or decline slightly, but we have seen little evidence that is occurring in the utility and communication markets to date.

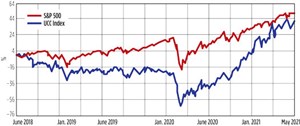

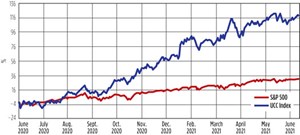

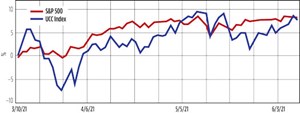

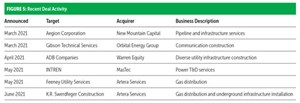

The Utility & Communications Construction Index presents the price performance of the sector’s publicly traded stocks over the past three years (FIGURE 2), last 12 months (FIGURE 3) and the past three months (FIGURE 4). The UCC Index has a reduced the number of companies in this period because Aegion was taken private by New Mountain Capital. Thus, the UCC Index now represents the 10 companies in FIGURE 5. I included both the three-year performance and the LTM performance of the UCC Index to highlight the relative decline of the industry followed by the impressive gains over the past 12 months. The growth of the companies during that period suggests that investors are very optimistic about the priorities of this administration. However, the last quarter performance illustrates the holding pattern the industry is currently in. We have stability while the direction of infrastructure legislation and spending is determined

at the federal level.

The value of the companies inside the UCC Index have continued to improve with expectation of a federal infrastructure package, strong efforts to improve electric and water infrastructure independent of Congress and the consistent profitability of the essential infrastructure contractor. The high expectations tied to current valuations could result in material declines in the price of the companies in the public markets if Congress is unable to fund the programs discussed.

Closing out the UCC Update, deal activity in 2021 has a full head of steam. Meaningful acquisitions in some of the nation’s largest markets have occurred in the first half of the year and two companies have been taken private. In the past three months, Artera Services has announced two transactions in the underground segment (Feeney Utility Services and K.R. Swerdfeger) that have catapulted them into one of the leading gas distribution companies in the United States. MasTec has made a meaningful acquisition in the power transmission and distribution segment by acquiring Intren in Chicago. Private equity has also disrupted the segment through a take-private of a former UCC Index company – Aegion Corporation by New Mountain Capital, and ADB Companies was acquired by Warren Equity as a new infrastructure platform in the Midwest. Lastly, Orbital Energy Group acquired Gibson Technical Services (GTS) and if management continues to make additional acquisitions in the space, we will begin to track and Orbital in the UCC Index in the future.

Comments