February 2021 Vol. 76 No. 2

Features

24th Annual Municipal Sewer/Water Infrastructure Forecast & Market Analysis: Work Will Continue

By Robert Carpenter, Editor-in-Chief

With 2020 in the rearview mirror, most cities are breathing a sigh of relief. The year saw municipalities lose more than $27 billion in tax dollars and user fees, as communities shut down their businesses, manufacturing and other activities due to Covid-19 fears. To make matters worse, several major cities experienced racial strife replete with non-stop protests and even rioting for weeks at a time. A raucous U.S. election further stirred tensions and concerns. Relief seems distant as America and the world struggled to regain both physical and economic health.

As we enter 2021, the tide apparently has turned. The approval and distribution of two extremely effective vaccinations (with potentially three more on the way) in January provided a much-needed spark of hope. Most states finally started listening to health experts and were willing to permit their citizens to reengage in normal activities (though still using ample health precautions that have become second-nature over the past 11 months).

While coronavirus still rages in parts of the U.S. and world, and renewed shutdowns are being instituted, the path to recovery is clear: mass inoculations, combined with large numbers of people who have contracted and fully recovered from COVID with little or no effect, should finally create the much sought-after herd immunity necessary to defeat the virus.

Depending on what part of the country you live in, typical activities are slowly returning. No one can yet predict when the virus will be completed eradicated, but with the knowledge that outcome is finally in process, citizens are feeling better about their future, albeit slowly.

But how will that be reflected in 2021 spending by public municipalities across the U.S.? The exclusive 24th Annual Municipal Sewer and Water Infrastructure Forecast & Analysis, conducted by Underground Construction magazine, queried municipal personnel about a variety of important subjects, among them projected spending for 2021, amidst all the negatives and anxiety of 2020.

While municipalities are seeing their infrastructure project spending budgets decrease, the contraction isn’t nearly as great as many anticipated. Overall, spending is expected to see a 3.1 percent drop in 2021.

“Our city is tightening the belt across the board,” said a municipal manager from the Northeast. “But fortunately – or unfortunately, depending on how you look at it – our sewers are in such bad shape that the plans we worked out recently are largely going forward. Our infrastructure is at a critical stage.”

Another respondent pointed out that his city is working under an Environmental Consent Decree with the Environmental Protection Agency (EPA). “After everything we’ve been through in 2020, the EPA is willing to work with us on some of our short-term deadlines –

but only to a point. We’re still going to be held to the overall deadlines.”

Spending

The survey polled U.S. municipalities about their top concerns and issues, 2021 infrastructure spending plans, and working relationships with consulting engineers and contractors. This exclusive annual study also provides detailed insight into America’s cities with information and perspectives on industry topics and technology. The survey reflects only information regarding sewer, water and stormwater piping infrastructure and does not include figures or data on pumping and lift stations, treatment plants, etc.

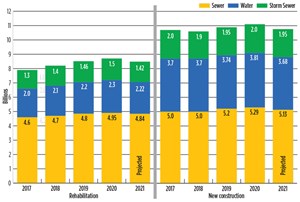

In total, $19.24 billion has been budgeted by America’s cities in 2021 to replace, rehabilitate and install sewer and water piping systems. Approximately $10.76 billion has been appropriated for new and replacement installations, while $8.48 billion is dedicated to rehabilitation.

Specifically, sewer projects are projected at $9.97 billion, water at $5.9 billion and stormwater at $3.37 billion. Interestingly, about 9 percent of respondents said their budgets would actually increase in 2021.

“We’re staying the course this year,” said a muni manager from the Rocky Mountain region. “We’ve got no choice, as our systems really need to be upgraded and we don’t want to get in trouble with regulators.”

Said a Southeast municipal official, “we actually feel confident about our budget this year due to a variety of factors.”

Respondents ranged in size from rural communities of less than 1,000, mid-sized cities, and a representative sampling of the nation’s largest municipalities.

“No doubt it’s been a very rough year for us,” said this municipal manager for an Upper Midwest community. “While the economy always impacts us, this virus thing was something different and no way were we prepared for it.”

As office buildings closed (some remain so), they were quickly followed by the shutdown of retail businesses, restaurants and bars. Though many businesses were able to quickly transition to a work-from-home structure, the impact on commercial and retail businesses was devastating. With the shutdown of factories, distribution nodes and even large sections of construction, the American economy took a nose dive. While Amazon and similar internet-based business templates prospered, their tax liabilities are only at the state levels. Local retail stores and shops struggled to survive at a much-reduced volume, thus eliminating essential tax sources for local communities.

Further, the fear of COVID-19 has spawned long-term travel bans by most U.S. businesses, including municipalities and engineering firms, not just as a budget-cutting measure, but primarily to keep employees from risking exposure to the virus. This has prompted an even greater loss in revenue for cities heavily dependent on tourism and meetings, such as Orlando, New Orleans and Las Vegas.

“The city budget has really been restructured and tightened in 2021 – for everything, not just sewer and water,” pointed out a respondent from the Atlantic Mid-Coast region. “Typically, we get a lot of tourist traffic pumping dollars into our economy, but that came to an abrupt stop by March (2020).”

Now more than, perhaps ever, an industry that historically has always been under-funded and constantly challenged to meet needs and growth patterns of communities, finds itself in an even more dire condition. The mountain of work needed to expand and rehabilitate America’s sewer and water infrastructure just got substantially taller and steeper.

Starting the climb back

As mentioned earlier, the good news on the health front is equating to a recovering economy. An influx of federal dollars will help boost spending abilities of many cities, through inclusion of substantial funding for federal programs in FY21 budget passed by Congress in late December. Included was:

- $1.6 billion in the Clean Water State Revolving Fund

- $1.1 billion for the Drinking Water State Revolving Fund

- $59.5 million for the EPW Water Infrastructure Financing & Innovation Act

- $40 million for the Overflow Control & Stormwater Municipal Reuse Grant Program

- $25 billion in a COVID relief package for renter assistance that allows those funds to help pay for drinking water and wastewater utilities.

A city official from a Southwest community stressed “that the virus doesn’t slow down our work; we’re still getting projects done. But the one thing that stops us dead in our tracks is lack of funding.”

Yet another respondent from the Southwest indicated a strong need for infrastructure work to continue, one way or another. “Right now, we’re mainly just handling projects already scheduled or reacting to emergencies that routinely crop up in our sewer systems. We’re no longer being proactive like we were a year ago and that is going to cause major problems in our systems,” she pointed out.

The key in 2021 and beyond for most cities is to resume somewhat normal activities where factories, retail stores and office buildings are open and active enough to restore traditional consumption and local spending.

But even with that resumption, cities’ sewer and water infrastructure systems continue to be underfunded. “We’ve been operating behind the eight-ball for years. The virus has just put us further into the hole,” observed this Northeast city official.

“The big question before the COVID virus was where will our funding come from?” related a Southeast respondent. “Even when the virus is over, that question will remain.”

The shift in political fortunes at the national level was profound last November and in early January when Joe Biden won the presidential election and Democrats, in effect, took control of the U.S. Senate. The Democrats’ control of the U.S. House of Representatives slipped substantially but still remains secure, albeit by a narrow margin. Of course, all of this could change in the 2022 elections. For the Senate, 34 seats are up for grabs and control of the House is now in play.

Regardless, as of this writing, the new government is already talking about a third, massive stimulus to further offset the negative impacts of COVID-19. An infrastructure stimulus is one of the lead components being discussed. If, indeed, a $1 or $2 trillion stimulus does come to fruition and underground infrastructure receives a reasonable share of the funding, 2021–‘22 could suddenly reshape the economic and project outlook for sewer and water markets.

“We’re putting a lot of hope that an infrastructure stimulus does get approved,” said this West Coast survey respondent. “We’ve been hit so hard with the events of 2020 … we really need to get back to work repairing our sewer and water lines that have been overburdened for decades.”

Said this survey respondent from the Mid-Atlantic region, “we’re already hearing chatter about another big stimulus that will include infrastructure. Our industry just has to make sure sewer and water is included in whatever package is put together.”

Dream dollars

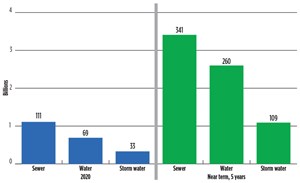

With the pandemic largely putting the brakes on local cities’ economic growth, it was no surprise that survey respondents expect a flat 2021, at best, in terms of spending. However, to obtain a grasp of the magnitude of the spending gap that exists between actual infrastructure needs and available funds, respondents were asked: how much funding is necessary to bring your sewer, water and stormwater systems up to date over a five-year period? Survey participants estimated that, collectively, more than $710 billion would be required, an increase of almost 4 percent over 2020.

Several respondents noted that thanks to modern asset management, they have a better handle on the true condition of their systems. This is allowing them to better estimate needs. Unfortunately, for the majority, those needs are even worse than they suspected. However, several cities indicated they have been pleasantly surprised at the status of their pipes.

Regardless, city officials report that asset management continues to play a strong and growing role in their project planning. More than 48 percent of America’s cities report having a program fully in place, compared to 44 percent in last year’s survey. About 34 percent now have a program in development and about 18 percent have no plans to implement an underground asset management program at this time.

User fees

In recent years, many U.S. cities have felt obligated to increase user fees as costs continue to exceed their ability to maintain systems. Several cities indicated that they raised rates in the first quarter of 2020. However, most agreed that any consideration of raising user fee rates went out the window by the second quarter. Overall, for the second year in a row, survey respondents reported an average of 2.8 years between rate hikes.

Municipalities rated several broad categories as to how much of an impact they have had on their operations. As discussed earlier, funding remained the number-one concern, with 81 percent of the respondents citing that issue. Regulations/EPA was cited by 72 percent of the respondents; hiring qualified employees was mentioned by 47 percent; safety concerns by 38 percent; and community relations by 35 percent.

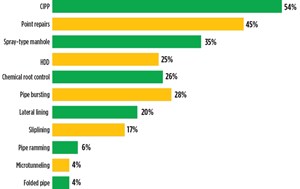

About 47 percent of those surveyed commented that they prefer to use trenchless methods when feasible, up slightly from 2020, while 33 percent said it didn’t matter to them, and 20 percent still prefer open-cut methods.

Rating engineers, contractors

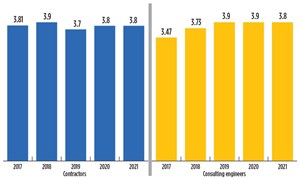

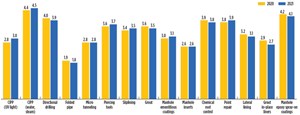

The survey asked municipal personnel to rate the consulting engineering community – basically a confidence index. The overall rating was a composite from four categories: quality of work, timely project completion, fair pricing and dependability, based on a scale of one (worst) to 5 (best). The consulting engineer’s score for 2021 regressed from 3.9 in 2020 to 3.8 as 2021 gets underway.

When asked about the most important values looked for in engineering firms, quality, by a wide margin, was again the most cited factor, by 84 percent of municipal mangers. Other areas included “understanding of new technology,”

cited by 75 percent of respondents; “cost” was mentioned by 74 percent of respondents; and “productive relationships with contractors” was mentioned by 32 percent.

“We frequently find that our consultants haven’t explored options as fully as we’d like,” said this city official from the West Coast. “Inexperienced engineers” was another common complaint cited by several respondents. This muni representative from the Midwest added that “we need our engineering consultants to be more well-versed in modern technology.”

Contractors

Municipal personnel were also asked to rate contractors based on the 1-to-5 scale in the areas of quality work, timely project completions, price, and dependability. Contractors saw their composite score climb for the second year in a row to 3.9, slightly ahead of consulting engineers.Most of the city respondents praised

the contractors they work with as reliable and knowledgeable. “Change orders” was cited frequently as a major concern.

“I can’t tell you how many times our projects have almost gotten out of control with change orders,” complained this Southwest city official. Said a Northeast official, “we understand that sometimes change orders are necessary. But we expect our contractors to keep a tight handle on that and keep us in the loop before problems come up.”

Respondents also encouraged contractors to become more knowledgeable about technology and increase options for projects.

Comments