October 2020 Vol. 75 No. 10

Features

Utility and Communications Construction Update

Daniel Shumate | Managing Director, FMI Capital Advisors Inc.

As I have begun to travel and interact with companies building and repairing critical infrastructure, there is a very different energy than what one might pick up from the nightly news. Productivity is high for many companies in highly populated areas (mainly because traffic has been less of a concern). Work did not stop when most people went into lockdown.

The general sentiment is positive and optimistic. This does not minimize the real challenges faced by people who contracted the coronavirus or the incredible decisions owners and managers have made to protect their workforces. It speaks to the resilience of an industry that understands the importance of its work to the daily lives of Americans.

This has been demonstrated numerous times over the last six weeks, as natural disasters such as tornadoes, hurricanes and wildfires caused significant damage across the country. Utility contractors are the first to answer the call to ensure water, power and gas are working. We have also seen significant efforts in the communication space, as workplaces and schools rely on technology more than ever. It is the fiber backbone that makes all of it possible. While the outlook past December of 2020 is foggy for those who rely on public funding, the industry has weathered this storm well.

There are two stories that will define the fall and ultimately, the outlook for the next four years. The first is what we have been dealing with for the past six months – Covid-19. As the weather cools and people are forced indoors, health experts are concerned about a second wave of the disease. The impact on the underground construction industry will be limited to actual cases among crews, but the same challenges companies have been dealing with, remain: employee health, permitting and coordination, and energy price decline for those touching the oil and gas industry. We hope that because the virus has spread through most major cities and cases per million in most states are normalizing, the fall will not have the spike that has experts concerned.

The second and most impactful story is the election. There are some key factors we look at to determine what effect the presidency may have on the industry. First is direct investment in utility infrastructure. Both candidates are pledged to support legislation that improves our utilities, roads and communication networks. Support on the campaign trails is largely universal; getting the legislation through a divided Congress has proved more challenging.

Second, we look at the tax and monetary policy. Both candidates look to encourage the federal reserve to keep interest rates down, in order to support growth. The risk of inflation in the near-term appears low, so we see little change in rates. Tax policy would likely remain similar under President Trump, while there could be significant changes under a Biden administration. An increase in the capital gains rate would directly impact the value of an owner’s company. Similarly, higher corporate tax rates could also affect shareholders. These changes would require a “blue wave,” but recent polling suggests this is a possibility.

Third, we look to regulatory burden. This concept is difficult to quantify, but outside of the legal battles from environmental groups surrounding major oil pipelines, the Trump administration has attempted to limit governmental red tape and encourage companies to do their job. In general, Democrats prefer more governmental oversight, and limits on the energy and construction efforts being completed today.

Some of this oversight is necessary for public health and safety; other requirements can simply increase cost with limited public impact. Regardless who wins the election, critical infrastructure legislation will likely be brought to Congress. Federal infrastructure legislation combined with low interest rates could continue the golden age of the underground contractor, despite the coronavirus.

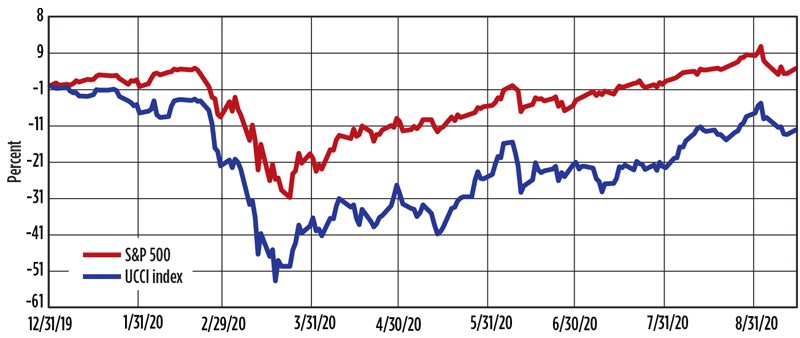

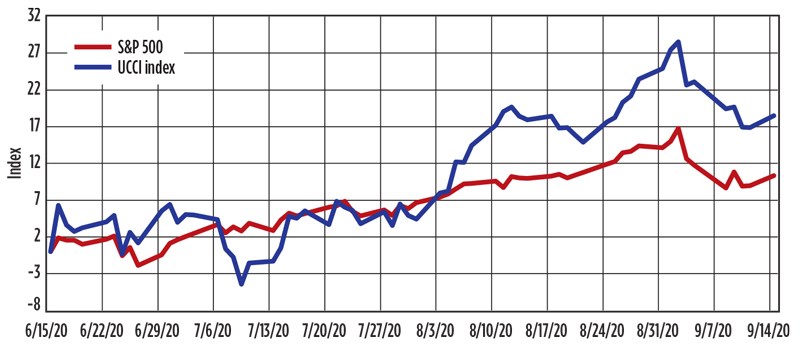

The Utility & Communications Construction Index (UCCI) presented on Page 12 shows the stock performance of the sector’s publicly traded stocks year-to-date (Figure 1) and the past three months (Figure 2). The year-to-date performance indicates how much more significantly the construction industry was impacted by the two-pronged attack of falling oil prices and coronavirus.

March 18, 2020, was the low point – a 54-percent decline from the beginning of the year. Because of the federal reserve and congressional action, Figure 2 illustrates the strength of utility services and the hope for energy, as tech stocks (that drive the S&P 500) have fallen. Stock prices for the UCCI rose an additional 19 percent in Q3, over Q2’s 23-percent increase. The action of Congress and the decline of coronavirus are the two primary factors in whether we continue to return to valuations at the beginning of the year, or if the “V” becomes a “W.”

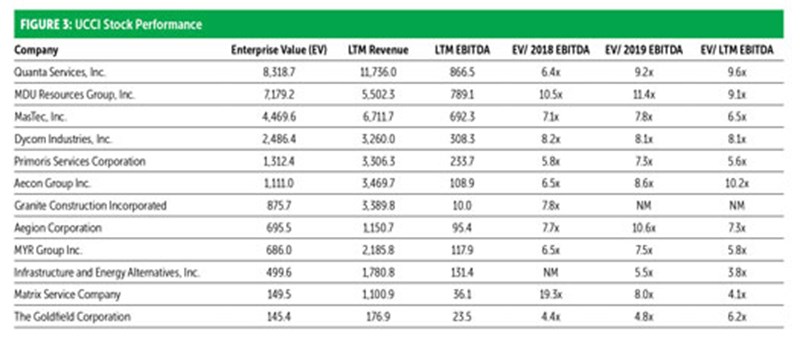

Lastly, as the stock market has roared back, the valuations of most companies in the UCCI are down, but not by as much as one would expect given the upheaval in the energy industry. There are also a couple of positive outliers looking towards future results, such as Quanta and Aecon.

Third-quarter activity increased, with the first deals having to survive Covid-19 diligence processes being completed. This is encouraging for the industry and for owners seeking to exit their companies in the coming months. We have also begun to see additional companies on the market and expect more transactions to make it through diligence and close before year-end.

The expected spend required to upgrade electrical distribution grids to a more automated system (that can incorporate renewable energy and serve electric vehicle grid demand) is a common theme among investors looking to add expertise in electrical transmission and distribution. We also see continued consolidation of the fragmented telecommunications market, as 5G plans are executed and additional capital is spent in rural areas to create a more balanced solution for families with limited broadband access. Artera Services (formerly PowerTeam Services) also continues to grow in its core market, through the acquisition of Otis Eastern. After acquiring Miller Pipeline and Minnesota Limited, the Artera Services group is one of the most rapidly growing underground companies in the U.S. •

Comments