January 2020 Vol. 75 No. 1

Features

Global Pipeline Construction Outlook 2020

By Jeff Awalt, Executive Editor

For those who thought producer retrenchment in U.S. shale basins, global trade wars or middling commodity prices would stop pipeline expansion dead in its tracks: Move along, folks. There’s nothing to see here.

Sure, there’s been a marked exhale since previous exhilarating highs, but the pipeline construction business is starting off the new year with a solid project backlog. And, even in those cases where market fundamentals have seemed to put projects on the brink, operators have been far more inclined to delay than abandon them outright.

Their optimism is mostly running on the same fuel as it was a year ago. Oil and gas companies are operating leaner and generally are better positioned to weather low prices. Worldwide energy markets, particularly in developing regions, are continuing their shift toward natural gas, requiring significant investment in infrastructure for exporting and importing countries alike.

There are concerns, to be sure. U.S. shale producers are struggling. Tariffs have weakened in areas where excess pipeline capacity has, for the moment, at least, outpaced demand. Rapid development of liquefaction and LNG export facilities in some regions may undercut financial support for planned pipelines and infrastructure on the drawing boards in other areas of the world.

That is to say, the energy industry is just as cyclical and subject to external impacts as ever, from weather to politics. At the outset of 2020, however, it’s a pretty good time to be a pipeliner.

Here’s an update on some of the notable pipeline activity taking place across key regions:

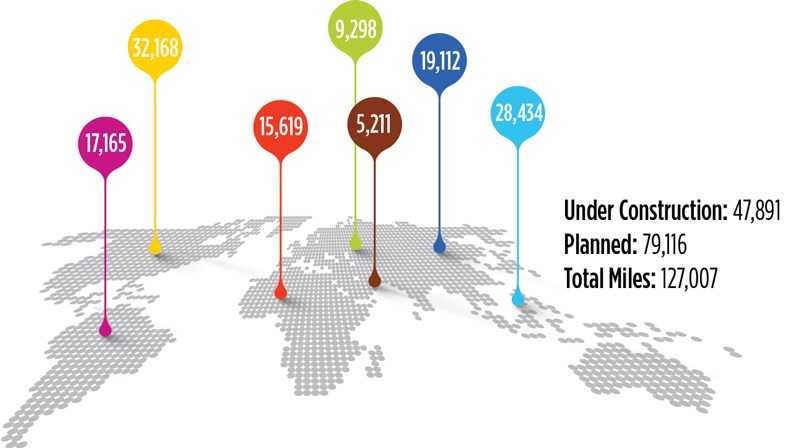

North America

Pipeline Miles Under Construction: 8,076

Pipeline Miles Planned: 24,092

Total: 32,168

The dramatic rise in oil and gas production from shale basins in the United States was a big driver of pipeline construction activity in 2019, with the Permian Basin of West Texas and New Mexico leading the way. A number of pipeline projects started construction as Permian oil production outpaced pipeline takeaway capacity, and major projects of more than 2,100 miles of pipe and 2.5 MMbpd of capacity came online in the latter months of 2019.

There are at least three more Permian crude oil pipelines planned for completion in the next two years. Red Oak Pipeline, a joint venture of Plains All American and Phillips 66, announced in June that they approved financing for the project, which is projected to begin transporting 400,000 bpd to Houston and multiple locations along the Texas Gulf Coast in 2021.

Jupiter Energy secured funding for a 650-mile crude oil pipeline from the Permian to the Brownsville, Texas, for targeted completion this year. Jupiter is also planning up to 10 MMb of storage along with three docks in the Port of Brownsville and a very large crude carrier (VLCC) loading facility offshore the city, near the border of Mexico.

The Wink to Webster Pipeline is a joint venture among affiliates of ExxonMobil, Plains All American, MPLX, Delek US and Rattler Midstream. The project, underpinned by a significant volume of long-term commitments, is expected to add 1 MMbpd of crude and condensate capacity upon startup in 2021.

Fast-rising oil production in the Permian Basin has led to soaring levels of associated gas production, resulting in pipeline bottlenecks, depressed prices and record levels of gas flaring by oil producers. Those constraints began to ease with the late September startup of Kinder Morgan’s 2 Bcf/d Gulf Coast Express – one of three major Permian Basin gas pipelines slated to come online through 2023.

Others include the 430-mile Permian Highway Pipeline, a joint venture of Kinder Morgan and EagleClaw Midstream scheduled for startup in early 2021, and Whistler Pipeline, designed to transport 2 Bcf/d of gas through 475 miles of 42-inch pipeline from the Waha hub to Aqua Dulce, on the Texas Gulf Coast, starting in 2021. The proposed 625-mile Permian Global Access Pipeline also would originate at Waha and deliver to the growing LNG center along the Sabine River, north of Lake Charles, La.

Kinder Morgan said in December, however, that it will likely put on hold its plans to build the Permian Pass pipeline, which would deliver 2 Bcf/d to the southeast Texas LNG market. The company has not reset a schedule for the project, except to say it would probably be delayed beyond 2022.

In Canada, where Alberta production has been constrained by a lack of pipelines, Calgary-based Enbridge has made steady progress toward the replacement of its Line 3 crude oil pipeline. The project, which has been plagued by environmental activists, was found in December to pose no serious threat to Lake Superior if crude oil ever leaked from the line. The latest environmental review was one of a series of hurdles Enbridge has faced in gaining construction approval from the U.S. state of Minnesota. Last month, Enbridge announced it began commercial operation of the Canadian section of Line 3.

Also in Canada, Trans Mountain restarted construction in December on parts of its pipeline expansion to nearly triple the flow of crude from Alberta’s oil sands to the British Columbia coast. The Canadian government, which bought Trans Mountain in 2018 from Kinder Morgan Canada, hopes to complete its expansion to 890,000 bpd in late 2020 after years of delay and relentless opposition by environmental and indigenous groups.

Asia-Pacific

Under Construction: 15,737

Planned: 12,697

Total: 28,434

China continues to dominate the energy demand and discussion in Asia as it restructures its state-owned energy assets and focus on the development of a natural gas-centric future.

It reached two important milestones in its development of natural gas supply and infrastructure development, starting with the start of flows from the Power of Siberia pipeline, which now transports natural gas more than 1,800 miles (3,000 km) from Russia’s Chayandinskoye and Kovytka fields in eastern Siberia. The start of gas flows via the landmark pipeline reflects Moscow’s attempts to shift its attention east from Europe, attempting to mitigate some effects from Western financial sanctions after its 2014 annexation of Ukraine’s Crimea.

Flows via the pipeline are expected to gradually rise to 38 Bcm per year in 2025, possibly making China Russia’s second-largest gas customer after Germany, which bought 58.50 Bcm of gas from Russia last year.

Also last month, China’s state-owned energy businesses underwent their biggest shuffle in two decades as it created a new centrally administered, state-owned pipeline company that combines all pipeline assets of the top three state-owned energy giants: China National Petroleum Corp., China Petrochemical Corp., and China National Offshore Oil Corp.

The change is designed to open access to China’s pipeline infrastructure to private and foreign energy producers to spur oil and gas exploration. The open pipeline network will allow companies to focus on exploration without any additional costs to move the fuel to market.

China is the world’s second-largest oil consumer and third-largest natural gas user, but its 82,600-mile oil and gas pipeline network is less than one-fifth the size of the system in the United States, the world’s biggest oil and gas consumer. It plans to dramatically increase the breadth of its pipeline transmission and distribution networks.

Asia is expected to see the largest increase in total capital expenditure for 2019–2023 of any region compared with the previous five years, according to Westwood. Despite global trade disputes and a cooling Chinese economy that may soften predicted demand for natural gas imports, Westwood projects a 75 percent increase in energy infrastructure investment during the period.

China, of course, isn’t the only source of gas import demand, with strong LNG imports from Japan, as well as less-developed economies that are attempting to build infrastructure for gas.

In India, which is rapidly transforming to a natural gas-fired economy, Eni plans to add to growing supply in 2021 when it begins output from its offshore Merakes project, which includes construction of subsea systems and pipelines to transport production to the Jankirk floating production unit about 22 miles away for shipment through existing systems.

Neighboring Pakistan also plans to offer dozens of gas field concessions and deregulate its pipeline system in the coming years to address a fuel shortage after domestic gas output plateaued to 1.46 Tcf in 2017-18 from 1.51 Tcf in 2012-13.

Russia & CIS

Under Construction: 11,385

Planned: 7,727

Total: 19,112

For all of the U.S. sanction threats and European handwringing about overdependence on Russian piped gas, Gazprom has proceeded virtually unabated with its development of massive pipeline projects that will ultimately bring significant new supplies to the continent via the Balkan and Black seas.

In October, Gazprom began filling the first of Turkstream’s two parallel pipelines that connect large gas reserves in Russia to the Turkish gas transportation network, bypassing Ukraine. It planned to launch the first part of the pipeline, with annual capacity of 15.75 Bcm, by the start of the year. Bulgaria is expected to complete an extension of TurkStream, creating a path directly to Europe, with potential completion as early as this year. The second part of the twin-line also has a capacity of 15.75 Bcm/year.

Also, in October, Denmark’s energy agency approved the construction of Gazprom’s Nord Stream 2 gas pipeline project in Danish waters, removing the last major hurdle for the Russian-led gas project. Denmark was the last of several countries to approve the project that divided the European Union and drew the ire of the United States, which continues to pursue sanctions. The twin Nord Stream 2 will be capable of carrying 55 Bcf/year of natural gas across the Baltic Sea from Russia to Germany.

Despite its continuing strides in expanding natural gas deliveries to Europe, Russian crude oil exports fell to an 11-month low mid-year due to oil contamination of the Druzhba Pipeline, which delivers oil to Germany, Hungary, Poland and Slovakia.

Middle East

Under Construction: 1,302

Planned: 3,909

Total: 5,211

Israel is significantly increasing the amount of natural gas it plans to export via the EMED Pipeline to Egypt, Israeli energy companies said. Partners in Israel’s Leviathan and Tamar offshore gas fields agreed last year to sell $15 billion worth of gas to a customer in Egypt under the landmark deal. The amended agreement sees a 34% increase in exports to about 85 Bcm. One source in the Israeli energy industry told Reuters the estimated the value of gas is now $19.5 billion, with $14 billion coming from Leviathan and $5.5 billion from Tamar.

Texas-based Noble Energy, Israel’s Delek Drilling and Ratio Oil own Leviathan. Noble, Delek Drilling, Isramco and Tamar Petroleum are leading partners in the Tamar field. Noble and Delek Drilling have also partnered with Egyptian East Gas Co. in a venture called EMED, which bought the subsea EMG pipeline to carry the gas. The $518 million purchase enables the supply of 65 Bcm of gas over 10 years. Supplies were to begin Jan. 1 and continue through 2034.

Jordan and Iraq have continued to hold talks about construction of a 1,044-mile, twin oil and gas pipeline from Bara to Aqaba, and while ground has not been broken on the project, there appears to still be momentum and bilateral support. In July, Iraq’s cabinet formally approved the project, and there have been ongoing between ministers of the two countries, but no firm timeline for construction has been announced.

Western Europe/EU

Under Construction: 4,292

Planned: 5,006

Total: 9,298

Europe remains a key battleground for global natural gas and LNG market share. As the United States and others target LNG markets and Russia expands its pipeline capacity, other construction activity has been driven by countries seeking to diversity their supply sources.

Polish and Danish gas grid operators have approved financing for the Baltic Pipe project, a 560-mile pipeline designed to reduce regional dependence on Russian supply by transporting Norwegian gas to Poland via Denmark. The project is projected to cost between $1.8 billion and $2.4 billion (1.6 billion to 2.1 billion euros) and begin flowing in late 2022.

Norway is Europe’s second-largest natural gas supplier after Russia, providing about 25 percent of its gas, primarily through an offshore network that delivers to Britain, Germany, France and Belgium. Norway’s Gassco described Baltic Pipe as an alternate delivery route that will not increase overall quantities of natural gas from the North Sea to Europe.

Construction of a 113-mile pipeline between Greece and Bulgaria is scheduled for completion this year. The link was designed to transport gas from Azeri to Bulgaria, as well as some LNG from terminals in Greece. •

Comments