July 2019 Vol.74 No. 7

Newsline

Diversified Infrastructure Providers Reshaping Private Water Landscape

The U.S. municipal water landscape is undergoing a transformation, as critical infrastructure services – water, gas, and electricity – converge under single investor-owned utility banners. This trend is highlighted by the growing roster of diversified infrastructure service providers owning water and wastewater utilities in the U.S., according to a new report from Bluefield Research.

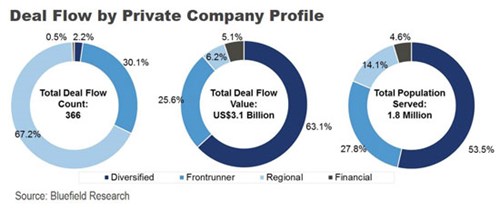

U.S. Private Water Utilities: Drivers, Competitive Landscape and Acquisition Trends, 2019, offers in-depth analysis of investor-owned water utility strategies and water/wastewater system acquisitions. Of 517 transactions from 2015 to 2018, 366 were executed by private buyers. While ushering in new market entrants and reshaping the competitive landscape, regionally, these deals also reflect growing interest in private investment in the U.S. municipal water sector from water industry outsiders.

“The consolidation of critical infrastructure services is not a new phenomenon, and current market conditions are re-reinforcing this trend,” said Reese Tisdale, president of Bluefield Research. “This most-recent wave of M&A feels different in that municipalities and system owners are being forced to weigh the benefits of outsourcing against owning and operating a portfolio of aging assets.”

These diversified service providers are poised to gain from their proven experience with utility commissions, rate cases, customer management and infrastructure finance. They are also going head-to-head with well-established investor-owned utilities (IOUs). Given the mounting financial, regulatory, and environmental pressures on municipal water and wastewater systems – particularly for smaller, private system owners – the steady flow of M&A is expected to continue and open the door further to new entrants.

While the municipal market, as a whole, is highly fragmented, the private share of the market is more structured. The IOU landscape is segmented among well-established frontrunners, regional firms, diversified service providers, and a circling group of financial investors. Private ownership of U.S. municipal water systems currently stands at 15 percent, with approximately half held by these IOUs, according to Bluefield’s analysis.

Underpinning this scaling interest in municipal water infrastructure investments from outsiders and insiders is a more favorable policy environment enabling acquisitions of community water and wastewater systems. Fair Market Value (FMV) policies in nine states – and pending legislation in others – are incentivizing municipalities to sell utilities based on appraised, rather than book, value. Still, more than 60 percent of acquisitions are for private systems, rather than those owned by municipalities.

Comments