April 2019 Vol. 74 No. 4

Features

Utility & Communications Construction Update

Daniel Shumate | Director, FMI Capital Advisors Inc.

Strong revenue and profitability marked the first quarter of 2019 for the utility and communications industry, particularly among the publicly traded members of the Utility & Communications Construction Index (UCCI).

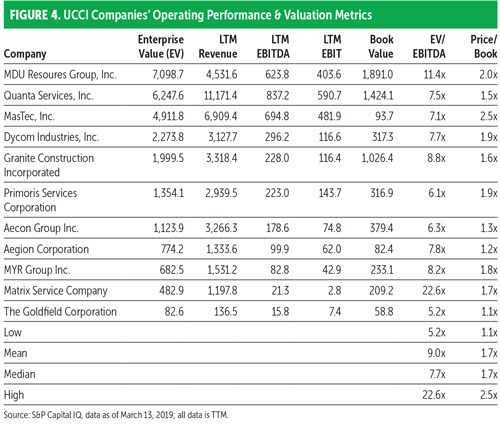

Quanta Services surpassed over $11 billion in revenue and UCCI companies are at all-time highs of revenue and profit. Near-term growth opportunities remain strong and expected investor-owned utility and telecommunication company capital expenditures are expected to increase year-over-year. The primary drivers of this spending trend are similar: aging infrastructure that requires repair or replacement, reliance on the contractor to provide labor to supplement utility workforce and demand-driven spending on fiber infrastructure.

Conversely, the first quarter of 2019 has been rather tumultuous for select customers of underground construction companies—PG&E and Windstream. Since the fire in November of 2018 that devastated California and took the lives of more than 80 people, inverse condemnation laws put PG&E at risk of bankruptcy. Inverse condemnation occurs when property is taken by the government without payment. In order to receive payment, a property owner must sue to receive compensation.

For regulated utilities given the power of eminent domain, if their equipment causes damage to property, then it is treated as “taking property” without payment. Negligence does not come into the equation if the damage occurs while the utility acts in performance of regulated activities (i.e. power delivery).

PG&E took a $10.5 billion pre-tax charge in February related to third-party claims from the 2018 fire and the total liability could exceed $30 billion. PG&E has secured short-term financing as it works through Chapter 11 bankruptcy, but significant work must occur on its system despite the financial hardships.

Of the $1.7–$2.3 billion in capital to be spent on wildfire mitigation, the vast majority will be tied to overhead transmission inspection, repair and replacement, distribution hardening or replacement, as well as vegetation management. Over 25,000 miles of power distribution and over 5,500 miles of power transmission lines are in high fire threat district areas.

Many legislators and the public are calling for more power lines to be placed underground to decrease the potential threat. However, the cost is substantially higher in California to do so. According to James Sprinz of decentralized energy research at BloombergNEF, installing a 230kV line overhead is $320,000 per mile versus about $2.6 million per mile underground. However, liability is reduced, and reliability is substantially improved through targeted undergrounding programs like what Duke Energy has implemented in its outage-prone areas.

Windstream’s woes and its impact on the rural communication market are unrelated to any infrastructure issue but, rather, to upholding the covenants of a 2015 bond issue. The hedge fund, Aurelius Capital Management, received a ruling in its favor in February 2019 that resulted in a judgement of $310 million dollars after the court ruled that Windstream had defaulted. Other claimants can also seek payment resulting in liabilities of over $5.7 billion dollars.

Windstream has filed for Chapter 11 bankruptcy and received debtor-in-possession financing to continue operation until the legal and financial challenges are resolved and the business is appropriately restructured. The downside of the ruling is that growth and expansion plans for improving rural broadband will likely be placed on hold during this period.

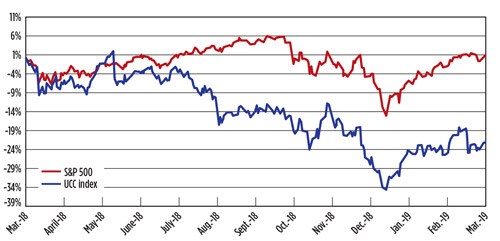

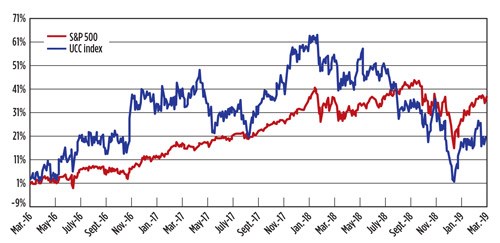

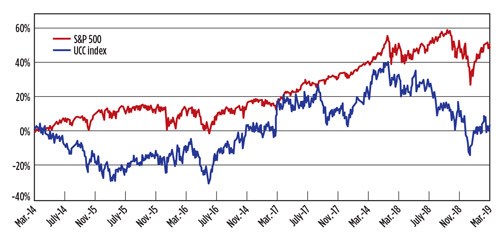

The UCCI presented below presents the performance of the sector’s publicly traded stocks over the past year (Figure 1), the past three years (Figure 2) and the past five years (Figure 3). The 1one-year UCCI performance is poor relative to the S&P 500.

March of 2018 represented a high-point for the UCCI due to expectations for an infrastructure bill and rising oil prices. Because oil prices have decreased and the infrastructure bill is unlikely, the UCCI has been impacted. Another component is the lag in the communication construction expectations related to broadband infrastructure. The results are depressed stock prices relative to other segments of the market.

The market categorization of utility and communication contractors as energy services companies fails to consider the regulatory and demand-driven construction that will occur regardless of oil prices. Thus, we expect revenue and profitability to continue to improve and that the market will adjust to earnings improvements throughout the year.

The UCCI is significantly more volatile than the S&P 500. Figure 3 illustrates the impact that oil prices, Chinese trade negotiations and potential infrastructure legislation can have on the UCC companies. From March of 2014 through the end of the year, the UCCI tracked closely with the price of oil. Similarly, since the WTI Crude high in October of 2017, the UCCI has declined (and risen of late) similar to the price of oil.

As we look at performance across the UCCI, valuation is slightly depressed relative to the profit and revenue increases that have occurred in the past quarter. We would expect valuation to increase to historical levels, assuming similar performance and limited weather challenges in the first and second quarter.

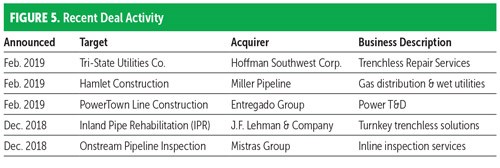

2018 year-end and early 2019 deal activity has held steady as consolidation continues in underground construction and related solutions. Orix Capital Partners continues to invest in utility services through its portfolio company Hoffman Southwest and its acquisition of Tri-State Utilities Co.

Miller Pipeline, a subsidiary of MVerge, acquired Hamlet Construction to expand its presence in the Southeast and take advantage of the population growth occurring in Florida. In addition, Entregado Group, a portfolio company of AEA Investors, invested in the power transmission and distribution segment in Florida with its acquisition of PowerTown Line Construction. •

Comments