June 2014, Vol. 69, No. 6

Features

HDD Evolves To Match New Market Dynamics

It’s a big, new world. At least big in terms of horizontal directional drilling rigs (HDD).

Contractors – and even owners – continue to increase the size of their rig fleet both in terms of actual physical size and number of units as project requirements become more demanding and key markets continue to display long-term health.

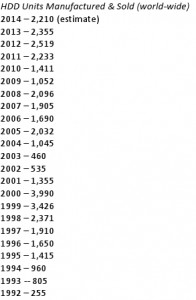

This information and much more are detailed in the 16th Annual Underground Construction 2014 HDD Survey of the U.S. market. This exclusive industry research was conducted during March and April. Surveys were sent via both U.S. Postal Service and email to contractors and organizations that actively own and operate HDD drilling units. The number of completed surveys allowed for an accurate statistical portrayal of the market. Survey responses came from all 50 states plus Puerto Rico.

“We believe this market will be a driving force in underground construction going forward, often in lieu of open-cut construction,” stressed this West Coast contractor. “It’s growing exponentially,” a Southwest contractor agreed.

Another western states respondent pointed out that “there are plenty of opportunities with existing pipelines approaching the end of their service life.” Gushed an upper Midwest contractor, “It’s great!”

But caution was not lost for many of the more experienced HDD contractors who survived the telecom boom and bust at the turn of the century. “For us, it all depends on what the telecommunication companies do,” said a Midwest respondent. A Southeast contractor in the electric market sees HDD leveling out in that niche. “We see it reaching a plateau and expect a slight increase over the next five years.”

But predicting the future of construction markets is an inexact endeavor at best. As one veteran Texas contractor observed: “It’s a roller-coaster – who knows?”

Energy drives work

What is known is that the energy markets are driving an HDD renaissance that could potentially fuel a prolonged strong market cycle – and not just from oil and gas transmission pipelines. While the larger pipelines receive most of the headlines, smaller diameter but even more plentiful gathering lines are required to support the thousands of new wells being drilled each year.

In addition to the gathering lines required to transport the oil/gas to transmission lines, most of those locations are in undeveloped areas where infrastructure is either inadequate and ill-equipped to handle the boom in population and strain on local services, or there is no infrastructure at all. That means water, sewer, electric, cable, telephone – all utilities services are going through a rapid expansion in these areas.

But it’s not just oil and gas that is on fire. Several nature-related incidents over the last decade ranging from long, hot summers to hurricanes have exposed glaring deficiencies in much of the nation’s electric grid. After years of start/stop efforts to address the problem, bureaucratic challenges have at last been overcome allowing electric utilities to embark on an expansion and rebuild unprecedented in the industry. While much of the electric transmission and distribution is still overhead, a marked increase in underground work has resulted, especially within city limits where there is steady pressure on electric utilities to remove those “unsightly” poles. Weather has also encouraged many cities and utilities to rethink their positions that overhead is always cheaper. For the HDD market, the electric market is now rivaling telecom. The electric grid build-out has finally reached critical mass and is projected to be a very strong market for at least five years.

Telecommunications work, on the other hand, is justifiably viewed by contractors as a much tougher market in which to make a reasonable profit. While the work remains strong – and should for some time – telecom owners seem intent on squeezing every ounce of savings they can out of contractors. This has gone way beyond cutting the fat and more in line with the Wal-Mart philosophy of “if you want to do business with us, it’s our way or the highway.” Owners are tending to ask for sometimes ridiculous concessions all the while insisting on moving virtually all construction risk to the contractors’ shoulders.

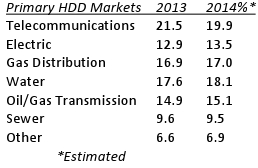

The predictable result is that contractors are looking elsewhere for work rather than aggressively pursuing telecom contracts as they have in the past. In fact, the project telecom market share for 2014 fell from 21.5 percent to 19.9 percent – a significant departure from previous years. Increasingly, the electric distribution – even transmission – markets are extremely appealing as a convenient, sister market that many companies work in to some degree already.

Gas distribution

Another area catching the eyes of telecom/electric contractors is the gas distribution market. Already a strong niche, the outlook for gas construction over the next 20 years is tantalizing for quality contractors seeking a decent return on successful projects. New construction in the gas distribution arena is just now beginning to take off.

Unfortunate accidents in recent years that resulted in major damage and worse – loss of life – has boosted federal and state concerns over the care and maintenance of underground transmission and distribution lines. Stringent integrity management rules have created a new focus for both transmission pipeline companies and local gas distribution companies/utilities (LDCs). Spending in these areas over the past 10 years has seen quantum increases from historic levels and contractors largely reap the economic benefits of the additional work.

While the economy is still sputtering but making progress towards more sustained recovery, pressure is beginning to mount on LDCs to address expansion or upgrades of their systems in order to meet new demand for gas, especially now that a multitude of transmission pipelines have started coming online in areas previously not served by gas. HDD plays a major role in gas distribution work in general and should offer aggressive project opportunities for many years in conjunction with new transmission pipeline installation.

While most gas distribution contractors believe they are capable of handling new construction demands in combination with ongoing integrity management, the LDCs aren’t as confident. There have even been meetings of LDCs at high levels of management to address concerns as to how they are going to maintain new construction and integrity management workloads when both areas of focus are booming.

Complicating the situation for LDCs is the absolute need for high quality, safe project practices. Will contractors new to the gas distribution market understand the safety protocols necessary in today’s gas work? Will those HDD contractors be able to effectively avoid installing time bombs from crossbores? Many concerns right now with the answers still in development.

Unrelated to energy but nonetheless a strong growth market for HDD continues to be the water transmission and distribution market. For many contractors who are used to the private market, they would prefer to avoid the public works market that includes consulting engineers (often with very little practical knowledge of HDD) and a highly competitive, low-bid marketplace. But nonetheless, HDD has become an attractive alternative as a competitively priced installation method, especially on larger diameters requiring more depth and lengths. In fact, the popularity of HDD has grown to the point that more than 15 percent of respondents to the HDD Survey are utilities that own and operate HDD rigs on a regular basis. The water market continues to gain market share, up again in 2014 to 18.1 compared to 17.6 only a year ago.

Sewer continues to be a viable but small market segment for HDD. While the technology works well for pressurized force mains, the difficulty HDD has in general for maintaining line and grade for gravity sewers in an efficient and cost-effective manner challenges contractors. “Accuracy in slope and alignment for gravity sanitary sewer applications remains a big problem for us,” admitted a West Coast contractor.

Large rig market

Big rigs continue to grow at a faster rate than even 2013. However, 2014 will probably not be the year of breakneck work pace that the market has seen off and on for the past seven years. That does not mean an off-year by any stretch of the imagination. Merely a tap on the brakes as pipeline construction adapts to new market and economy dynamics. Long-term pipeline construction outlooks call for another explosion in projects by 2016 or 17.

Several large rig contractors commented that while remaining busy, they are now working through backlogs. Many believe 2014 – and possibly 2015 – will be relatively flat years. But as one long-established big-rig contracting company official emphasized, “We’re flat at a high level. The past few years have spoiled us a bit. But work is still strong and we’ll gladly take this kind of year compared to what we had several years ago.”

Another contractor observed that 2014 and 15 are most likely to be “the calm before the storm” as pipeline companies are gearing up for another mad construction dash in a few years. “Quite frankly, we could use a little slower pace,” said another veteran large-rig contractor. “Work is still good but we need a year without running from one job to the next. Our company is looking to add and train more personnel, possibly buy another rig – just take care of business without so much pressure.”

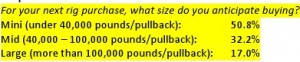

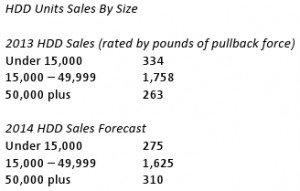

Fleet expansion is still underway at a fast rate as more than 67 percent of the survey respondents plan to purchase rigs in 2014. As reflective of the current market trends, the number of large/jumbo rigs will account for 17.0 percent of all rig purchases. Mid-sized rigs will be purchased by 32.2 percent of buyers and 50.8 percent will stick with small unit purchases. Contractors and utilities will average buying 1.6 rigs each for 2014.

Interestingly, small rig purchases, which accounted for well over 70 percent of the annual market just a few years ago, have fallen sharply five straight years, a strong indicator of the role that shale and other energy activities play in the HDD market. Further, jumbo rigs (greater than 300,000 pounds pullback force) are as common today as large rigs (100 – 300,000 pounds) were about five years ago.

About 75 percent of the companies/utilities participating in this survey have not purchased a used HDD unit. Many reasons were cited but most centered around the fact that it has been a seller’s market to a large degree for the past few years. However, for small rigs, 65 percent said they would strongly consider buying a used rig – assuming the availability of a quality machine at a reasonable price. About 40 percent of respondents would consider a used mid or large rig.

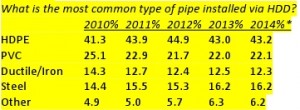

With electric and telecommunications work still dominating the application of smaller drilling rigs, average bore distances continue to stay lower at 263 feet compared to 279 in 2013. Mid-sized units averaged 608 feet while big rig drills averaged 2,221 feet per bore.

Challenges

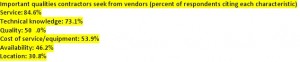

Certainly, the HDD industry has come a long way in its short history, developing from a disruptive technology to a reliable construction option – often the first choice for specific installations and frequently a major component of a total project.

However, the industry still struggles with many challenges and issues. The topic of crossbores is still a sensitive issue for both owners and contractors. Similarly, avoiding other utilities continues to complicate projects. These two related topics were cited many times by survey respondents.

“Getting accurate locations of other utilities and exposing those crossings is our biggest challenge,” said this southeast contractor. A Mid-Atlantic contractor agreed. “Finding a workable depth and missing other utilities is an ongoing problem for us.”

This Midwest contractor stressed that “fiber and phone are all at different depths, causing problems when installing other utilities.” An upper Midwest contractor complained that “One-Call locates are not accurate and not on time.”

Directional drilling operators also don’t like drilling into unknown soil conditions. Lack of accurate pre-drilling soil investigation continues to plague many HDD projects. A Northeast contractor related that “typically the engineers or owners put the burden of bidding blind on us as they provide very little – if any – information regarding ground conditions in the bore path. However, recently we had an engineer who provided detailed geotechnical information. The job went well as we were prepared. Wish more owners and engineers would learn this valuable lesson!”

Different states put a variety of restrictions on drilling operations, particularly mud disposal and installation routes, adding another layer to job requirements. Noted this Southeast contractor, “We see laws changing for stricter control of placement.”

Labor continues to plague growth opportunities for many contractors. Even utilities trying to operate drills are not immune. Said one municipality from the West Coast, “keeping and retaining employees hits us even harder than contractors. With HDD being strong, we have a tough time competing with private sector salaries.” A Midwest contractor said that simply “finding operators” had become their biggest challenge. Another wrinkle to the labor shortage, complained this Southeast contractor is that “it is challenging for us as inexperienced operators underestimate costs.”

Lamented this Midwest contractor, finding “qualified personnel” is a major problem. “Society is so concerned about everyone going to college. We need workers also. College is not meant for everyone. Good wages can be earned in the trades. This needs to be voiced loudly!”

As well- known as HDD has become to the underground construction market, many survey respondents believe there is still much work to be done in educating owners. “Education remains a challenge in dealing with water companies,” stated this Southwest contractor. Added a Southeast contractor, “getting customers to realize our cost of operation, especially insurance and liability is a major challenge for us.”

Cutthroat competition in many areas is an ongoing battle for veteran contractors causing complications in many ways. Explained this Southeast contractor, “Inexperienced drillers are bidding and sub-contracting work on bores that have no engineering available. On many projects, the drillers are assuming all the risk without adding any costs to address these risks.”

Comments