February 2014, Vol. 69 No. 2

Features

17th Annual Municipal Survey

Despite Continuing Funding Concerns, Budgets Expected To Rise

When the Federal deficit began to slowly climb during President George W. Bush’s administration, it caused many raised eyebrows and several economists voiced concerns about the long-term economic impacts. Still, the United States stayed its course.

But with the skyrocketing deficit that has been symptomatic of President Obama’s administration (and still climbing), concerns about funding issues have reached a fever pitch on the political stage. There is no longer any doubt of the negative implications such a heavy debt burden is having upon our economy and indeed, our society.

Efforts to raise spending at the Federal level – no matter how important – are being stonewalled at every corner. Rare is the Congressman or Senator who dares suggest increased spending – and justifiably so. However, for the much maligned, aging and failing sewer and water infrastructure, falling Federal funding sources have caused a near-panic for some cities and a wild scramble by many others to not only locate other funding sources, but find a way to pay back infrastructure loans. Gaining additional funding at state levels is meeting a similar slate of challenges from local municipalities.

Worse, large cities such as Bakersfield, CA, Birmingham, AL, and Detroit, MI, have declared bankruptcy. While the justifications for declaring financial insolvency by these cities are many, the net result for the underground infrastructure is that it plummets into an even worse state of decay while the courts and cities try to sort things out.

With that backdrop of money woes, it is no wonder that funding issues are the number one concern for more than 80 percent of municipalities across the U.S. These results were revealed in the 17th Annual Underground Construction Municipal Sewer & Water Survey. The research includes a detailed look at 2014 underground infrastructure spending plans for America’s cities along with insights and perspectives on industry topics and issues from the municipal perspective.

Good news for spending

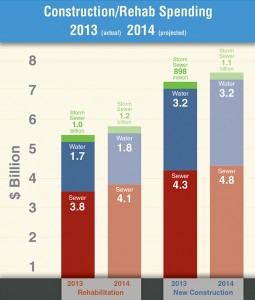

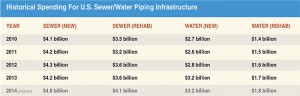

Despite strong, continuing funding concerns by cities, for the first time in several years, municipalities as a whole are expecting a substantial increase (7.7 percent) in new construction pending for 2014. This optimism runs counter to what many expert prognosticators are predicting for the public infrastructure market in 2014. In total, new construction for sewer/water/storm water piping infrastructure is expected to approach $9.1 billion this year.

The rehabilitation market, which has maintained at least some growth throughout the recession, should reach almost $7.1 billion or an increase of 8.4 percent. Cities short on money for major projects have found that increasing rehabilitation budgets to address specific and concentrated problems was still cheaper than funding major projects.

Conducted in October and November 2013, the survey polled U.S. municipalities about their 2014 infrastructure funding plans along with perspectives on technologies, trends, industry issues and working relationships with consulting engineers and contractors. The survey results came from all 50 states plus the District of Columbia, and were weighted for regional population density and city sizes to develop a nationwide benchmark that would allow for projections.

Responding cities ranged from very small such as: Savanah, NY ( population 950), Grandview, IN (851), Bayfield, WI (600) and Hot Springs, MT (655); to major metropolis’ such as New York City, Los Angeles, Houston, Las Vegas, NV (Clark County), Honolulu, HI, Baltimore, Miami and Chicago; and every size in between.

Virtually all the cities, both large and small, expressed a very real concern about both the short- and long-term status of the funding sources for their water, storm water and sewer departments.

“Funding! Funding! Funding!” exclaimed this Pennsylvania municipal person when asked about their biggest issue of 2014. Indeed, the word “funding” and just about every derivations of the term were cited repeatedly in the survey.

“Doing more with no additional resources,” was a major concern of this Texas city official. That sentiment was also repeated frequently. Said a respondent from a major Northeast city, “we have fiscal issues with the added pressure of maintaining water rates.”

More with less

In fact, several city personnel expressed similar challenges that involve trying to maintain sewer/water systems without increasing their user fees. This official from an East Coast state cited “cash flow” as a significant problem for their municipality as it struggles to pay for necessary system maintenance and improvements.

Another interesting problem related to money was postulated by this respondent from a Southeastern city who pointed out that with all the conservation efforts, their city’s water department finds its cash flow falling due to “a customer base that continues to decrease water use and very little new growth of customer base.”

Of course, having funding issues has led to additional concerns for cities. A municipal official from the Mountain West region reported that due to lack of funding, his city is always looking for ways to “repair old, failing systems as cheap as possible.”

So why do a majority of the respondents believe they will actual spend more money in 2014 than in past years? Some of the survey participants admitted it was just “blue sky, feel good” opinions. “We’ve been expecting the worst for so long, it’s about time we started expecting something better,” admitted a West Coast municipal spokesperson.

But most had tangible reasons for their optimism – like the release of full budgets. “We’ve had budgeted money each year but couldn’t spend a big chunk as our city council was worried about cash flow,” explained a respondent from the Midwest. “But while we’re still a long ways from where we were five or 10 years ago, our budgets have stabilized now for several years in a row so we’ve got a little increased confidence that our funds will be available.”

Said another survey participant from the Southwest: “Our managers actually believe we’ll have the money available that’s been budgeted when we need it, so we’re getting ready to let contracts this spring – for the first time since 2009!”

Indeed, a level of confidence in the public works economy has been largely absent from U.S. cities since the Great Recession peaked in 2009-2010. Over the last two years, the Municipal Survey has been filled with comments about cities being too concerned about cash flow to actually fully fund budgets. Finally, at least to some degree, it appears that municipal management believes their figures.

Of course, there is another practical reason for increased funding in 2014 – desperation. Sewer, water and storm water systems, already in poor condition, have reached the critical stage for many cities. The Environmental Protection Agency has shown little concern for city budget woes when it comes to Consent Decrees.

Desperation is a strong motivator. Cities who failed to adequately adjust their user fees over a period of time are now finding they have little choice but to boost rates in order to find some funding to maintain systems. Cities reported an average of 3.4 years since their sewer rates were last increased, 3.2 years for water.

However, even with the projected increase in spending anticipated for 2014, survey respondents emphasize that just to meet their actual needs in 2014, they need an increase of 23 percent – far exceeding any proposed increased. And, as one Midwest muni official stressed, “That’s just to maintain. We need a whole lot more if we’re ever going to get ahead of our system’s demands.”

Funding hope

In Congress, some reason for optimism has been raised since the fiscal year 2014 budget agreed to by both Democrats and Republicans contains a $22 billion pot of money to be used by the Obama administration to fund investments in education and infrastructure. That kind of funding has not been available since the 2009 economic stimulus bill. Unfortunately for sewer and water infrastructure, as much money as that is, when spread over education needs plus roads and bridges, odds are not good that large sums will trickle down to the underground infrastructure.

Actually, the Senate included creation of a Water Infrastructure Finance and Innovation Authority as an amendment to the Water Resources Development Act of 2013. That bill passed the Senate and is currently in conference with the House. However, Congress would have to appropriate federal funds to seed the Authority. That would be somewhat unlikely, given the congressional opposition to almost all new federal spending programs.

In the House, a Water Infrastructure Investment Act has been introduced with the support of senior Republicans on the water infrastructure authorizing Committees. The legislation would establish a trust fund and then create a voluntary fee program where manufacturers of products that use significant amounts of water in production or produce materials that require special filtration from wastewater could choose to add a 3 cent surcharge per unit to their product to be deposited in the trust fund. The revenue from this fee would go towards a Water Infrastructure Investment Trust Fund, of which 85 percent would go towards replenishing the Clean Water State Revolving Fund (CWSRF) and the remaining 15 percent would fund a Water Infrastructure Finance and Innovation Authority to provide low-cost capital to clean water infrastructure projects.

In the meantime, congressional appropriations for the CWSRF and Drinking Water State Revolving Funds (DWSRF) continue to decrease. Federal agency budgets for fiscal year 2014 have been operating under a continuing resolution. That means they are set at the same level as in fiscal 2013, but were reduced further as a result of sequestration, the across-the-board cuts to each agency enacted in early 2013. CWSRF is being funded at a level of $1.379 billion in fiscal 2014 and the DWSRF at $863.3 million. Even with recent progress in budget work by both houses of Congress, the funding for those programs is not expected to rise. In fact, it may be even cut further.

Assets and trenchless

Asset management programs have been a major industry buzz term for several years. However, the survey found that only 21 percent of cities have a fully-in-place and operational asset management program. Just over 46 percent of cities do have such a plan in development while 32.9 percent have no plans at this time to develop an asset management program.

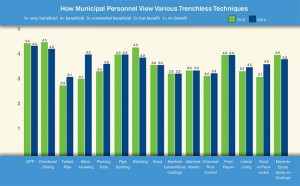

When it comes to rehabilitation of underground pipes, most cities still utilize dig-and-replace/repair as their primary method. However, trenchless rehab continues to gain ground with cities reporting that trenchless methods are the prescribed solution in 41.6 percent of projects. For new construction, trenchless installation accounts for about 15 percent of the work.

Trenchless construction and rehabilitation has gained strong favor with cities. Survey respondents report that they actually prefer trenchless solutions 52.7 percent of the time compared to 24.3 percent that prefer open-cut and 22.9 percent said it didn’t matter which techniques were used as long as the project was successfully completed.

In addition to funding concerns, coping both with increasing government regulations and the EPA was cited as a major issue by over 60 percent of the municipal respondents. Damage prevention and safety remains a major concern for about 50 percent of municipalities.

Another area of concern cited by muni managers mirrors a major issue for contractors: replacing retiring employees and finding/hiring qualified personnel. Cities, due to heavily structured and frequently rigid pay scales, often find it hard to compete with private industry.

Manhole replacement remains a huge area of emphasis for cities. In 2014, it is anticipated that 83 percent of all U.S. cities will be replacing or rehabilitating an average of 163 manholes each.

Each year, the Municipal Survey queries city personnel about their contractor and consulting engineering partners. An alarming trend this year was that the approval ratings for both groups fell dramatically.

Engineers

On a scale of one to 5 (with 5 being the highest mark), engineers received a rating of 3.47. That’s down from 3.73 in 2013 and 3.75 in 2012.

The survey determined that the most important aspect of engineers for cities is quality, as it was cited by almost 87 percent of respondents. Other key qualities cities look for in consulting engineers include “understanding new technology” (cited by 57.3 percent), “affordability” was mentioned by 49.3 percent of muni respondents followed by “productive relationships with contractors” (48 percent).

Municipal employees had many suggestions for how consulting engineers could work more effectively with cities. A Midwest official pointed out that engineers need to “keep their cost overruns down.” Another Midwest respondent suggested that engineers should “be more open to working with contractors to provide incentives for best rehab/replacement methods (design-build), instead of sticking to old technologies.” Yet another Midwest neighbor explained that engineers must “understand that local issues are always unique and there is not a ‘one size fits all approach’ to the project. Listen to local officials,” he concluded.

A muni official from the Southwest pointed out this concern: “Private firms have cut back and are pressuring their remaining employees to do more work in less time. Consulting firms must ensure that they are adequately supporting their employees so that neither the employees nor their work will suffer.”

Sage advice was offered by this city respondent: “Accomplish due diligence in considering all potential problems and pitfalls that could go wrong or evolve during prosecution of a project, from initial preliminary design to final design to project completion.”

Contractors

While municipal personnel’s rating of contractors fared better than engineers, it too fell substantially. The rating of 3.61 was down from a high of 3.91 in 2013 and 3.87 in 2012.

As the nation continues to recover from a prolonged recession and slow economy, it is no wonder that the top quality cities seek in contractors is “low cost,” cited by 92 percent of all respondents. “Experience” was a factor preferred by 80 percent of respondents, “timely completion of projects” was cited by 78.7 percent and “quality of work” was mentioned by 77.3 percent.

Many of the municipal personnel comments about contractors involved staying abreast of the latest technology developments. This comment from a West Coast survey respondent summed up several of the perspectives. “Move out of the stone age and into the modern world. Stay current with training as it relates to new and innovative products and procedures.”

Another common comment thread was dealing with the public. Contractors should “be polite to inquisitive customers,” pointed out this East Coast muni official. Another city manager from the Pacific Northwest suggested that contractors should “be a part of the team to address a problem.”

From the Mountain West, came the suggestion that contractors should always “look at multiple solutions” to projects.

Comments