June 2010 Vol. 65 No. 6

Features

Good Vibrations: HDD Industry Riding Out Recession Better Than Other Market Niches

As the current recession begins to ebb, market stabilization in 2010 seems to be a viable goal for many contractors in the underground construction market, with many areas still struggling to survive another tough year.

While that scenario does apply for the horizontal directional drilling industry to some degree, it is also a market that is already seeing an upward surge in some parts of the country, according to results from the exclusive, 12th annual Underground Construction HDD Survey of the U.S. market.

“We have seen business pick up,” said a Midwest contractor whose company derives 60 percent of its business from HDD. “We have never been this busy in the winter and early spring.”

Diversification was one reason cited for an unexpected robust market in late 2009/first half of 2010. “We just got started in HDD to fill in due to bad times. But it has really taken off for geothermal and waterline installation,” stated this contractor.

Another survey respondent observed that “there is more and more drilling going on. I expect that to be how underground [construction] will be done when feasible.” A West Cost contractor expects their HDD work to increase annually at about 5 percent for the next several years.”

Conducted in April and early May, the survey queried United States contractors and utilities that own and actively operate HDD rigs and equipment. Survey participants were asked about industry trends, concerns and market status. All things considered, the HDD market appears to be surviving this latest economic challenge in much better condition than in the past.

Several contractors predictably outlined how they were still struggling to survive, let alone yield a profit. But the strength of the positive economic comments – from contractors of all sizes and all areas of the country running rigs of every size – was surprising. “It’s expanding,” observed a Mid-Atlantic contractor. “Prices are steadily climbing and there are more uses for HDD,” reported a contractor from the Rocky Mountains. Even major rig manufacturers have reported stepped-up demand from their products.

Challenges ahead

But as good as many respondents feel about their market niches, there remain many challenges for 2010 and beyond. “Slow to moderate,” is how this upper Midwest contractor viewed the market, but cautioned “we’re seeing lots of small competitors.”

Along that same line of thought, one mountain states contractor said that their market is getting “tighter” due to poorly qualified people entering the business and wreaking havoc in the market for experienced firms.

A Southwest respondent expressed concern as “interest in HDD is still limited to when it seems to be the only alternative. Many projects still opt for open-cut if possible without considering potential savings via HDD.”

Price continues to be a hot topic and major concern for most areas of the country, the survey revealed. “I still see mom and pop-type drillers getting into this industry and killing a market that should be thriving,” lamented this Southeast driller. “The prices are going lower (especially on the telecommunications side) and knowledge is not there. Quality should count,” stressed a Mid-Atlantic contractor. A Texas respondent believes “the biggest challenge would have to be the competition. We’re beating each other to death.”

Concerns about cross bores remain a stumbling block for HDD in the municipal market. It is not uncommon for HDD to be banned or cumbersome restrictions established in attempts to prevent further cross bores. When major accidents occur as the result of cross bores, the resulting bad press serves only to give the industry a black eye.

Efforts to prevent cross bores – and locate existing cross bores – are becoming important to many contractors who have experienced problems. “Successful bores and no damage to existing utilities is the biggest challenge to the industry,” observed a Southwest contractor. “The industry is still plagued by the impression that HDD is really good at destroying existing utilities.”

A California respondent added “We have to stay current with new technology and avoid hits.” Another contractor succinctly summed up the situation: “Underground utilities are becoming a lot more crowded than in the past.”

Frac-outs (drilling fluids leaching from bore paths, often to the surface) are major concerns from owners and engineers as that could lead to serious state environmental quality issues (dependent upon the state). “Too many people are trying to get into the business that don’t have any knowledge. They are doing a halfway job and making mistakes by fracing out under roads and streams, and then letting the frac-outs go without containing them,” stressed this contractor.

Consulting engineers and municipalities, while vastly improving their HDD knowledge the past two years, are still woefully lacking in detailed knowledge of the technology. Their inability to effectively inspect HDD leads to a lack of confidence in the technology and, in turn, often unnecessarily inhibits contractor management of projects by making invalid and extraneous demands. “Our jobs are hard enough without engineers expecting us to give them on-the-job training about what they should look for on a drill,” complained a Southeast respondent. “Educating public officials is a major challenge for the HDD industry,” emphasized a Northeastern contractor.

Mid-sized trend

The trend to mid-size rigs continued in 2009 and demand is projected to grow even more in 2010. For the first time in the 12-year history of the survey, more contractors are interested in buying new rigs of 40,000 pounds/pullback force through 150,000 pounds as they are for smaller rigs under 40,000. When asked what rig size would be their next purchase, 40 percent of the survey respondents indicated a mid-size rig compared to 39 percent for a small rig. Also impressive was that 21 percent of respondents are seriously considering a large rig for their next purchase. Due to the traditionally small number of contractors operating in the “big rig” world, clearly the large rig market is viewed as expanding with potential market opportunities.

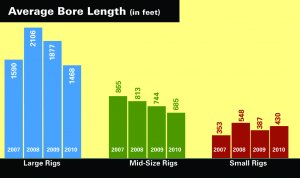

Apparently, slowing telecom, electric and gas distribution work has sent HDD contractors scrambling to expand their capabilities with larger rigs, capable of drilling water and sewer lines as well as tackling longer bores for telecom and electric. Plus, there continues to be strong demand for HDD work in the oil and gas transmission markets that frequently mid-sized rigs are capable of handling. Reported this East Coast contractor: “The market is changing to bigger product and deeper and longer bores.”

Traditionally, HDD has been considered a perfect technology for telecom, gas distribution and electric installations, but guidance and precise control quirks – which generally is irrelevant for those market niches – can be a detriment for sewer and water.

Yet, water and sewer continue to be viewed as growing markets for HDD. As discussion continues both at the federal and local level on ways and means to increase infrastructure spending over the long term, HDD seems poised to play a more significant role in those markets. Long-time, traditional sewer/water contractors, with large fleets of backhoes, excavators, auger boring and tunneling equipment are part of the new wave committing to HDD. They realize that HDD can be a practical, necessary and profitable addition to their tool chest.

HDD is already established in the water market as pressurized pipe makes the technology more immediately applicable to the sometimes erratic path of bores. PVC is the dominant plastic pipe used in the water market and PVC manufacturers have excelled at producing pipe products (restrained joints and fusible pipe) that make it an effective material for use with HDD water applications.

HDD also continues to gain favor for certain aspects of sewer construction such as force mains. However, the ability to achieve line and grade with HDD in a fast and cost-effective manner continues to elude manufactures, though substantial progress has been made and research and development is ongoing. In fact, several respondents cited the ability to bore precisely for water/sewer as one of the major challenges facing the HDD industry. The needs of sewer/water pipe installation often requires stronger rigs, further driving demand for mid-sized units.

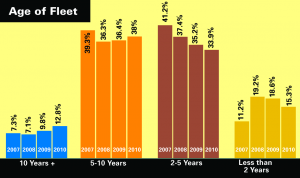

As expected with a major recession, sales slowed in 2009. However, by the first quarter of 2010, some manufacturers reported that sales of assorted rig sizes were bouncing back strongly. The veteran HDD contractors learned their lessons well after the telecom bust and as markets started weakening in 2008, most quickly scaled back their purchase plans to ride out the anticipated tough economic conditions. Subsequently, the age of the HDD fleet has increased. Rigs that are 10 years or older have grown from 9.8 percent in 2008 to 12.8 percent in 2010. Numbers for rigs less than two-years old fell from 18.5 percent in 2009 to 15.3 percent in 2010.

Growing up

The maturation of HDD in the construction market place can be easily traced to the diversity of materials that can now be effectively installed. Traditionally, HDPE has been the dominant pipe material installed. And while that still held true in 2009, other pipe materials displayed growing acceptance. HDPE was used on roughly 41.3 percent of projects with PVC being used 24.1 percent of the time. Ductile iron and steel pipe held strong at a combined 28.7 percent market share.

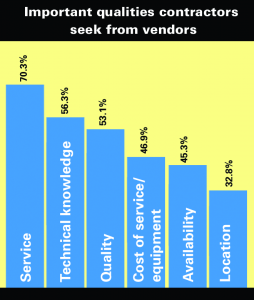

Service, by far, was the most cited quality contractors want from their equipment/service providers, at 70.3 percent. Technical knowledge was cited by 56.3 percent of respondents followed by quality at 53.1 percent, cost of service/equipment at 46.9 percent, availability at 45.3 percent and location at 32.8 percent.

The primary markets for HDD have changed little for 2010 although the various construction niches are all strong with no particularly area dominating. As in the past, the largest niche remains telecommunications at an 18.6 market share, down from 19.2 percent in 2009. The HDD electric niche remained constant at 17.3 percent followed by gas distribution at 16.1 percent (down from 16.5 percent), water at 15.8 percent (up slightly from 15.7), oil/gas transmission pipelines at 14.1 percent (down from 14.3 percent), and sewer up slight from 11.7 to 11.8 percent.

The “other” category represents a hodgepodge of niches carved out of the marketplace by creative contractors or emerging applications. Geothermal falls into the latter category and while still a small blip on the radar screen, several survey respondents expressed optimism about its potential. Manufacturers are also betting on geothermal as four rig manufacturers now have specific geothermal products.

In 2009, 54.2 percent of contractors performed HDD work valued in the $1 million to $5 million range. For 2010, 31.4 percent expect to see an increase in HDD projects, 55.3 percent anticipate roughly the same amount of work, and 13.3 percent expect a decrease.

More than 25 percent of the survey respondents expect to purchase a new rig in 2010 compared to 22 percent in 2009. The used rig market continues to thrive as well with 45.5 percent saying they have purchased used rigs in the past and 60.8 percent saying they would consider a used rig for their next purchase. Mid-sized rigs are also the most popular size class in the used equipment market with interest from 42.9 percent followed by small rigs at 39.3 percent.

A typical HDD contractor in 2009 carried a fleet valued at $1.2 million, drilled 29,666 feet for the year and pulled in product pipe that averaged eight inches in diameter. The value of a contractor’s walkover locating equipment was $38,902, wireline systems $101,800, and other types of tracking equipment was valued at $55,333. Contractors owned an average of $82,531 in downhole equipment such as tools, reamer and mud motors.

Contractors also reported that they try to replace mini rigs every 3,000 hours of use, mid-sized rigs every 5,100 hours and large rigs get at least a major overhaul every 5,300 hours.

Comments