February 2010 Vol. 65 No. 2

Features

Lower Prices, Consumption, Near-Term Construction Lessens 2010 Spending Levels

The latest figures from the U.S. Energy Information Administration (EIA) indicate that close to 70 million customers rely on the nation’s natural gas distribution network to deliver fuel to their home or business. Natural gas is delivered to customers through a 2.3-million mile underground pipeline system that includes:

- 2 million miles of local utility distribution pipes (1.2 million miles of utility mains, plus 800,000 miles of utility service lines); and

- 300,000 miles of transmission lines.

These customers consume 23.2 Tcf of natural gas, accounting for 24 percent of the total energy consumed in the U.S. yearly. More than 1,500 companies carry out the natural gas distribution process and vary in size and type. They include LDCs serving millions of customers, as well as those that serve less than 100. They also include mainline pipeline companies that provide direct service mostly to large volume end users, although the bulk of the natural gas transported by pipeline usually reaches end users via LDCs.

Spending trends

The American Gas Association (AGA) reports that customers can expect lower bills on average this winter compared to last. Plentiful domestic supplies and lower wellhead prices will lower bills and provide relief for natural gas customers struggling in a troubled economy. Supporting this is the EIA’s Short Term Energy and Winter Fuels Outlook released Oct. 6 which indicates energy prices remain volatile, reflecting uncertainty or risk in the market.

Natural gas prices have dropped considerably since last year. However, after falling to as low as $3.82 per MMBTU on Oct. 14, prices have steadily drifted higher into the $5 – $6 range.

The EIA report anticipates consumption to decline by 2 percent in 2009 and 0.2 percent in 2010 as weak economic conditions hamper the industrial sector, where data show consumption is down by 12.4 percent through July compared to last year. With lower consumption in the residential and commercial sectors as well, natural gas use in the electric power sector continues to serve as the only demand outlet for increased supplies.

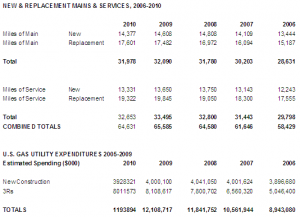

Insert table titled New & Replacement Mains & Services, 2006-2010

Lower prices and consumption coupled with lower near-term new construction spending to rehabilitate, repair and replace existing systems, is expected to slightly reduce overall spending levels in 2010. For this reason, Underground Construction’s latest survey figures indicate gas utility spending to serve new customers and rehabilitate, repair and replace mains and services, meters, valves, regulators, cathodic protection, SCADA networks and peak-shaving facilities will total about $11.9 million in 2010, compared to $12.1 billion this year.

These spending demands come at a difficult time for the distribution sector. Deliveries by LDCs have decreased by 15 percent since 2000 and some large-volume customers have switched to mainline pipeline systems. Nonetheless, the LDC remains the backbone of the natural gas distribution network.

As to higher spending for LDCs in some sectors, corrosion costs continue to be a costly problem for all facets of the oil and gas industry. The total annual direct cost to corrosion on the nation’s natural gas distribution system is estimated at $5-6 billion.

As a result, companies are seeking solutions. Energy West, a Montana-based gas utility and energy supplier, became the first utility in North America to install Evonik’s VESTAMID® LX9030 PA12 (VESTAMID PA12) pipe on a three-mile distribution system along Interstate 15 frontage roads outside Great Falls earlier this year.

Safety

Safety also is costly. Gas utility and pipeline companies spend close to $7 billion annually to ensure that natural gas is delivered safely and reliably.

All natural gas in distribution systems must be odorized so a leak can be readily detected without special instruments. Federal pipeline safety codes also require that distribution systems comply with requirements for design, construction, testing, inspection, operations and maintenance from the point of connection to the point of transmission, up to and including the customer’s meter.

Distribution systems regulated by a state agency are required by law to comply with standards that are at least as stringent, or more stringent, than those set forth in federal minimum safety mandates.

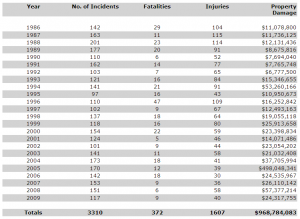

The latest statistics compiled by the Pipeline Hazardous Marerials Safety Administration (PHMSA) indicate that from Jan. 1 to Oct. 31 the LDC sector accounted for 117 incidents resulting in 40 injuries and nine fatalities. Nevertheless, pipelines remain the safest and most cost-effective means to transport the extraordinary volumes of natural gas needed to meet the nation’s needs.

DIMP rule

The long-awaited Gas Distribution Pipeline Integrity Management (DIMP) rule proposed by the PHMSA was expected to be finalized before year-end 2009. Although that didn’t happen, expectations are that the DIMP rule will soon be approved and each operator of an LDC will have at least two years before the program takes effect.

While it is likely the final rule will be somewhat different than the proposed rule, the basic structure is unlikely to change. This means operators will be required to fully implement an integrity management program that contains the following elements.

- Knowledge

- Identify threats

- Evaluate and prioritize risk

- Identify and implement measures to address risk

- Measure performance, monitor results and evaluate effectiveness

- Periodic evaluation and improvement

- Report results

Though no firm cost figures have been established, the rule is expected to be costly and time-consuming for LDCs.

Training of distribution employees at all levels continues to grow. More companies are looking to programs like the courses offered by GTI for engineers, technicians, supervisors, managers and other industry professionals who are responsible for gas distribution operations. The course is designed to help build or expand the knowledge base in the construction, operation and maintenance of modern gas distribution systems. Community colleges offer certified training for utility workers.

Developed by GTI, the Certified Operations Technician (COT) Training Program offers a 70-hour training course at several community colleges. It is designed to introduce students to the natural gas industry and provide the skills necessary for an array of field positions.

There is also an online version of the Gas Distribution Operations course that provides an understanding of the processes and procedures needed for reliable delivery of natural gas to consumers. The course comprises 12 modules on gas distribution operations and a final exam to test knowledge.

Survey results

For our annual pipe report, managers at LDCs were again queried to comment on several subjects, including the cost of finding and repairing leaky mains. The cost figures and comments from industry participants on these and other topics follow.

As in past years, those surveyed unmistakably report the utility industry is replacing older, leaking, inefficient and structurally deficient mains and services. As to ongoing programs to replace existing cast iron or unprotected steel mains with plastic or protected steel, 68 percent of those surveyed report programs in progress while 17 percent indicated they had no cast iron or bare steel in existing systems. Of the 13 percent reporting bare steel in existing systems, leak history was consistently cited as a primary area of focus. Just 2 percent of those surveyed indicated they had not yet started a long-term program to replace bare steel and cast iron in existing systems.

Most residential pipe installed in the past 30 years has been plastic, chosen for its flexibility and resistance to corrosion. Today alone plastic reportedly accounts for more than 39 million services and 3 billion feet of the pipes in service and over 97 percent of all new gas distribution piping installed each year.

After decades of successfully using polyethylene pipe in sizes up to 12-inch diameter, utilities are recognizing the potential for larger diameter applications in gas distribution lines. Cities such as Chicago and Kansas City have used large-diameter gas pipe mains for many years to renew the cast iron pipes that reached the end of their service lives. The availability and ease of installation of pipes offer safe, economical solutions for large-diameter gas pipe mains.

Survey recipients also indicate that 2- and 4-inch diameter PE pipe is widely used in the gas utility industry and accounts for 95-98 percent of all new main installations in developed areas. As to cost, the following figures reflect the average cost per foot reported to install plastic and steel mains. Costs for plastic main installations ranged from $16.70 to $10.20 for 2-inch diameter; $13.60 to $20 for 4-inch; and $12 to $33.50 for 6-inch.

Those reporting protected steel main installation costs listed the following: 2-inch, 17.35 to $20 foot; 4-inch, $28.20 to $30; 6-inch $33.05 to $45; and $60 to $74.70 for 6-inch.

Respondents reporting costs for finding and repairing leaky mains consistently said that costs varied widely depending on location, street vs. lawn. While 43 percent of those surveyed cited surface location as a major cost factor, 33 percent of these same respondents gave $1,500 as an average finding and repair cost while the remaining 10 percent gave $2,000 as an average cost.

Of those reporting finding and repair costs per occurrence, regardless of size, the following were given as the highest costs: $855 to $2,850. Those reporting costs by size provided the following: 2-inch $1,000 – $2,420; and 4-inch, $1,800 to $2,500.

One gas utility with 100,000 customers indicated that most of its gas leaks occurred in 2 to 4-inch coated cast iron pipe that was located under pavement. They placed finding and repair costs as averaging $1,800 per leak.

A small gas utility with 6,000 customers that provided costs by pipe diameter provided the following as its average finding and repair costs for leaking mains: 2¼ to 2½-inch $1,300 per leak; and 4-inch, $1,500 per leak.

Integrity management

Response to this question clearly illustrates the uncertainty the LDC feels regarding PHMSA’s proposed rule to establish integrity management for gas distribution pipeline systems. More than 75 percent of those surveyed said they expected the rule to be far more costly for the LDCs and ultimately the customer than the PHMSA has suggested.

Several LDCs indicated they did not expect increased costs in the field, but they did anticipate added costs to prepare extensive documentation, plus the potential for software and hardware upgrades and additional administrative personnel.

A sizeable portion of this year’s recipients indicate that contractors continue to provide a major portion of new distribution construction to install gas utilities. Figures indicate that 85 percent rely on contractors to carry out 85-100 percent of all new construction on projects, while 10 percent indicate they relied on contractors to perform 20-70 percent of this work. Of the remaining 5 percent, 3 percent indicated they didn’t use contractors at all and the remaining 2 percent reported using contractors to perform 20-35 percent of their work.

Comments